Budget Templates for Everyone

Financial planning for a set period of time is commonly known as budgeting. A budget is an estimate of the revenues and expenses that a person or organization expects to incur during a specific period.

Budgets include forecasts of incoming revenue (income and volume), operating expenses, and any capital investments that an individual, family, or business may be planning.

Budgets can be created for short periods, such as a week or a month, as well as for longer periods, such as a year or more. The most common period for budgeting is one year, although it actually depends on the budgeting person’s personal preference and the relevant situation.

Once expected revenues and expenditures are drafted, a budget may be in surplus or deficit. A budget surplus is when expected incomes are higher than expenditures. In such a case, it is feasible to make plans on how to utilize leftover resources.

A budget deficit occurs when expected income is less than expenditures. In such a case, additional financial resource planning is required to finance the deficit. There are several ways to clear the deficit, including cutting down expenditures, utilizing savings, or securing a loan.

How to make a good budget?

To create a sound budget, the most critical factor is accuracy in predicting both income and expenses. To create an effective budget, you must be able to estimate your income and expenses as accurately as possible. Usually, if income from property, investments, or wages and salaries is fixed, forecasting is not a problem. However, if income is expected to be variable, a good strategy is to use a historical average or alternatively, a moving average to forecast income.

The same goes for forecasting expenses as well. The next important step in making a good budget is to minimize expenses and prioritize them.

For example, if in a certain time period you have to choose between repairing a leaky roof or investing in air conditioning, you must be able to choose to get the roof repaired.

Prioritizing expenses can free up financial resources for later use and also provide leverage against unexpected circumstances. Finally, a good budget has very little difference than the actual budget if given circumstances are stable and supportive.

Benefits of Budgeting

Budgeting is essential whether you are managing personal expenses, managing a small business or a multinational. Budgets are useful for everyone. The benefits of budgeting are:

Mapping: Budgets outline what to expect in the near future. By estimating expected income, one can determine how much money will be available, which helps in planning and prioritizing expenditures.

Strategizing: Budgets are a key to devising future strategies/plan of action for the given time period. Once you know how much income is expected, expenses can be prioritized on the basis of the budget. Thus budgeting enables one to plan out when and where to spend.

Efficient management: Budgets allow efficient management of limited financial resources as expenditures and income are forecasted. Thus important decisions can be made timely resulting in optimal resource utilization. Budgeting through efficient management can also aid in avoiding unnecessary financial losses. It can also help in repayment of the outstanding loan and prevent building up of debt.

Focus: Budgets allow one to remain focused on attaining both financial and non-financial goals. They constantly act as a reminder of what was initially planned. When you have a budget to follow, you have a goal and sense of purpose; therefore, you abstain from making unnecessary.

A budget as a tool for financial management

Budgets are the most important tool in financial management. They not only provide a benchmark for actual income and expenses but also provide control over the situation. Budgets help explain which income or expenses were unforeseen.

Benchmarking: Budgets act as a benchmark for actual expenses so that expenses can be tracked diligently and differences can be critically examined. This allows one to monitor income and expenses.

Control: Budgeting gives you control over your resources, allowing you to decide when, where, and how to allocate them. Budgeting allows you to take control of the situation and reassess your plan of action when necessary.

Managing surplus and deficit: Budgets allow further planning regarding excess funds that could be better invested elsewhere. Alternatively, budgets enable financial managers to assess the situation and decide whether additional funding is required or not.

Different types of budgets

There are many different types of budgets including personal budgets, family budgets, educational budgets, government budgets, business budgets, and others.

