Cash Flow Log

Every business must closely monitor the movement of cash into and out of the organization. This tracking process is recorded in what is known as a cash flow log. It’s important to note that cash flow is not the same as profit. While profit shows the earnings after expenses, cash flow reflects the actual money available to run daily operations.

Understanding a Cash Flow Log

A cash flow log is a financial record used to track the inflow and outflow of money in a business or an individual’s account over a specified period. It helps in monitoring liquidity, assessing financial health, and supporting effective budgeting and decision-making.

Importance of Cash Flow Management in Business

For businesses, the amount of money they generate is crucial, as it directly impacts their credibility in the marketplace and among clients and customers. To manage this effectively, businesses maintain a cash flow log, a record that details all incoming and outgoing funds and assets within the organization. This log helps monitor financial health and ensures smooth operations.

Purpose and Importance of a Cah Flow Log

A cash flow log helps an organization or business understand how much money is coming in and how much is being spent. Its primary purposes include:

- Tracking daily or monthly cash movements

- Forecasting future cash needs

- Avoiding cash shortfalls

- Identifying unnecessary expenses

- Supporting informed financial decision-making

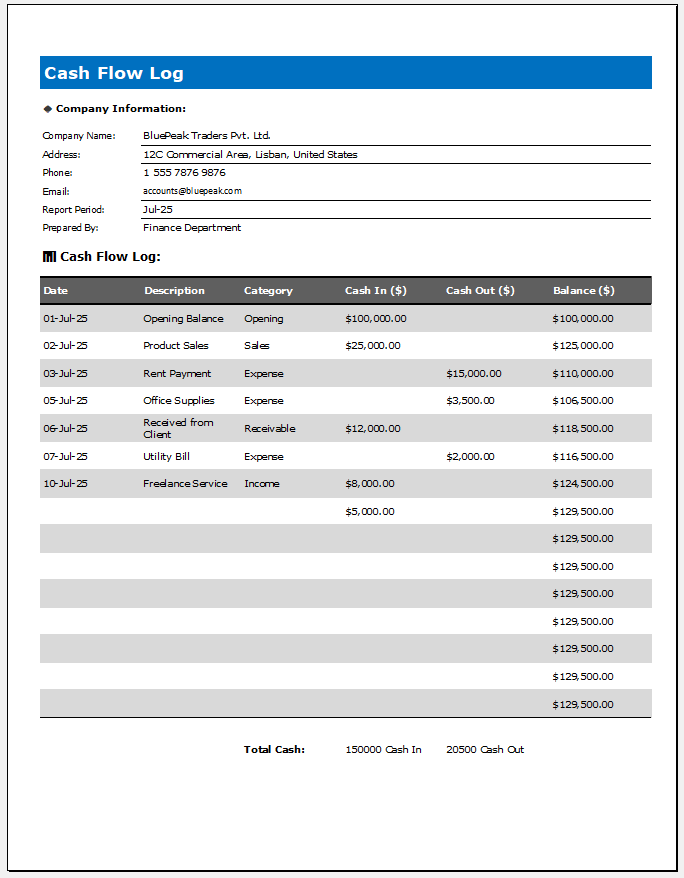

Here is a template for a Cash Flow Log.

File Size: 589 KB

The Importance of Maintaining a Cash Flow Log

Every business owner wants their business to grow and succeed. Regardless of whether a company is thriving or struggling, cash flow remains a critical and constant factor. Many companies fail to progress simply because they overlook the importance of managing their cash flow. Ignoring it can lead to severe cash shortages, which pose a serious threat to the survival of any business. That’s why maintaining a cash flow log is essential.

A cash flow log is valuable because it supports:

- Financial tracking, budget control, and informed decision-making

- Cash forecasting, spending awareness, and profit monitoring

- Payment scheduling and effective debt management

- Assessing liquidity and ensuring business stability

Importance of Using a Cash Flow Log Template

A cash flow log template is a useful tool that records the financial transactions of a business. It typically includes two main sections: one for cash inflows and another for cash outflows. To ensure accurate financial tracking, every entry must be carefully reviewed, as even a minor error, such as a single incorrect digit, can cause significant issues for the organization.

