Expense Reimbursement Form

Reimbursement is a process of repaying a person who has spent money on your behalf. This process is widely conducted in different organizations to reimburse all the money that their employee spending.

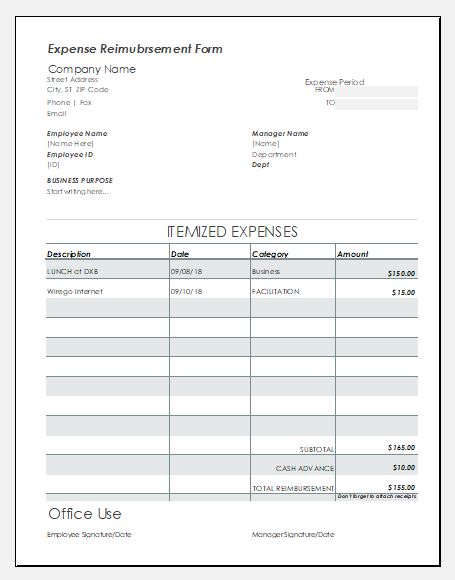

The employees are asked to fill an expense reimbursement form in order to let the company know about the total amount to be reimbursed.

What are the key parts?

The main parts of reimbursement form are:

- The name of the company

- The name of the employee

- Job title of the employee

- The department of employee

- Contact details of the employee

- The list of all the expenses

The list of expenses also includes the date on which the purchase was made. It also includes the complete description of the product that was purchased and the total cost of the product. The bank details of the employee are provided in this form so that the company can easily reimburse all the expenses.

Every company wants its employees to prepare an expense report before reimbursement. This report includes the expenses such as travel expenses, medical etc. This report can also be used to record several other types of expenses.

The employee is required to attach all the receipts with the expense report so that the company can confirm all those expenses. The employee is required to provide the proof of these expenses.

For example, if an employee wants the reimbursement of travel expenses, he should provide the details about travel such as total mileage, total fuel consumed and others.

Reimbursement is considered as an important part of every organization as it is helpful in designing personal budget of the company. Reimbursing the expenses is a major expense that should be included in the budget of the organization.

Expense reimbursement form template

In order to avoid preparing a reimbursement form from scratch, you can download a readymade expense reimbursement form from this page. You can also modify the form according to your choice and needs by adding or removing certain fields from it.

Preview

Expense Reimbursement Form

Download File Format: Excel [.xlsx]

← Previous Article

End of Day Cash Register ReportNext Article →

Cash Flow Statement Template

Leave a Reply