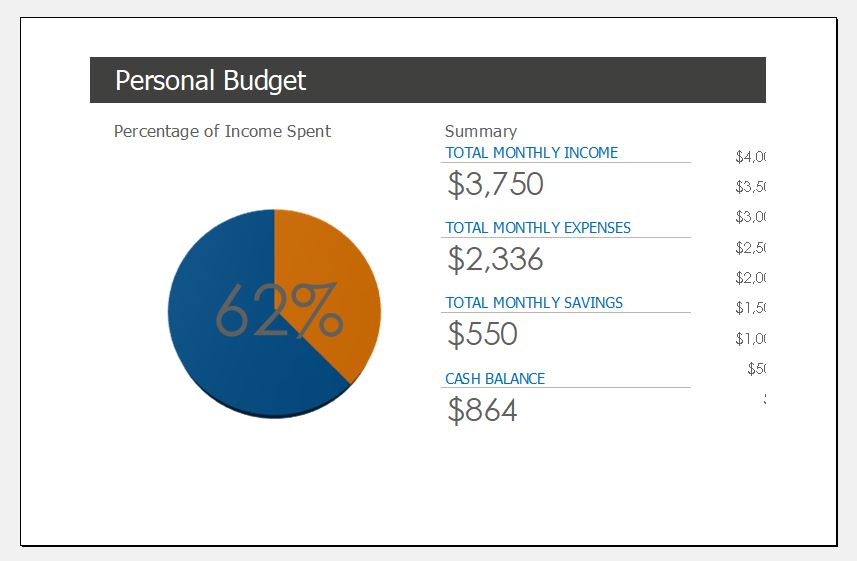

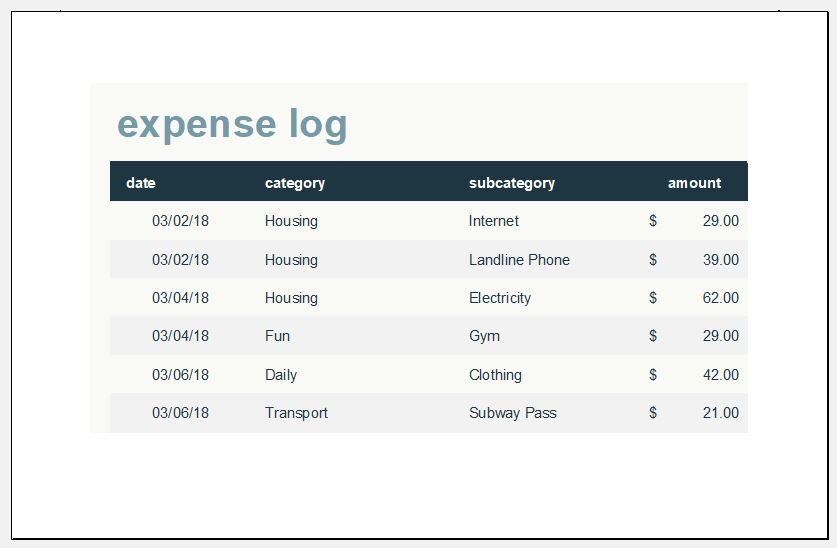

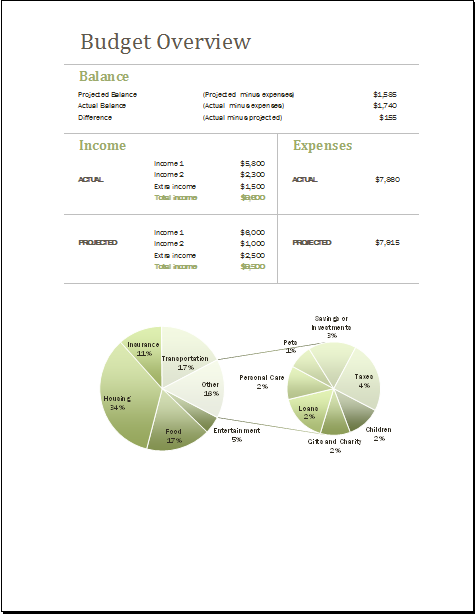

Personal budget: A personal budget is usually kept by individuals who like to keep track of their income and expenses, who are saving up for something or have a certain goal to achieve. Personal budgets can be based on predictions about the monthly expenses and revenues or even longer term. (Samples below)

