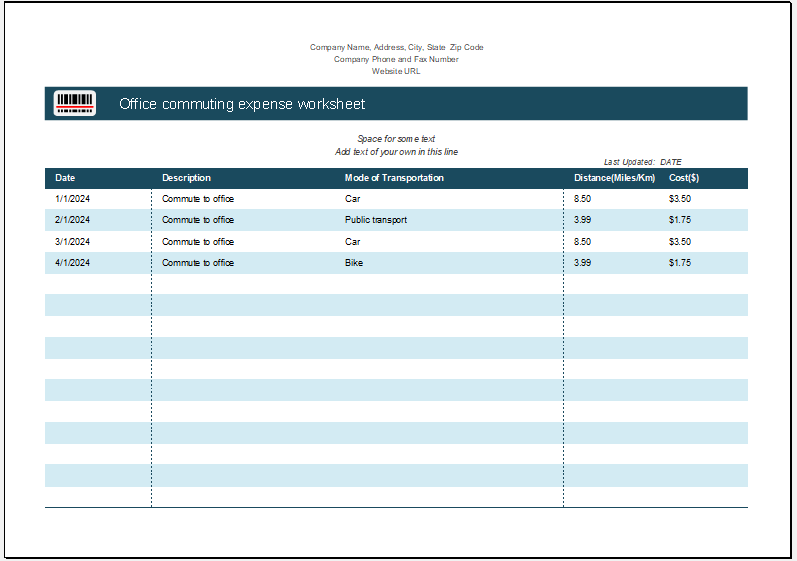

Office Commute Expense Worksheet

You are lucky if your workplace is close to your place of residence because you will have to pay less or nothing at all to commute daily to and from your workplace. People who have to travel several kilometers away from their area of residence spend a substantial amount of their salary on daily commutes. In some cases, if an employee comes from an area that is far from his workplace, the employee will commute to him. However, the company first tries to know how much an employee pays for commuting in a month.

What is an office commuting expense worksheet?

It is a record sheet that keeps the information about the expenses of commuting in its database. Whenever a person gets a job opportunity, the distance from the workplace to his house is a major consideration. Some employers also don’t hire those people who have to commute from a long distance because it is clear that they will have to be paid extra.

In some cases, employers are ready to work with such individuals who come from far-off areas and also offer them the reimbursement of commute expenses. However, employees are required to keep track of their commute expenses for which, the office commute expense sheet is the best tool.

What is the advantage of using the office commuting expense worksheet?

Those who travel daily from their house to their office are often required to record the expenses of moving to and from their office. It helps them see a clear picture of how much they are spending from their salary on getting transport services. Employees who want to perform the process of budgeting and also have to pay the tax can also get various benefits by using this record sheet.

What does a record sheet use for transport expenses records?

Every record sheet has a specific purpose and it can be a useful tool only when it serves that purpose. For this, it should be able to collect the information that it needs to help a person keep an eye on the cost of commuting. Following are some basic elements of this worksheet:

Date of entry:

Every time you make an entry in the worksheet, you should record the date on which you are recording the cost of traveling that you have incurred that day. If you travel to your office daily, make sure to make an entry in this tool daily.

Mode of transportation:

The expenses of traveling are unavoidable whether you have your vehicle or you are using public transport. However, there is a slight difference in the expenses due to the change in the mode of transportation.

Mention the distance traveled:

This worksheet also records the total distance that an employee covers every day to reach the office and then come back home. This information makes sense when the employer has a look at the total expenses and wants to determine how these expenses are justifiable. You can use different units to mention the distance covered. It can either be in kilometers or miles.

Make a list of miscellaneous expenses:

Many other expenses are directly or indirectly related to traveling to the office. If you have your car, you can mention the expenses of fuel in the whole month, the total amount spent on servicing the car, the amount spent on buying the parking pass, and much more.

These all details will let you know the exact cost of commuting. To make things easy for you, you can categorize these expenses into various sections, and then recording the data and retrieving useful information from it becomes easy.

When you give all the details of the expenses you have faced in the entire month to travel to the office, you can easily manage your budget. In some cases, people use different modes of transportation to see which one is most affordable for them.

This is possible only when they keep a record of costs incurred by using all the modes being compared. The employer can also prepare documentation based on expenses to prove he is paying against the transportation services.

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

- Event Planning Gantt Chart

- Employee Attendance Dashboard

- Monthly Study Reminder & Planner

- Move-in Checklist Template

- Camping Checklist Template

- Employee Orientation Checklist Template

← Previous Article

Personal Financial Transaction RegisterNext Article →

Small Family Kitchen Design Planning