Cash Flow Report

The cash and its equivalents flowing in and out of the company are summarized in a document known as a cash flow report. This report aims to assess the company’s performance in managing cash.

A cash flow report also shows how well a company pays off its debts. This report is usually prepared when a company applies for a loan and wants to show that it can repay the money.

There is no specific format for a cash flow report. How you structure the report depends entirely on the needs of the business.

The cash flow report shows how changes in the balance sheet affect cash flow and analyzes investing, financing, and operating activities. The report discusses cash flow and its related issues, while also examining any deviations in the balance sheet. It determines the feasibility of a business by analyzing the company’s ability to pay its bills on time. The related International Accounting Standard that deals with cash flow statements is International Accounting Standard 7 (IAS 7).

Investing

When cash is used to purchase equipment, premises, or other assets, it is called cash-out because money is going out to buy these items. Conversely, when assets are sold, the incoming revenue is known as cash-in.

Financing

When the capital amount increases, cash inflow occurs, while paying obligations results in cash outflow. Buying bonds increases cash, whereas paying interest reduces cash, thereby decreasing the overall cash balance.

A cash flow involves the following individuals

- Accounts staff.

- Lenders of creditors, to provide a clear report of the company’s income.

- Investors, to show that the company is not incurring a loss.

- Employers or contractors, to ensure the company can pay them fairly and on time.

- Potential employees or contractors, to determine whether the company can afford compensation.

- Shareholders

We have drafted free templates to create a well-organized cash flow report. They can be customized to suit your needs. After downloading the template, fill in your details and print it as an official document.

What is the purpose of using the cash flow report?

Cash flow reports are prepared to show how well a company manages its operations. The business owner may want to know where the company spends most of its cash. The cash flow report also helps investors understand whether the company’s financial position is strong.

The company uses receipts from selling and purchasing goods to prepare the cash flow report. Other items are also considered, such as income tax payments, employee salaries, rent, and other business expenses. If a company needs to submit a cash flow report to investors, it should also include debt payment receipts, loan details, and similar financial information.

The company’s total revenue for a specific period is calculated along with its expenses. The difference between the two is then used to determine the cash flow.

The company’s transactions are also considered. If a transaction includes non-cash items, these will be converted into cash equivalents.

About Template

The cash flow report template is a valuable tool for anyone who wants to avoid the hassle of doing multiple steps to create a cash flow report.