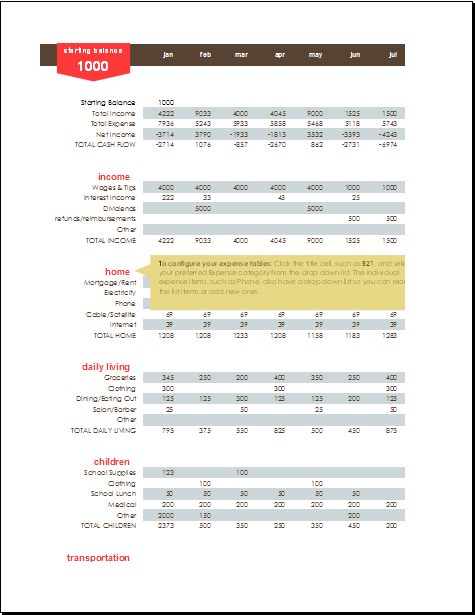

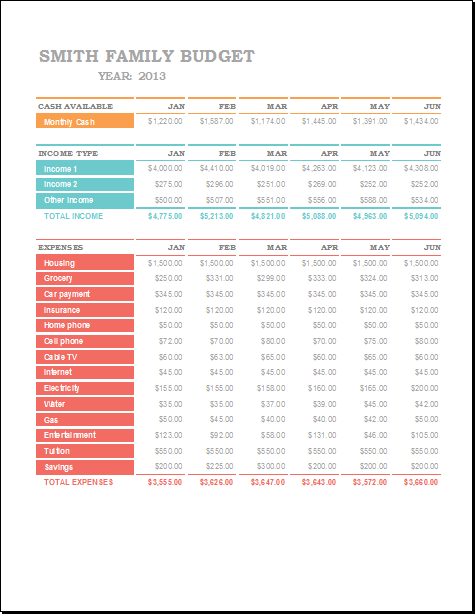

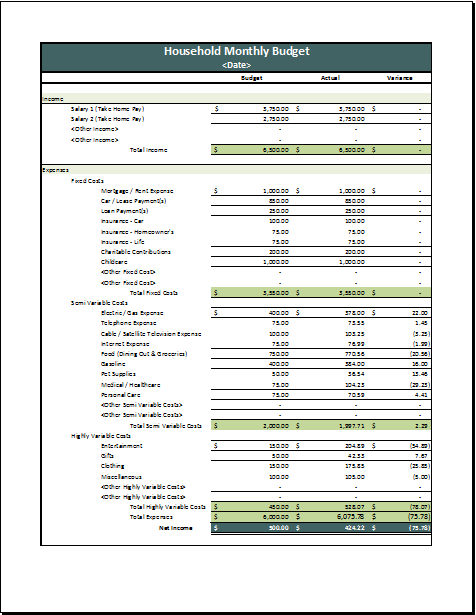

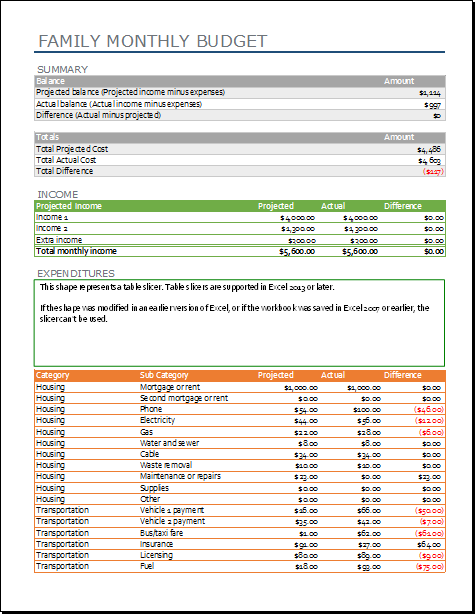

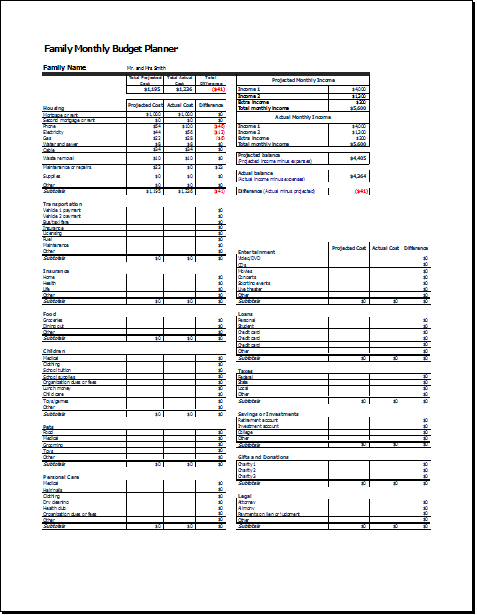

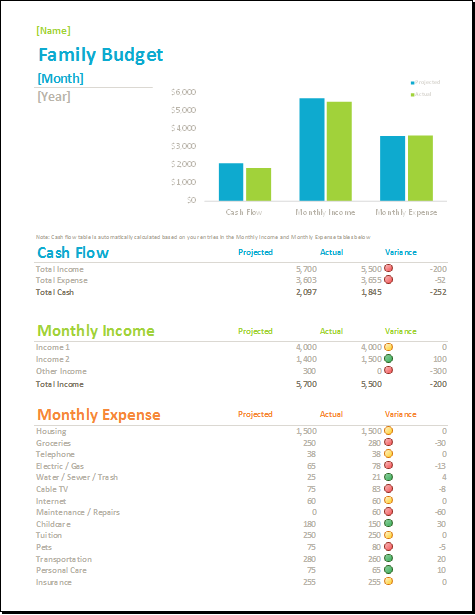

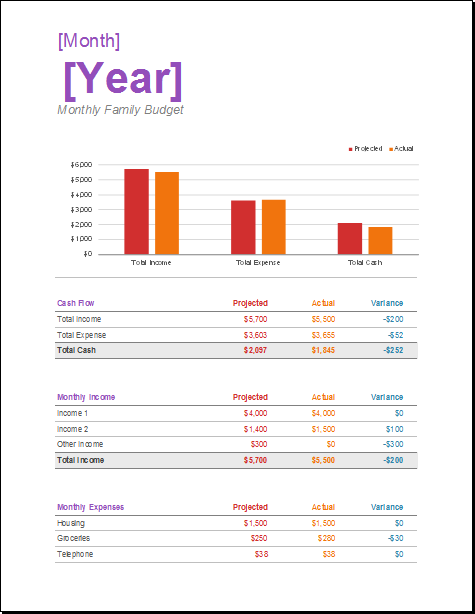

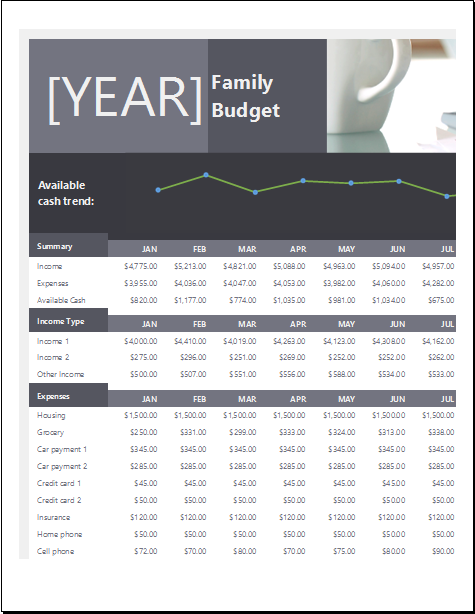

Family budgets: Some families are very good at maintaining and following budgets. Particularly, families with limited resources are most keen on making budgets to help them keep track of their goals and comfortably sail through the month or until the next income source is found. Family budgets include bills to pay, school fees for children, monthly groceries, entertainment, and savings for house, car, or travel.

