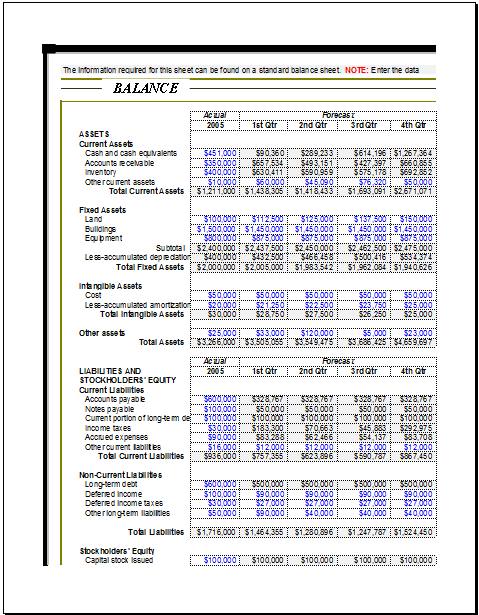

Corporate Analysis Balance Sheet Template

A balance sheet is a useful document that is usually used by companies that are concerned about their accounting and financial processes. When a company wants to see its assets, it has to fall back on its balance sheet. This tells the company how many assets it has to protect all its shareholders. The use of balance sheets also clears up lots of confusion, such as how the management is making efforts to keep the balance between the assets and liabilities and how much the risk of bankruptcy is.

Corporate analysis:

Since a balance sheet is a useful document, a corporation always needs to analyze it so that it can ensure that there is a balance between assets and liabilities. When a corporation wants to know whether it is in a position to pay off its debt, it takes a look at its balance sheet. Hence, the analysis of the balance sheet uncovers lots of things.

In accounting, the company recognizes revenue on verbal terms. So, it does not matter whether the company has received cash or not. There can be a shortage of liquid assets because sales are conducted on credit. To see how high the risk of a shortage of liquidity is, the company analyses the balance sheet.

Elements of the balance sheet:

To ascertain all the aspects of the balance sheet, a company is required to see every element in detail. Here we are also going to see all the elements of the balance sheet one by one to determine how a balance works.

Cash:

Cash is one of the biggest factors that keeps reassuring the company that it will survive in times of recession. Investors want to see the financial health of the company before they make any decision to invest in that organization. So, cash is their major point of interest. The balance sheet keeps information about the cash and thus, becomes a useful tool for determining the position of a corporation in terms of the revenue it earns.

Account receivables:

Accounts receivable refers to the cash the company is required to collect from different entities. This is a major part of the balance sheet that shines a light on how effectively a business can collect payments from all those individuals who have purchased services on credit.

The account receivables values in the balance sheet keep fluctuating depending on the business. it tells a lot about how a business has been operating. If there is a decline in the value of the account receivables, it shows that the company has successfully collected the payments from different people. However, the rise in the value of the accounts receivable tells us that the business has not collected payments because it has been so lenient in terms of its payment policies, or there can be many other factors.

Inventory:

Another factor that contributes to the successful and accurate analysis of the balance sheet is inventory. Inventory on the balance sheet has a pivotal role to play. Companies take inventory information on board when they want to see the value of liquidation. The corporation often has to draw a parallel between the cost of the items and the inventory. If there is a considerable difference in value that is being seen, it means that the firm is going to falter.

Liabilities:

Liabilities on the balance sheet indicate the amount that the corporation is required to pay. They say a lot about the position of the firm. If the liability value goes too high, it means the firm has not been paying its bills and other payments. Due to this, it can be easily seen that the company is having a hard time.

Some businesses always manage to keep the value of liabilities low or zero because they know that the surge in value will put them in hot water. In this situation, the companies often have to make hard decisions, such as compromising on revenue being generated and much more.

Asset’s quality:

Whenever a balance sheet is made, the quality of the assets is always taken into consideration. The assets usually constitute the property, inventory, and all the cash that is left after the company has finished paying all the liabilities. These things must be seen before one can judge the quality of the assets.

Conclusion:

Balance sheets keep the business alert so that the corporation can take the necessary action when it sees that it is going to stumble. The most important thing that every business is required to have is cash. A business should always pay attention to its balance sheet and see what details it is providing. This will always help a business, even if it is close to bankruptcy.

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

- Event Planning Gantt Chart

- Employee Attendance Dashboard

← Previous Article

Daily Assignment LogNext Article →

Sign Up Sheet Template