Employee Expense Report Sheet to HR

Organizations usually have a reimbursement policy through which they repay employees for money spent out of their own pocket on official expenses or entitled facilities, such as medical bills. However, to bring uniformity in the way employees request reimbursement for their expenses, organizations develop an employee expense report sheet.

What is an employee expense report sheet?

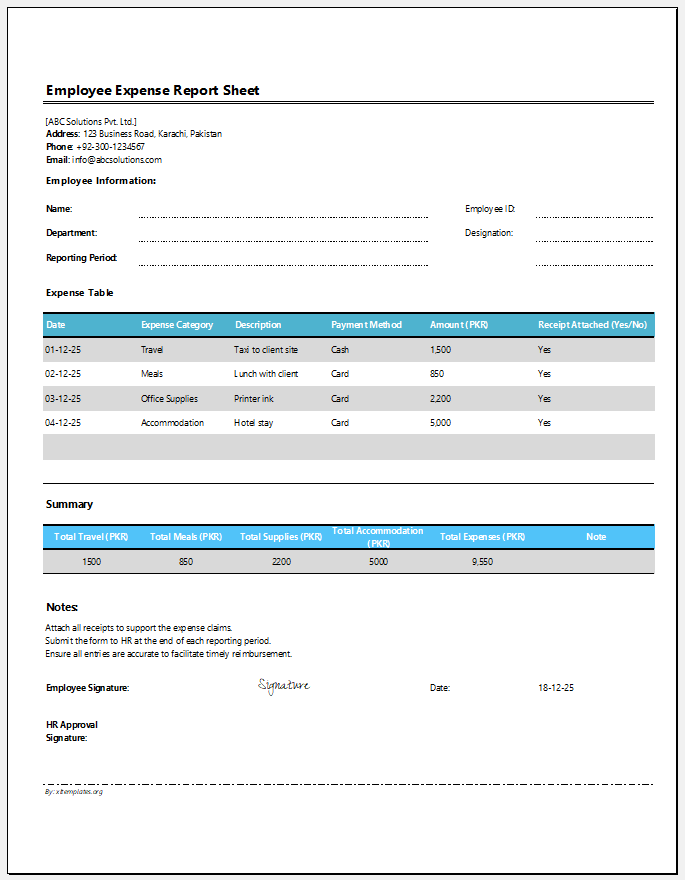

An employee expense report sheet is a worksheet designed by an organization, either created in-house or customized from a ready-made free template. It is filled out by employees when they want to request reimbursement for money they have paid for official expenses or other reimbursable fringe benefits.

The sheet is sent along with the receipts as evidence to minimize the chances of cheating and fraud. In short, this sheet is used to report expenses incurred by employees and to request reimbursement for the amounts paid.

What are the advantages of an employee expense report sheet?

The following are a few advantages of these sheets:

Employee Reimbursement Overview

The details of reimbursement requests made by employees can be viewed at a glance on this sheet. It helps the organization analyze the amount of money spent on reimbursements and make relevant decisions.

Enhances Harmony, Reduces Errors, and Speeds Up Processes

Since all employees will submit reimbursement requests through the same sheet, it will standardize the reporting process, which can also speed up the processing of requests. In addition, since the sheet has built-in formulas, the likelihood of errors in the calculations is minimal.

Matches Expenses with Allowed Amounts

Organizations set limits for different types of expenses. This sheet allows them to analyze whether employees are exceeding those limits and to adjust the requested reimbursement amounts accordingly.

Analyzes Trends to Offer Relevant Discounts

The management can analyze the trends of the usual expenses and take the relevant decisions. For instance, if the employees are often traveling for official meetings, and the hoteling expense is costing the organization a lot, it might decide to negotiate with a few hotels, and bring them on a panel, so to avail of the offered discounts.

What are the components of an employee expense report sheet?

Different organizations select different components, as per their requirements, the type of expenses frequently incurred, and the demands of the auditors. However, generally, the following components are present in such sheets:

- Date.

- Time period covered.

- Name of the employee.

- Employee ID.

- Department of the employee.

- Name of the manager.

- Purpose of the report.

- Type of expense.

- Description.

- Any unusual and additional expenses are not mentioned in the fields.

- Amount.

- Gross total of expenses.

- Any advances.

- Total reimbursable amount.

- Notes, if any.

- Disclaimer, if any.

- Signature of the employee.

Preview

File Size: 162 KB

See also:

- 1 to 10 Multiplication Table for Kids

- 18 Period Budget Template

- 401K Calculator Template

- 7 Day Schedule Worksheet Template

- Academic Activity Budget Worksheet

- Academic Activity Budget Worksheet

- Address List or Address Book

- Adjustable vs Fixed Rate Mortgage Comparison Worksheet

- Advance Payment Invoice

- Allergy Trigger and Symptom Table

- Allowance Tracker Template

- Annual Dinner Budget Worksheet

- Annual Profit Budget Sheet

- Annuity Investment Calculator

- Annuity Payout Calculator

← Previous Article

End of Day Cash Up SheetNext Article →

Vehicle Mileage & Fuel Log Sheet