Deferred Tax Rate Calculator

What is deferred tax?

A deferred tax causes a reduction in the taxable income of the person. The person is required to calculate the deferred tax when he pays the tax more than it is required. There are some pending payments that an Internal Revenue Service is required to pay.

The situation of deferred taxes takes place when there are a whole lot of tax expenses. Sometimes, there is a huge difference between the revenue earned by the business and the taxable revenue receipt. There is limited taxation on the revenue generated by any business. Since taxation is an application of the revenue, the company should be able to recognize its revenue.

Why is deferred tax calculation important?

The deferred tax is very important to calculate because it is one of the most important accounting parameters to be taken into consideration. The effect of the tax on the revenue can be determined by using a deferred tax calculator.

How to calculate the deferred tax?

To calculate the deferred tax, you should be aware of the rules that need to be followed to reach accurate and precise results. Here we are going to give you step by step that will help you calculate the deferred taxes easily.

- Make a table and note down all the assets and liabilities in two different columns. It is recommended to mention your liabilities as a negative number and assets as a positive number. Make sure that you keep the equity accounts into consideration to make sure that your calculations don’t stay incomplete because of missing anything important. It should be kept in mind that the total of all the values added to the table should be zero. This is the best way to ensure the correctness of the record

- For each asset and liability, calculate the tax base. In the case of assets, the tax base is an amount that is deductible for the tax. Whereas, in the case of liabilities, the tax is a carrying amount that is deductible for tax purposes based on liabilities in the future.

- Calculate all the taxable temporary differences. The temporary tax differences can be either negative or positive.

- When all the assets and liabilities are taken into consideration, the deferred tax applies to this period and the tax rate is determined.

- Calculate the deferred tax on assets and liabilities. The taxable temporary differences are negative if deferred tax liabilities rise. Similarly, the taxable temporary differences will be calculated to be positive if the calculations show a rise in deferred tax assets.

- If there is anything that you have not included while making calculations, add it at the end of the calculation process and repeat the calculation.

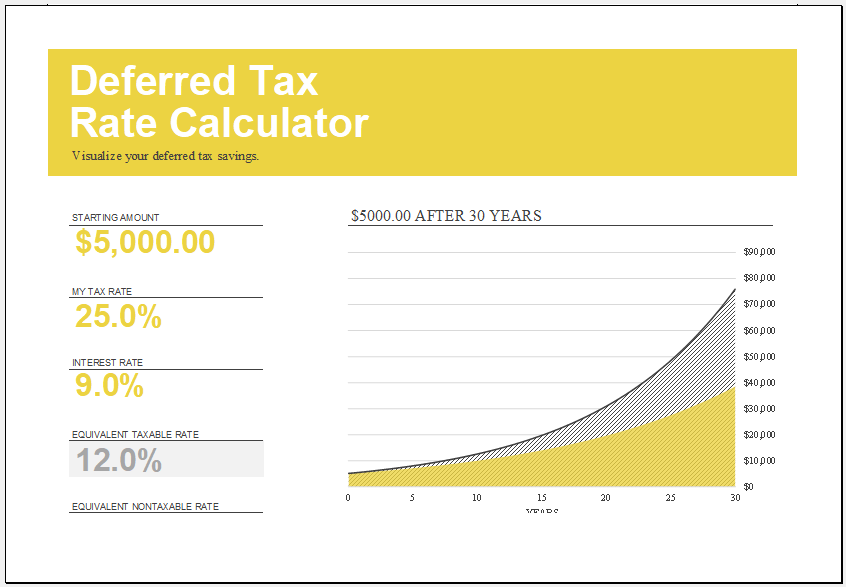

Deferred tax rate calculator template:

The deferred tax rate calculator is a great tool to be used for all those people who don’t have any clue about how to calculate the deferred tax rate. This calculator calculates everything with complete accuracy and ensures that it does not mislead you with wrong or inaccurate results.

Preview

Format: MS Excel [.xlsx] 2007/2010

- Business Startup Cost Estimator

- Home Construction Cost Estimator

- Kitchen Remodel Budget Calculator

- Personal Assets and Debts Calculator

- Power Consumption Calculator

- Payroll Calculator Template for Excel

- Food Fat Percentage Calculator Template

- Total Cost of Ownership Calculator Template

- Retirement Calculators

- Vehicle Loan Payment Calculator

- Year-end Tax Planning Calculator

- Sale Probability Assessment Calculator

- Travel Expense Calculators

- Sales Commission Calculators

- Mortgage Loan Calculator

- Simple Loan Calculator

- Net Present Value Calculator

- Mortgage Finance Calculator

← Previous Article

Kitchen Remodel Cost CalculatorNext Article →

Life Insurance Needs Calculator