Personal Monthly Budget Sheet

Living independently in a city and managing your own finances is not easy. It requires courage, discipline, and hard work. Most of us tend to earn a lot of money but spend it carelessly, leaving us struggling by the end of each month. Not planning your personal budget can lead to money problems. By planning your budget based on your yearly income, you can cover your needs and wants while staying within your limits.

What is a personal budget template?

This template provides the foundation for managing your finances. It includes income, expenses, and savings categories. giving you a clear view of the money you earn and spend. You can easily input your income, savings, expenses, and track the difference between your estimated and actual budget.

How to make a personal budget sheet?

Track your income and expenses

Before creating a budget, track your income and expenses. Gather your bank account statements, credit card statements, and other financial records to compile them into your budget. Knowing how much you have and how much you can spend is essential.

Categorize the budget sheet:

- Categorize your budget according to life necessities.

- Create categories for:

- Household or groceries

- Rent or housing expenses

- Health and medical costs

- Dining out or hoteling

- Other essential expenses

This approach helps you estimate your monthly or yearly budget. It also enables you to plan for savings effectively.

Keep a record of your expenses over several months. This will help you identify and reduce the items that are costing you the most.

Stick to your budget:

Monitoring your budget sheet regularly will help you stick to your budget. It allows you to save more and spend less. Enter your expenses consistently to ensure that nothing is overlooked.

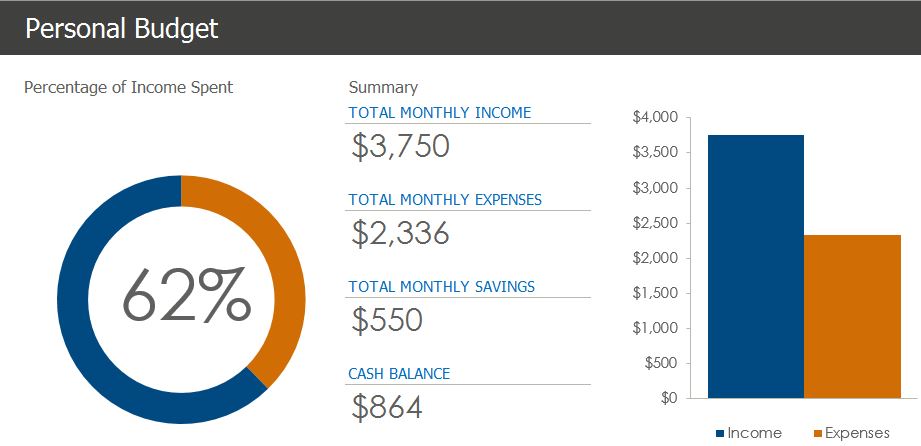

Here is a sample template from our team for your counseling.

Benefits of using a monthly budget sheet:

Here are some of the key benefits offered by the budget sheet.

- It helps track income and expenses clearly.

- Prevents overspending and financial surprises.

- Helps achieve financial goals faster.

- Encourages regular saving and investment.

- Identify unnecessary or wrong spending.

- Makes it easier to plan for emergencies or special purchases.

- Helps with better money management.

FAQs

1. What is a personal monthly budget sheet?

Reply: A budget template helps you save money by tracking your spending, identifying overspending, encouraging prioritization, setting savings goals, and preventing debt.

2. Is this budget sheet suitable for beginners?

Yes, this personal budget sheet is suitable for beginners. It has a simple structure, pre-filled categories, automatic calculations, and customizable tools.

3. Can I use this budget sheet for both personal and family expenses?

Yes, you can use this budget sheet for both personal and family expenses. To do this, you need to adjust a few sections, such as the Income section, Expenses section, and Savings & Investments section.

- Winter Clothing & Gear Budget Sheet

- Winter Utility Expense Template

- Fuel & Equipment Sheets

- Monthly Attendance Sheet for Employees

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

← Previous Article

Customer Feedback FormsNext Article →

Marketing Budget Planning Sheet

Leave a Reply