For this reason, it is highly recommended that the cash flow log be checked and verified by someone with expertise in accounting. Since businesses often have limited time and resources, they prefer to use a readymade template that can be reused for multiple clients. This approach is not only efficient but also cost-effective, allowing organizations to manage their finances more effectively with minimal effort.

Benefits of Using a Cash Flow Log

A cash flow log is a powerful tool that provides a clear view of your business’s financial activities. It helps track cash inflows and outflows, giving you full access to essential financial data without wasting time searching for scattered details. Here are some key benefits of maintaining a cash flow log:

- Clarity of Financial Position: It helps you clearly understand your current financial standing.

- On-Time Payments: Ensures employees and vendors are paid promptly.

- Better Financial Planning: Assists in forecasting and preparing for future cash requirements.

- Expense Control: Helps reduce or eliminate unnecessary expenditures.

- Faster and Smarter Decisions: Enables you to respond to financial situations quickly and wisely.

- Cash Flow Visibility: Keeps your focus on cash movements, building confidence in financial decisions.

- Crisis Prevention: Proactively managing cash flow reduces the risk of sudden shortages.

- Investor Confidence: Sound financial management attracts investors and promotes business growth.

By using a cash flow log, businesses gain greater control over their finances, improve operational efficiency, and build a foundation for long-term success.

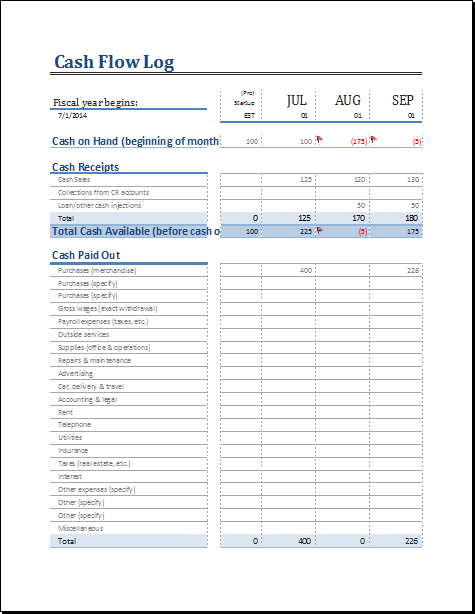

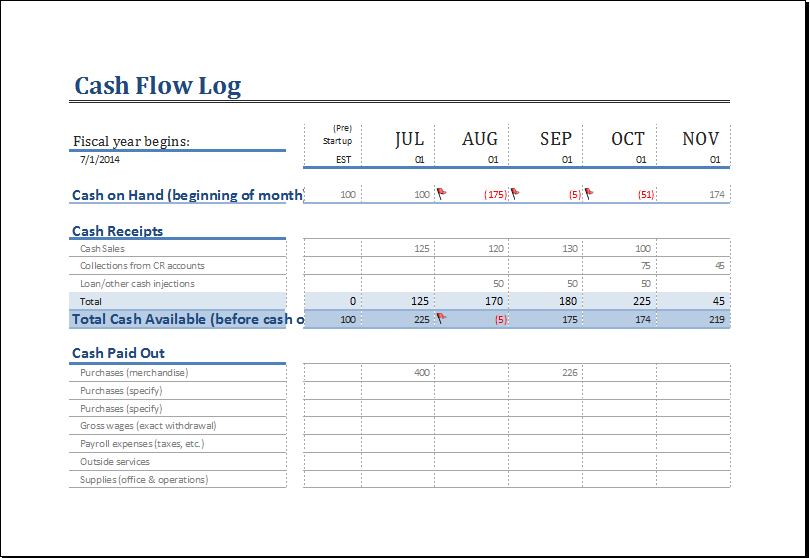

Download your file below. File Size: 56 KB

- Winter Utility Expense Template

- Fuel & Equipment Sheets

- Monthly Attendance Sheet for Employees

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

← Previous Article

Vehicle Log BookNext Article →

Rental Vehicle Log Book

Leave a Reply