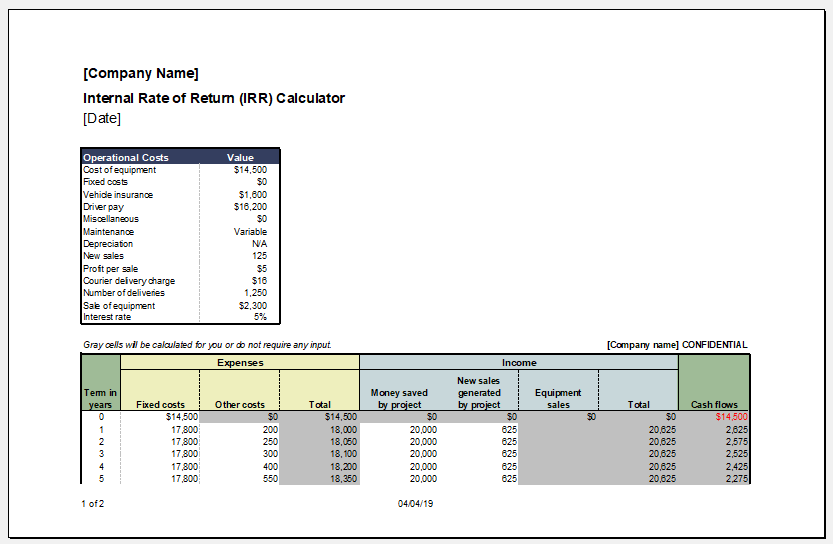

IRR (internal rate of return) Calculator

Every investor is interested to know how much profit he is likely to make by the investment that he is going to make in a particular project. The investor uses the IRR calculator to calculate the annualized rate of return. To make sure that the calculator is being used effectively, the user is required to keep the cash flow into consideration. The cash flow in a specific period is considered for better results. No matter the cash flow is regular or irregular, is always considered.

What is the purpose of using the IRR calculator?

Whether to invest in a particular business or a project or not is a tough decision that requires a lot of analysis and information. In an attempt to see the profitability of the investment, there are plenty of tools used by different organizations.

One of the most common tools which are used is the IRR calculator. The basic objective of using the IRR calculator is to know how the investment or capital expenditure is likely to work in the future. The companies also use the IRR calculator to know if the project in which they are investing is viable. If the investment does not seem to produce good results, the company can decide to stop investment in such a fruitless project.

Why is calculating IRR is important?

The investment return is what an investor is interested to know. Although many mathematical formulas and calculations can be used to know the potential of the investment, it is more feasible to calculate the IRR to know everything instead of using traditional mathematical ways. Calculating the IRR is way too important for an organization since it enables the company to know whether it is losing money or gaining it.

What are the benefits of using the IRR calculator?

It is very beneficial for calculating the IRR to predict the profitability in the future. Some of the key benefits that you can avail are:

- Calculating the profitability of an investment is a complex task. With the introduction of the IRR calculator, it has become easier for the user to calculate the IRR and the potential profitability.

- Companies can not only find profitability but also compare their profitability with the profitability of the rival. The companies can also compare the IRR of one project with the other project of the same company.

- Using the IRR calculator lets the user know in advance if it is feasible for him to start investing in the project. A business needs to know ahead of time if the investment it is going to make makes sense or not

- Sometimes, a company gets multiple options for investment and it becomes a daunting task for it to decide. The use of an IRR calculator makes it easy for the company to determine which project is worth the investment and which is not.

- Business Startup Cost Estimator

- Home Construction Cost Estimator

- Kitchen Remodel Budget Calculator

- Personal Assets and Debts Calculator

- Power Consumption Calculator

- Payroll Calculator Template for Excel

- Food Fat Percentage Calculator Template

- Total Cost of Ownership Calculator Template

- Real Estate Commission Calculators

- Retirement Calculators

- Vehicle Loan Payment Calculator

- Year-end Tax Planning Calculator

- Sale Probability Assessment Calculator

- Travel Expense Calculators

- Sales Commission Calculators

- Mortgage Loan Calculator

- Simple Loan Calculator

- Net Present Value Calculator

← Previous Article

Life Insurance Needs CalculatorNext Article →

Financial Calculator Template