Mortgage Loan Calculator

There are many reasons why people like to use a mortgage calculator. However, the primary reason to use the calculator is to figure out how much monthly payments a person is required to make.

What is a mortgage loan calculator?

Many financial institutes, as well as mortgage brokers, make use of a mortgage calculator to figure out many details regarding the mortgage. A mortgage calculator is a useful tool that enables a user to know about the amount to be paid in the form of monthly payments by entering some basic and important details into the calculator. The details that a mortgage calculator asks the user to provide are:

- The total value of the real estate property

- Duration of the loan

- Depreciation amount over time

- Down payment

- The interest rate on the monthly payments

What are the advantages of using the mortgage loan calculator?

The mortgage calculator enables a user to save money:

The mortgage calculator provides all the details about the down payment and the interest rate that the user will have to contend with. In this way, the user can choose the most suitable loan option for himself. A person is less likely to spend money on any inappropriate loan option when the mortgage calculator is used properly before making any special decision.

The user plans the budget more effectively:

The most important thing to consider before buying a house is whether your budget allows you to buy the house or not. This calculator not only tells you about your affordability but also tells you about the exact amount you will have to pay. People who search for a suitable and affordable real estate property can use this calculator. They can also know what their affordability is and how much they are required to plan ahead of time to be able to pay the monthly payments smoothly without facing any financial burden

The user can easily calculate mortgage insurance:

People who are not able to pay more than 20% of the down payment are required to pay mortgage insurance. It seems like an additional burden due to which, many people prefer calculating it before taking the next step. The mortgage calculator calculates the insurance mortgage amount you are needed to pay.

So, by using this calculator, the user can figure out whether he should pay the mortgage insurance or should wait until he gets more money to pay enough down payment to avoid insurance mortgage

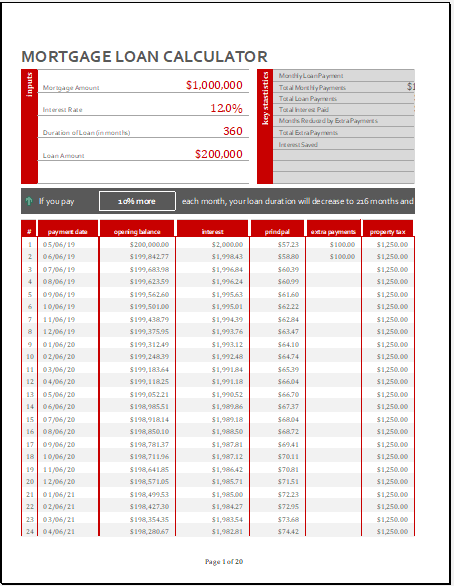

Mortgage loan calculator template

This template is an effective online tool that allows the user to figure out everything related to the mortgage loan before he starts preparing himself to go for it. For most people, getting a mortgage is a little daunting which keeps them from taking any decision. The mortgage calculator template makes it clear to the user due to its accurate and realistic results formulated very quickly.

Preview

Format: MS Excel [.xlsx] 2007/2010

File Size: 102 KB

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

- Event Planning Gantt Chart

- Employee Attendance Dashboard

- Monthly Study Reminder & Planner

- Move-in Checklist Template

- Camping Checklist Template

- Employee Orientation Checklist Template

← Previous Article

Simple Loan CalculatorNext Article →

Sales Commission Calculators