Yearly Comparison Balance Sheet

The balance sheet is the most commonly used document by a business to create different types of financial statements. For example, to create the statement of cash flow in two years, a business consults the balance sheet of the previous two years.

The details of income generated by a business and much more information is obtained from the balance sheet and then used to create the cash flow financial statement.

What is a yearly comparison balance sheet?

It is a professionally used document that is very helpful in making a comparison between two years for getting the necessary information. Whether the assets have increased or decreased can be determined with the help of this sheet.

The comparison balance sheet tells a businessman whether a business is progressing or not. On the basis of information provided by this sheet, a businessman can take several decisions.

In order that any business makes a profit and flourish, it is important to know the financial status of the business.

In order to make further improvements in the business yearly comparison balance sheet is the best way to Judge the company’s statuesque, it is a very systematic and arranged way to show the company’s status. The right balance sheet will make a sparky bounce in order to get a higher rank in the business market.

Comparative balance sheets basically an analysis of assets, liabilities, and equity-related to some business. If it is prepared on an annual basis then it is called a yearly comparison balance sheet.

It basically provides the reader with all the information regarding his finance. It will help the business owner to know his exact assets and liabilities.

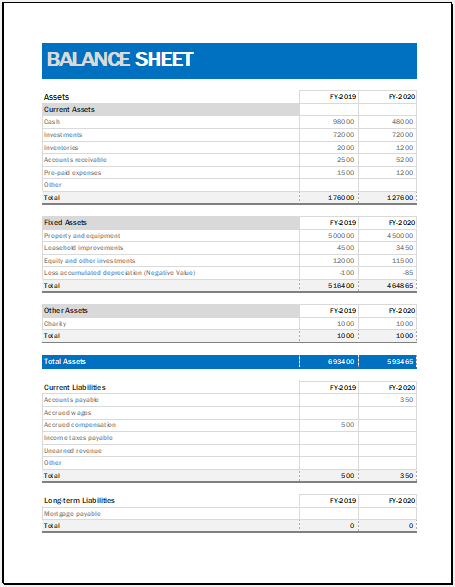

The typical format includes the detail of current assets fixed assets current liabilities and shareholder equity. In current assets, there must be details of cash, accounts receivable, and inventory.

The current liabilities include accounts payable, accrued expenses short-term debt, long-term liabilities. It consists of two columns, in one column there are details of the business assets, in the second column there are details of costs.

How to use the yearly comparison balance sheet?

In order to effectively use the comparison sheet, the user is required to be organized. For a better comparison, the details of all the years to be compared should be written side by side. When the data to be compared is written side by side, the comparison becomes easier.

As a matter of fact, when the comparison between more than two years is made, the business gets more information. However, the process of comparing the balance sheets of all the years gets too complex.

Template

In order to deal with the complexity associated with the comparison between multiple years’ balance sheets, the yearly comparison balance sheet template can be used. This template is a very useful tool for all those people who are in need to get the progress report of the business of previous years but don’t have enough knowledge to do so.

In some organizations, experts are hired for doing the job of comparison. The use of template saves the company from hiring experts and thus, saves money. The balance sheet also makes the comparison process faster and easier. The use of the template is recommended to save money and time.

It can save one’s time and energy and prevent the long and detailed calculation and will always give exact results. This balance sheet can be either manually created or it can be created using software usually MS Excel. Nowadays it is available in the market in the form of a readymade document. The available template will help one to maintain the record of his business assets.

File: (.xlsx) FREE Download

Size 22 Kb

Download

← Previous Article

Comparative Balance SheetNext Article →

Funds Tracking Balance Sheet

Leave a Reply