Net Present Value Calculator

Calculating the net present value (NPV) is important because it shows the current worth of the money you are expected to receive in the future. By converting future cash flows into their present value, you can make more realistic financial decisions and avoid overestimating the potential benefits of an investment.

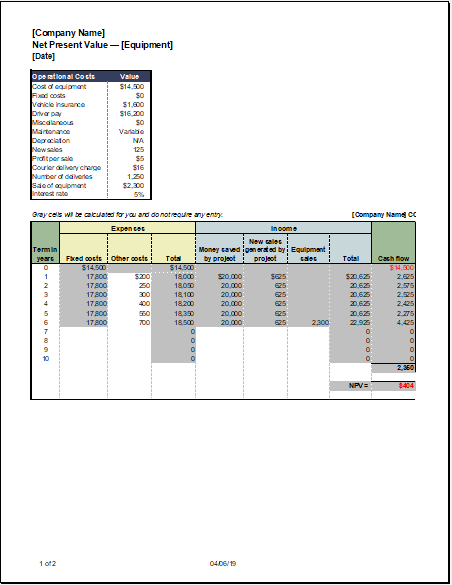

A net present value (NPV) calculator is a financial tool used to determine the present value of future cash flows, adjusted for a chosen discount rate. It works by requiring the user to input essential details such as the initial investment, expected cash flows, time periods, and discount rate. Based on this information, the calculator computes the NPV to help assess whether an investment is profitable or not.

Importance of a Net Present Value Calculator

Calculating the present value of future cash flows often involves complex formulas and time-consuming steps. A Net Present Value (NPV) calculator simplifies this process by quickly converting the lump sum of money you expect to receive in the future into its present-day dollar value. This gives you a realistic understanding of the true worth of your future returns.

The NPV calculator is especially valuable for professionals who need to evaluate whether investing in a particular project is financially viable. Many businesses use it when creating strategic plans, while individuals rely on it for personal financial planning to secure their family’s future.

Understanding Net Present Value (NPV)

The net present value (NPV) represents the current worth of money to be received in the future, expressed in today’s value. Since the purchasing power of money changes over time due to inflation and interest rate fluctuations, future cash flows must be adjusted to reflect their present value.

Because the value of money is not constant, financial institutions and accounting professionals use a discount rate to bring all future cash flows to a comparable present value. This makes it easier to evaluate investments and compare different financial options accurately.

Uses of a Net Present Value Calculator

There are many situations where using a Net Present Value (NPV) calculator is highly practical. For instance, individuals planning for early retirement can use it to evaluate the present value of their future income and estimate expenses, helping them make informed financial decisions.

The Template

This template is an MS Excel tool that helps users quickly and accurately calculate the net present value of an investment. It can be easily customized to fit individual requirements, allowing users to input their own cash flows, discount rates, and investment details to generate results.

However, it is important to note that the results obtained from an NPV calculator may not always be 100% precise. Many calculators use simplified assumptions, which means outcomes may vary depending on the tool being used and the accuracy of the data entered.

Format: MS Excel [.xlsx]

File Size: 33 KB

- Winter Clothing & Gear Budget Sheet

- Winter Utility Expense Template

- Fuel & Equipment Sheets

- Monthly Attendance Sheet for Employees

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

← Previous Article

Mortgage Finance CalculatorNext Article →

Simple Loan Calculator