Comparative Income Statement Template

An income statement is a very common financial statement used in all businesses to assess financial results within a specified time frame. The statement presents the revenues and expenses incurred during the year. This calculation of revenues against expenses gives the concluding profit or net loss. Hence, the income statement is a tool used to review the profit/loss a company has earned.

A company spends on various expenses. The best income statement is one that presents the nature of expenses, which include administration as well as distribution expenses. If the company is involved in research and development, the expense of research will also be included.

The income statement in itself provides a good analysis, however, for better results, it is best to study the income statements comparatively.

Comparative income statements represent data for multiple periods. This helps the decision-makers analyze the performance over time. The comparative analysis will show any changes in revenue and expenses. This can help the management make decisions regarding these items.

The comparatives can be for historical years, quarters, or even months. The best representation is to show the current year against the previous years.

Comparative financial statements are issued by the company, and they include an income statement, a balance sheet, and a statement of cash flow.

This set of financial statements can help show trends over time. Any unidentified trends can also prompt management to conduct an investigation. These comparisons can also help predict future performance.

Financial analysts study the company’s financial statements by using ratios and percentages. These ratios can help in predicting the future performance and position of the company.

This comparative analysis has various uses, one of which is to determine the future health and stability of the company. The income statement is also known as the profit and loss statement.

Most of the companies use both terms interchangeably. The profit and loss statement shows the gross profit of the company, whereas the income statement shows the net worth of the company.

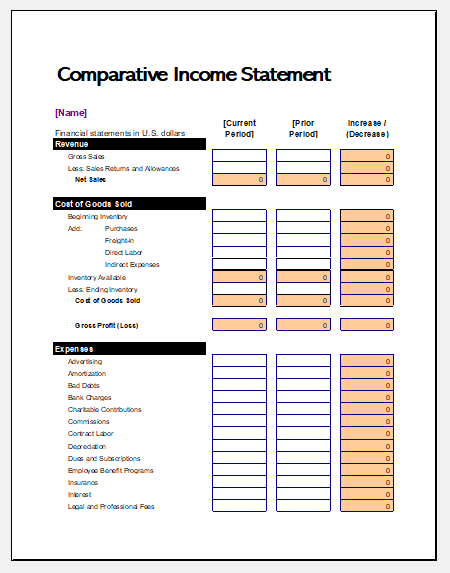

The income statement provides the details for the below:

- Revenue: which includes all types of revenue incomes

- Cost of goods sold: This includes inventory, purchases, and all other expenses related to inventory.

- Expenses: the company can identify the expenses and categorize them into administrative and other expenses.

- Net income: deducting the expenses from the revenue will bring us to the net operating income, or the net operating profit.

- Other income: incomes generated other than revenue will also be included in the income statement. Any gains or losses due to the sale of assets will be included in the statement. The final total will be the net profit minus the net income.

File Size: 16 KB

Format & Extension: Excel [.xls]

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

- Event Planning Gantt Chart

- Employee Attendance Dashboard

- Monthly Study Reminder & Planner

- Move-in Checklist Template

- Camping Checklist Template

← Previous Article

Vehicle Trip Tracker TemplateNext Article →

Warehouse Inventory Templates