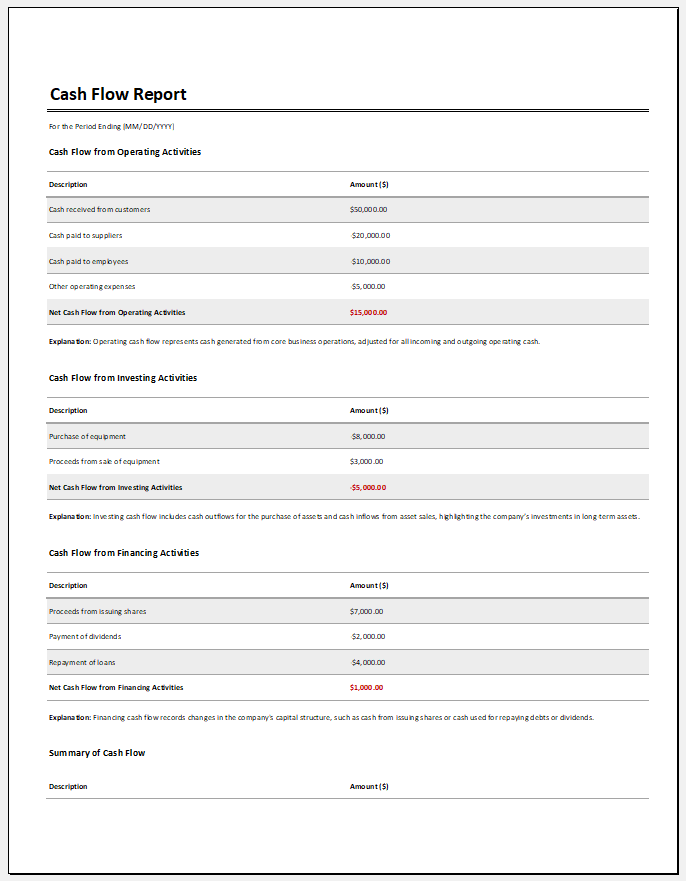

Sample -1

MS Excel (.xlsx) File

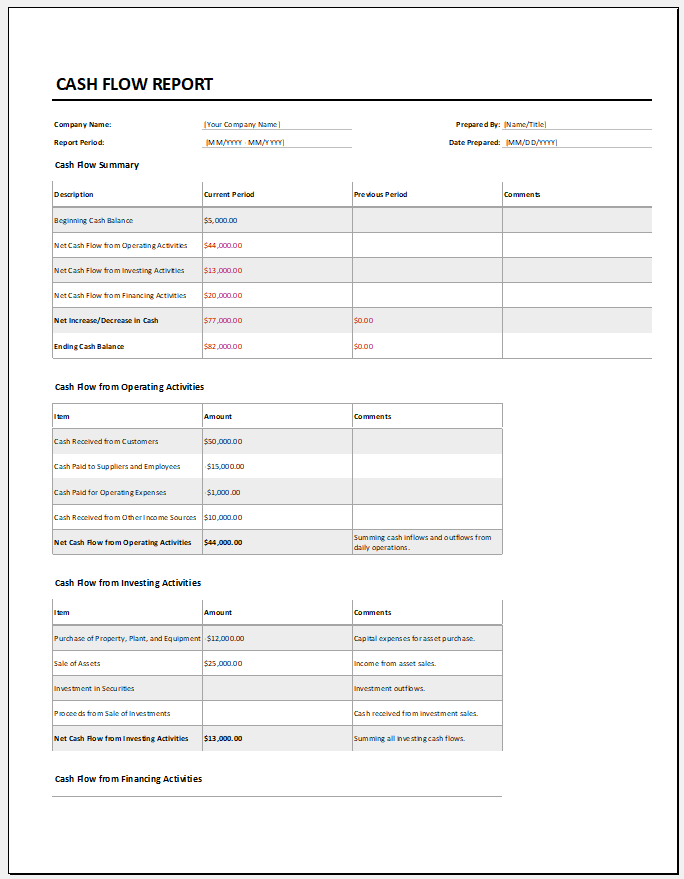

Sample -2

MS Excel (.xlsx) File

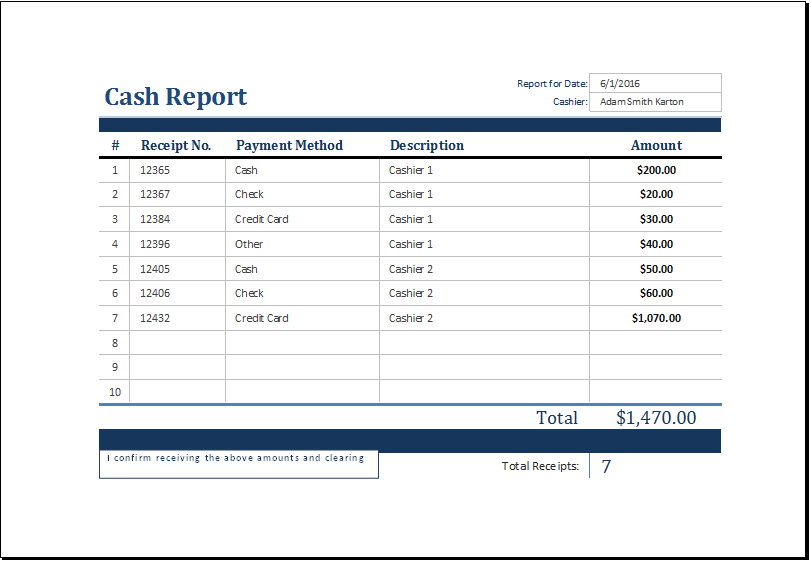

Preview

- Winter Clothing & Gear Budget Sheet

- Winter Utility Expense Template

- Fuel & Equipment Sheets

- Monthly Attendance Sheet for Employees

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

← Previous Article

Dinner Party List with MenuNext Article →

CD Switch Analysis Template

Leave a Reply