Personal Assets and Debts Calculator

Some people hold personal assets for security purposes, which is a good practice as they may be needed at any time. Assets include the value of securities, funds in checking and savings, real estate, retirement account balances, and trading accounts. Liabilities are any debts a person may have, such as personal loans, student loans, mortgages, and other obligations. It is important to know and track your assets and debts to understand your financial position.

What is a personal assets and debts calculator?

A personal assets and debts calculator helps you evaluate your financial position by comparing your assets to your debts. It takes into account all of your assets and liabilities, providing a clear understanding of where you stand financially.

Importance of a personal assets and debts calculator

The Personal Assets and Debts Calculator helps an individual determine whether they are facing financial challenges, such as having more debts than assets. Based on this information, they can plan how to address the problem and avoid accumulating additional debt, for example, by identifying areas to reduce spending. Conversely, it also shows if they are in a favorable financial position and can allocate funds to certain activities. Using this calculator, you can easily determine your net worth.

Tips to create a personal assets and debts calculator:

The personal assets and debts calculator is a useful one. The following tips can be kept in mind when creating this:

Know your assets:

It is important to know all your assets if you want to calculate your net worth. To start, you should consider how much cash you have, including both paper currency and coins.

Also, review the funds you hold in the bank, including savings, checking, and money market accounts. You may also have other financial assets such as stocks, bonds, and mutual funds.

Some people also have retirement accounts. Include the cash value of any life insurance you own. The current blue book value of your motor vehicles should be counted as part of your assets. Include the present market value of any property you own. Personal valuables, such as jewelry, furniture, and other items, should also be included. Additionally, any money owed to you that you expect to be repaid should be counted as an asset.

Liabilities and debts:

After listing your assets, create a separate list of liabilities along with their amount. Liabilities include any debts or payments you owe to others. Common types of debts include mortgages, showing the remaining balance you still need to pay. You may also have home equity loans or auto loans, with the outstanding amounts listed for each.

You may have student loans that need to be repaid. In addition, there may be a balance owed to your credit card company.

Calculation:

Once all assets and liabilities have been listed, you can calculate the totals. Add up all the amounts under assets to get the total assets, and add all the amounts under liabilities to get the total liabilities. After obtaining these totals, subtract the total liabilities from the total assets to determine your net worth.

Net worth:

After completing the calculations above, you will know your net worth. The calculator can be easily created by following these steps.

Final Words:

The Personal Assets and Debts Calculator allows an individual to determine their net worth. It helps them understand how much debt they have and whether their assets are sufficient to cover it.

Knowing this amount allows individuals to work toward improving their financial standing. Without this knowledge, people may spend carelessly, leading to increased debt and a weaker financial future.

It is important to calculate the amounts carefully to ensure accuracy and understand your financial position. This helps prevent careless spending and allows you to focus on improving your financial situation.

Here are the templates:

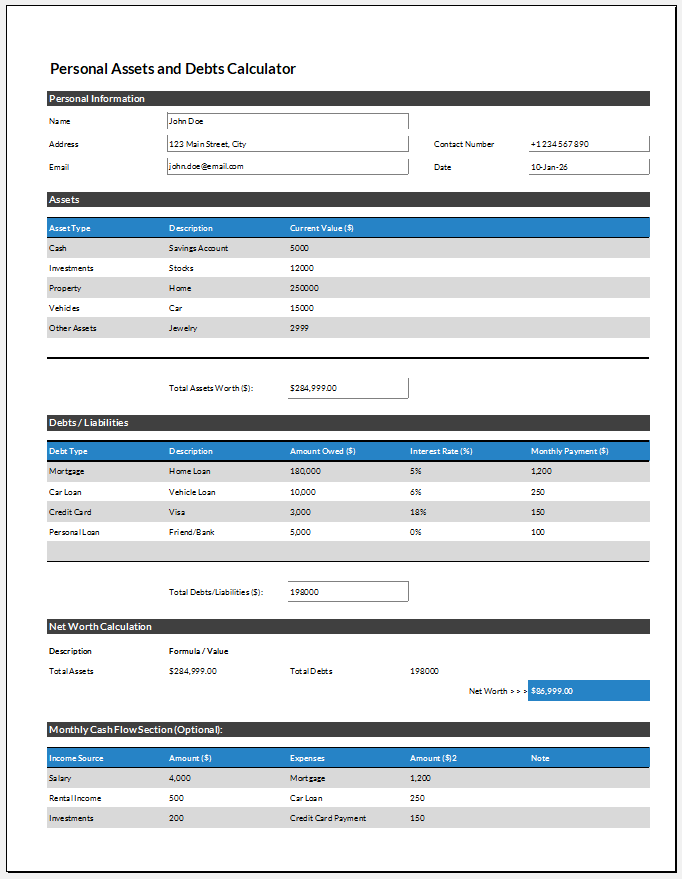

#1

Key Features:

1- Track all assets and debts in one place.

2- Calculate net worth (automatically).

3- Monitor financial health and progress (over time).

4- Support monthly cash flow tracking.

5- Easy to customize.

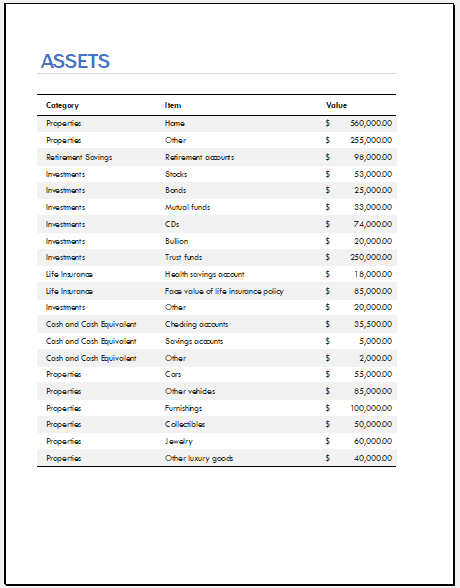

#2

Provided by templates.office.com

← Previous Article

Small Medium Large Box Graph PapersNext Article →

Weekly Appointment Sheet Template