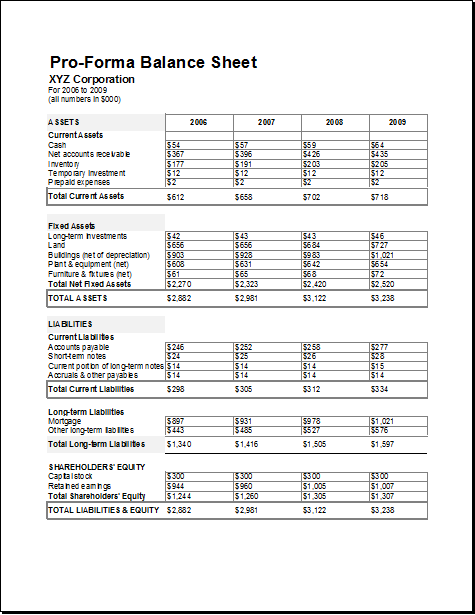

Proforma Balance Sheet

Managing assets is one of the most important and complex tasks a business has to perform. The Proforma balance sheet is a document that enables a business to predict how a business will manage the assets in the future. The details about the money associated with assets and inventory can easily be obtained through the Proforma balance sheet.

Although the Proforma balance sheet resembles the historical balance sheet, it is used to obtain information about the future. It is very important for a business to know whether it will run out of money or it will have extra money in the future. On the basis of this information, a business can take several steps. In other words, a sound a company will be working in the future can be predicted through the Proforma balance sheet.

The projected future status of a company is summarized using a proforma balance sheet. This is done after a much-planned transaction which is based on the recent financial statement.

What is the purpose of creating a Proforma balance sheet?

Many businesses prefer using Proforma balance sheets because they can easily manage the assets they have. Managing the assets in present enables a business to get better results in the future. Due to this reason, the business prepares and uses the Proforma sheets.

A person is required to prepare a proforma balance sheet whenever he is required to have it. The amount of money which a company has earned and other activities related to the finance are included in the statement which is made with the help of proforma balance sheet.

All the figures in the sheet must be labeled properly and all those figures which have deviated must also be mentioned in it. All future transactions such as new capital investment and assurance of quality are summarized in it; the anticipated results which are obtained from future statements are modeled through this balance sheet. The modeled transactions are particularly those, which focus on projected net flow, net revenue, and taxes.

In case a Pro-forma sheet has been decided to be applied to the business it should contain all current assets, inventories, non-current assets, intangible assets, financial and biological assets, liabilities, unearned revenue, equity as well as the net balance of the assets.

In order to structure compliance with debt, the lenders and investors can use this sheet as it can be very helpful for them. The proforma balance sheet is also prepared when a new company is envisioned in order to let the prospective investors know about the information about the company.

Every business can use this sheet for their own purpose of forming the status sheet of the company.

What should be included in the Proforma balance sheet?

Long-term assets:

All the long-term assets a company possesses are mentioned in this sheet. The sum of total long-term assets is also shown in the Proforma balance sheet. Buildings, land, vehicles owned by a business are all long-term assets. The asset value of all the long-term assets is calculated by subtracting the depreciation value from the original price of the asset.

Short-term assets:

Short-term assets include the cash money and some account receivables. The income of the company from any source is included in account receivables. The short-term assets are not available to business for a long period of time

Liabilities:

The money payable by the business is included in the sheet. The money a business has to pay in the form of employees’ salary, loan payment and other payable things are liabilities. This part of the balance sheet also includes the amount of mortgage.

PROFORMA BALANCE SHEET

Download your file below.

File Size: 35 KB

Download

← Previous Article

Funds Tracking Balance SheetNext Article →

Projected Balance Sheet

Leave a Reply