Year-end Tax Planning Calculator

What is a year-end tax planning calculator?

Most people use the Year-end calculator to discover all the opportunities they have for withdrawing money from the IRA. This calculator is the main tool that enables the user to plan everything related to tax efficiently. Using this calculator, the user can easily organize his finances. All planning is generally done at the end of the year, which is known as year-end tax planning

What is the purpose of Year-end planning?

Year-end planning is useful for people in many ways due to which many people prefer doing Year-end planning in order to get social security without having to pay tax. People can also get capital gains when they become aware of the Year-end planning and its benefits.

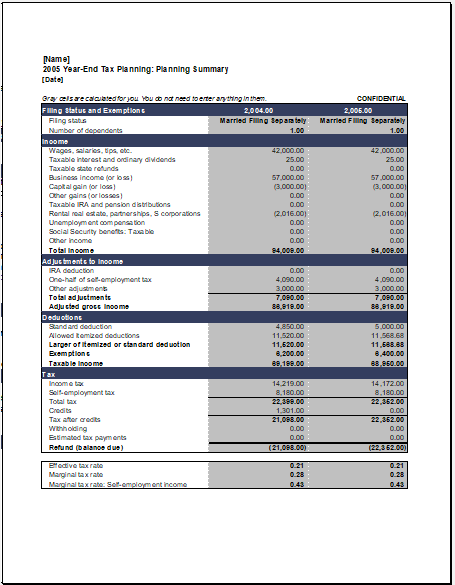

Year-end tax planning calculator template:

To ensure better Year-end planning, you can make use of an effective online program that will help you determine your liabilities related to federal tax. Moreover, there are also many additional features to the template such as calculating the exemptions and deductions.

What are the benefits of using the calculator?

A year-end tax planning calculator comes with plenty of benefits. Here we are going to discuss some of the benefits:

- This planning calculator template enables the user to consider the tax return of the previous year. In this way, the user can determine the tax return for the current year

- If you planning to get retired from the job, you can make use of this calculator to determine what you should consider while planning your retirement. it also helps you know what should be your contributions that can lead to effective retirement planning

- With the help of Year-end tax planning, you can generate an investment statement that can help you realize the potential losses or gains, details about dividends, and a lot more

- When it comes to getting the details about the projected income in the current year, expenses related to health care, interest to be paid on the mortgage, and other types of transactions related to tax, you can use the Year-end planning with ease and comfort

The use of a year-end tax planning calculator requires the user to provide the right information so that the calculator can give accurate results. The user should gather information about the tax returns of the previous year so that the tax return planning can be done. If the user does not collect this information, he will not be able to use the Year-end tax planning calculator.

Tax planning is generally done at the end of the year since all the information about the tax return can be obtained from the year that has ended because it cannot have the tax returns anymore. Thus, the user can rely on the information obtained from the previous year’s tax return.

Preview

Format: MS Excel [.xls] 2007/1013

File Size: 126 KB

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

← Previous Article

Sale Probability Assessment CalculatorNext Article →

Vehicle Loan Payment Calculator