Personal Assets and Debts Calculator

Some people have some personal assets which they keep for security purposes. It is a good idea to do this as they may be required at any time. Assets are said to be the value of securities as well as funds present in checking and savings accounts, real estate, retirement account balances, as well as trading accounts. Liabilities are any debts the person may have such as personal loans, student loans, mortgages, etc. You must know what your assets and debts are.

What is a personal assets and debts calculator?

A personal assets and debts calculator helps you calculate the number of personal assets you have in ratio to your debts. It considers all the assets that you have and the debts as well. An idea is then gotten of where you stand.

Importance of a personal assets and debts calculator

The personal assets and debts calculator lets one know whether they are facing any issues by having more debts than current assets. According to this, the person can organize how to solve the problem and not incur more debts. They can know where to cut spending for instance. On the other hand, it allows one to know if they are in a favorable position and can spend more on certain activities. You can know your net worth by this.

Tips to create a personal assets and debts calculator:

The personal assets and debts calculator is a useful one. The following tips can be kept in mind when creating this:

Know your assets:

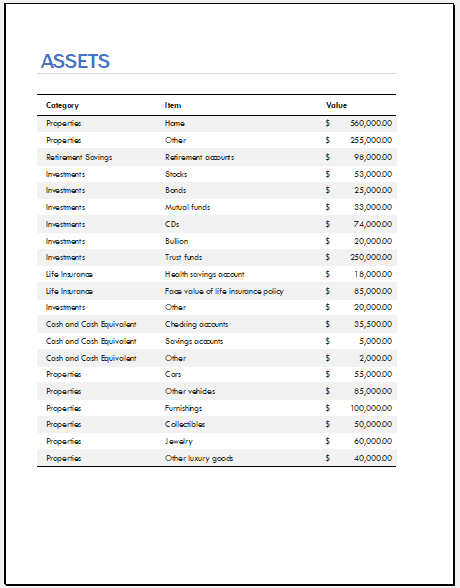

It is important to know what all your assets are if you want to calculate your assets and debts. For this, you will have to keep in mind how much cash you have. It is any physical currency along with coins that you have.

Also, see the funds that you possess in the bank. This is any savings, checking, and money market accounts that you have. You may have stocks, bonds as well as mutual funds.

Some people have retirement accounts as well. Count the cash value that you have in your life insurance. The present blue book value of motor vehicles is a part of your assets. The present market value of any property you own is included. Personal valuables like jewelry, furniture, etc. are a part of assets. Any money that someone needs to owe you and you expect that they will pay it back, include it as well.

Liabilities and debts:

After stating the assets, create another list of the liabilities along with amounts. The liabilities include debts and payments that you have to give to someone else. The common types of debts are mortgages which include the amount you need to still pay on any mortgage. You may have some home equity loan which you have to still pay. The total amount you need to pay on any automobile is needed.

There may be some student loans that have to be paid. There is sometimes a balance which you need to owe to your credit card company.

Calculation:

When the stock has been taken of assets and liabilities, then you can calculate the number. You have to add all the amounts that have been listed beneath assets and also beneath liabilities. There will be two numbers calculated, i.e., the total of assets along with the total of liabilities. When these figures have been gotten, you subtract the liabilities number from the total assets one.

Net worth:

After the above calculation, you will know your net worth. The calculator can be made by following the above calculations, simply.

Final Words:

The personal assets and debts calculator allows one to know what their net worth is. It aids them in knowing how much debt they still have and whether they can pay it through their assets or not.

Therefore, they can work to better their financial standing. If this amount is not known, people may spend carelessly leading to more debt and a weak financial future.

It is important to carefully calculate the amount so that it is accurate and you know where you stand. It stops one from spending carelessly and lets them focus on improving their financial situation.

Provided by Office Templates← Previous Article

Small Medium Large Box Graph PapersNext Article →

Weekly Appointment Sheet Template