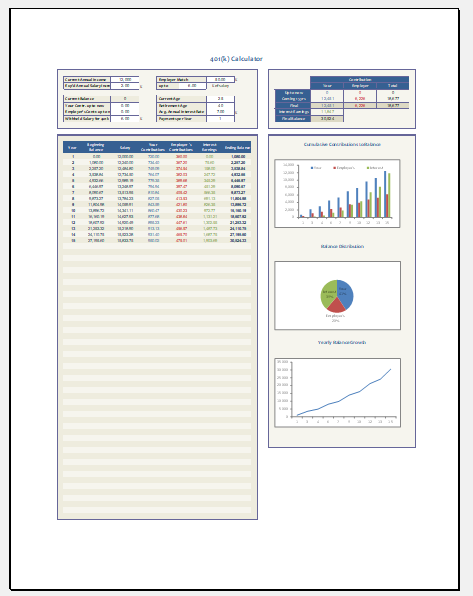

401K Calculator Template

What is a 401k calculator?

The calculator used for estimating the 401k balance at the time of retirement is known as a 401k calculator. People wanting to create a secure retirement can easily opt for this calculator. By using this calculator, one can easily estimate the distributions in retirement.

401(k) is a retirement plan designed for those who want to have a savings plan before retirement. This plan is very commonly used in the U.S. The assets in the 401k plan are tax-free and the person will not have to pay the tax after retirement.

Pros and cons of the 401(k) calculator

Pros:

- The individual’s earnings from interest or capital gains are completely tax-free. This aspect of the 401k calculator makes it highly efficient and makes it preferable for other people to use.

- With the use of a 401k calculator, you can determine how much flexibility you can get. An employee can contribute according to his choice. There is no restriction or limit on the contribution imposed on the employee.

- There are many retirement plans which are not tax-deductible. Many retirement plans depend on other plans, some of which are associated with taxable income. The 401(k) plan is completely tax-deductible since it lowers the taxable income.

Cons:

- The 401(k) plans come with very few investment options.

- The cost of getting this plan is very high as compared to other plans. The administration costs are generally too high since there is a lot to be done to get you verified and approved for this plan.

- There is a waiting period for employees that they have to pass to get approval of the plan. Commonly, the employees are asked to wait for six months at least.

How does a 401(k) calculator work?

The amount of income you will have to generate after retirement can be calculated using this calculator. One cannot predict the expenses accurately, especially the medical expenses. So, if you are going to face more expenses, you will end up consuming all of your savings.

The markets are also unpredictable. Similarly, knowing how much you will need to spend in the next 10 to 15 years is also not possible to predict.

The use of a 401(k) calculator comes into play when you want to estimate reasonable expectations regarding your expenses. The purpose of using this calculator is to ensure that you will live your life comfortably after retirement.

You may find many calculators containing a lot of variables for calculations. Too many variables used in the calculator don’t make it any better than other calculators. In most cases, using the calculator in its simplified form is more useful.

What are the main variables of the (401) k calculator?

- The average income contribution of the employee

- The average monthly contribution of the employee

- The contributions needed to reach the goals

- Limitations of the contributions

Preview

Format: MS Excel [.xls & .xlsx]

Size: 78 KB

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

← Previous Article

Doctor Bill TemplateNext Article →

Annuity Investment Calculator