Mortgage Finance Calculator

The amount of loan which is secured by the real estate property is known as a mortgage. For a lender, it is money that has been borrowed to buy the real estate property. In the system of mortgage, the borrower agrees to pay off the borrowed money over a specific period.

The borrower can take 10 to 20 years to pay off all the money he has borrowed. It completely depends on the financial condition of the buyer.

The borrower is required to make monthly payments to gradually pay off the borrowed money in the form of real estate property. The buyer should know the cost of the property he is buying through the mortgage system and the monthly payment he will have to make.

Moreover, the interest rate that will be added to the principal amount should also be known. To get these details, a person getting involved in the home-buying process can use the mortgage finance calculator.

Format: MS Excel [.xlsx] 2007/2010

File Size: 357 KB

What is a mortgage finance calculator?

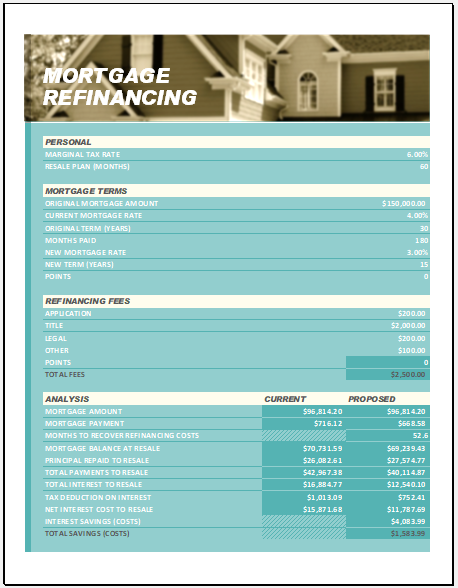

A mortgage calculator is an essential tool used by many borrowers when they want to calculate the estimated mortgage payment to be made every month. The user is required to provide different variables such as the actual price of the house, down payment of the house, duration of the loan, interest rate on the loan, and a lot more.

How does a mortgage finance calculator work?

The mortgage calculator breaks down all the provided information into different sections. This calculator then focuses on each section to give the correct results. The calculator asks the user to provide information about the ZIP code so that the mortgage calculations can be provided based on the location.

The calculator also asks the user to provide the range of credit scores. The mortgage loan repayment largely depends on the credit score of the user. So, this is another very important parameter to be taken into consideration before performing the actual calculations.

What are the benefits of a mortgage finance calculator?

People who want to get into the process of home-buying are required to collect a whole lot of information. The most common and important information regarding the home-buying process is the mortgage information. Using this picture enables the user to get a clear and realistic picture of the mortgage.

The calculations of mortgage payments are done quickly and accurately to ensure that the user is not being misled. The use of a mortgage calculator also ensures that the user can buy the house with confidence since he is sure about the actual complications and processes, he is likely to encounter.

The mortgage finance calculator is the best tool to be used when it comes to considering the cost of the house, mortgage, and all other costs that are directly or indirectly related to the cost. This will give the user a clear idea about the amount of cost he will have to incur after getting into the process of buying real estate property.

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

← Previous Article

Mixed Cash Flow Streams CalculatorNext Article →

Net Present Value Calculator