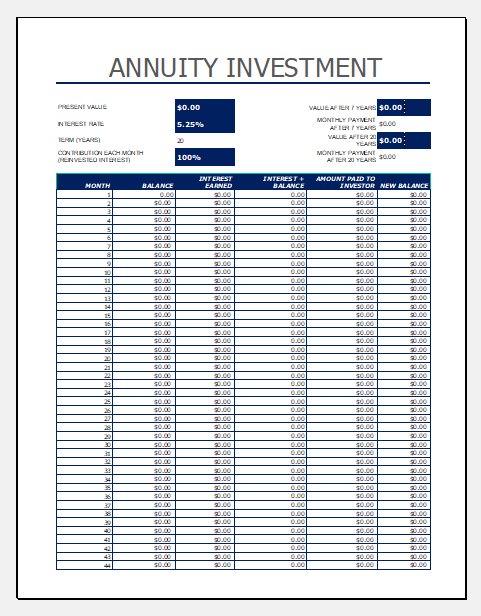

Annuity Investment Calculator

Everyone wants a secure life, especially after crossing the age of 50 when retirement time is near and there is no other type of employment to rely on for the rest of life. One of the best ways to make the future secure is to invest a lump sum of money somewhere and then receive the monthly payments for the rest of your life.

What is the annuity investment calculator?

An annuity investment calculator is a great tool for investors who want to invest money somewhere and then receive the monthly amount. This calculator tells them how much money they will receive every month or year after making a particular amount of investment. In other words, you can save money for a long period of time. Moreover, your savings remain tax-deferred.

The amount of investment necessary to be made to get the desired level of monthly income can also be calculated by using the annuity investment calculator.

What is an annuity?

An annuity is a stream of money a person receives for the rest of his life when he purchases the annuity from the insurance company. There are different annuity contracts. Some of them are very simple, while others are complex. Whether the annuity to be purchased is simple or complex; there are a lot of benefits one can avail of after purchasing the annuity.

There is no deduction on the money you deposit in the form of an investment. If you want to increase your savings, which are free from tax, you can opt for an annuity.

What is included in the annuity calculator?

Amount of investment:

The amount you want to contribute to the annuity is required to be entered. It is also known as the starting balance.

Annual investment:

If you have chosen a plan that requires you to contribute each year, you will be required to enter the value of the annual contribution.

Current age and age when you withdraw the contribution

The calculator will also ask you to provide your age when you started contributing and your age when you first withdrew your annuity balance. Withdrawal age is necessary because it is the time when you stop making the contributions and start consuming the funds.

The current rate of tax:

When you make the contributions, you are paying the tax since your investment is not tax-deductible. The rate at which you are paying the tax is important to know.

Interest rate:

The calculator also asks you to provide the interest rate to which you are contributing. You are also required to state the annual interest rate. Furthermore, the expected interest rate is also required to be known.

You can find different types of annuity investment calculators on different websites. Some of these are very simple, containing a few fields and generating results quickly. Some are too complex and ask for too many details before calculating the annuity investment.

Preview

Format: MS Excel [.xls & .xlsx]

File Size: 45 KB

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

← Previous Article

401K Calculator TemplateNext Article →

Annuity Payout Calculator