Petty Cash Log Template

Are you running a business or working in any organization? If yes then you might know the value of petty cash and its monitoring in a corporate. Petty cash is a small proportion of money kept at the office or reception for little or emergency expenses. The cash is kept secured and a log is maintained to monitor the flow of this cash.

Uses of petty cash

- Purchase of daily minor items like stationery, snacks or beverages, etc.

- To give a change

- Holding some amount of money that is not sent to the bank account

A typical petty cash holder is a box in which separate sections are remade to keep notes, coins, and vouchers. A lock system is installed for safety. You have to decide the floating amount initially that you withdraw from your bank account to keep as petty cash. Do not forget to take some coins of cash and write a voucher about this petty cash which has to be stored with the petty cash.

Another crucial thing in holding and maintaining petty cash is the use of a petty cash log book. This petty cash register should include the initial and daily petty cash in and outflow. You can buy an ordinary notebook and record your daily log into it or you can easily download free templates for petty cash logs. The user-friendly customizable option drafts a precise log where you can add your petty cash entry with no hassle.

File: Excel (.xls) 2007/10 Size 15 KB

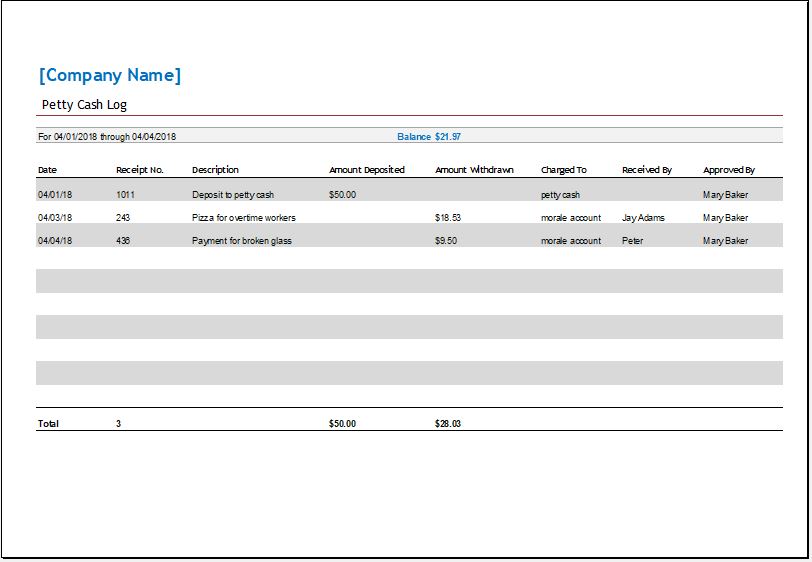

Petty cash log template given here is a comprehensive solution to keep a record of petty cash amounts deposited and withdrawn at a place. This Excel template provides you with ease of updating the petty cash record easily. Let’s see how it works!

- Download and save the template to your computer.

- Open the template file using MS Excel of any version.

- Once you open the file you will see the template interface as shown in the preview

- If you are using it for a company write the company name at the top

- Below you will see a table with multiple columns having different headings

- Start writing from the 1st column by putting the ‘Date’ of deposit or withdraw the petty cash

- Write the ‘receipt no.’ of the payment receipt

- Give ‘description’ to this record for later understanding

- Next, you can either insert ‘Amount Deposited’ or the ‘Amount Withdrawn’. Choose and enter the amount

- In the next column write to whom this amount has been charged

- In the last column mention who approved this transaction

- The sum of the “Amount Deposited” and the “Amount Withdrawn” will be calculated automatically.

Note: Do not alter the columns that carry formulas. Altering these cells may stop the worksheet from working properly.

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

- Event Planning Gantt Chart

- Employee Attendance Dashboard

- Monthly Study Reminder & Planner

- Move-in Checklist Template

- Camping Checklist Template

- Employee Orientation Checklist Template

← Previous Article

Lost and Found Log TemplateNext Article →

Equipment Inventory Template