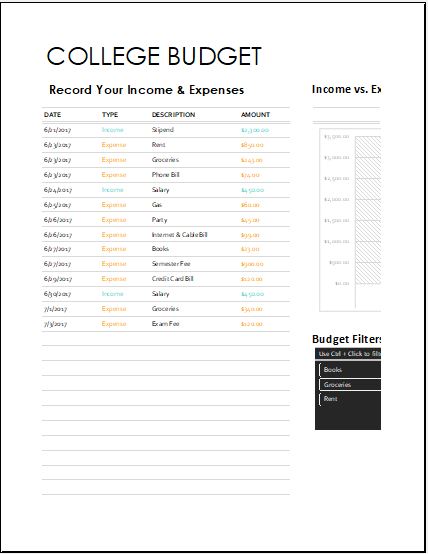

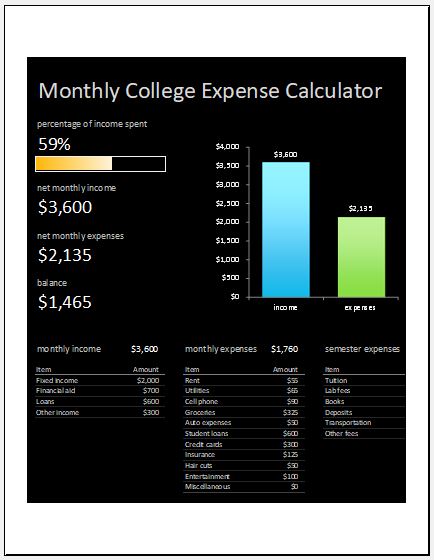

College Budgets: Students often find budgeting useful since they have limited resources. College budgeting involves identifying sources of income, such as family support, scholarships, or a monthly stipend. College expenditures include expenditure on hostel accommodation or rental apartment, semester fees, books and stationery, clothing, food, and travel.

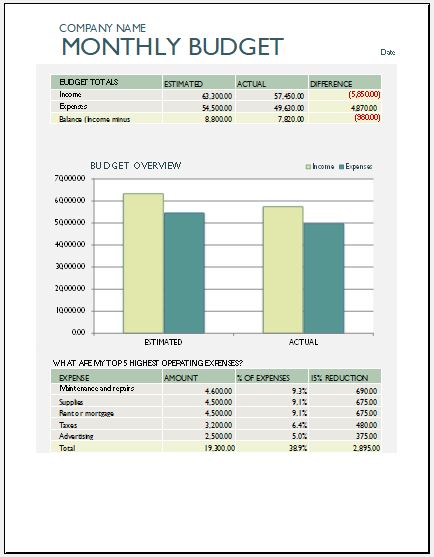

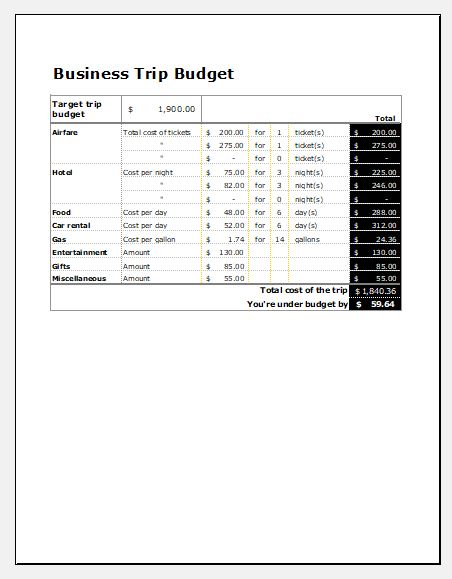

Business budgets: Businesses use budgets actively to manage their finances. Business budgets include income from the sale of goods and services. In addition, expenses range from utility bills, petty cash expenditure, procuring raw materials, salaries and wages, bonuses, rent of property and equipment, taxes, and other items that fall under operating expenses.

- Children’s Daily Activity Reward Sheet

- Winter Clothing & Gear Budget Sheet

- Winter Utility Expense Template

- Fuel & Equipment Sheets

- Monthly Attendance Sheet for Employees

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

← Previous Article

Office Supply Inventory List TemplateNext Article →

Small Business Inventory Spreadsheet

Leave a Reply