Home Mortgage Calculator

Everybody wants to have their own home where they can spend their time and they don’t have to worry about paying rent every month or the fear of being evicted or having to search for new homes every time the rent period finishes.

Everybody wants to be an owner of their own home and this is why they seek to have their own house. This house can be a bit expensive and nobody has a lot of money lying around, they need to be able to borrow money from someone they can trust. This money can be loaned in the form of a mortgage from a bank or a mortgage company and the money is to be paid back on a monthly basis for a specific period of time.

This mortgage can become a bit costly if one has no idea as to how much is it going to be costing monthly. That is why a home mortgage calculator is to be made use of.

If you are one of those people who is thinking to buy a home but are afraid of mortgage which is holding them back from buying a home, the mortgage calculator is for you. There are many reasons that stop the person from buying the home such as uncertainty of the job, unaffordability and lots of other things.

One of the major things that influence the decision you must make is the information you have. Before you decide regarding buying the home, you should collect the maximum information about the financial factors to be considered. One of the most important information that you should get before making this important decision of buying a home is the type of mortgage you will get.

What is a home mortgage calculator?

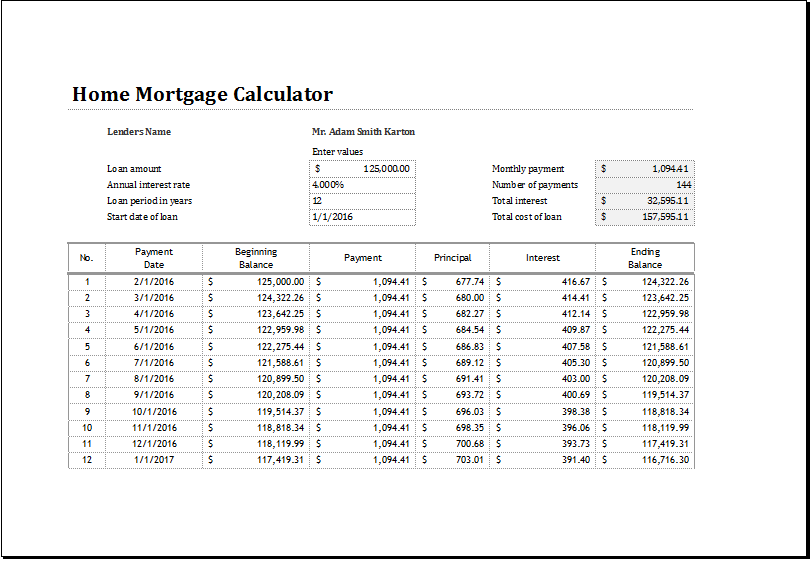

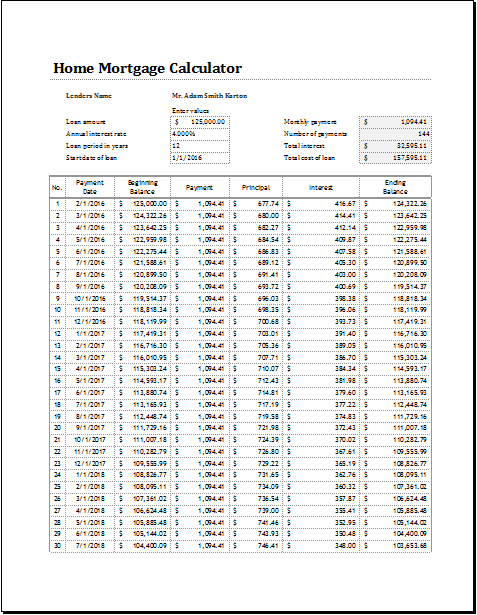

The home mortgage calculator is used when you want to obtain the information about the amount you have to pay on a potential mortgage. The information that should be provided to the home mortgage calculator is

- Value of the house you want to purchase

- Down payment

- Interest rate

- Value of depreciation of the house

What are the benefits of the home mortgage calculator?

They promote saving:

Since the mortgage calculator tells about the best value that you can choose for you, you can save a lot of money by calculating the interest rate, down payment and other details before buying the property.

They provide a lot of information:

The home mortgage calculator tells the user about different aspects. The criteria on which different institutes base their calculations are also known with the help of mortgage calculator. The calculator enables the user to calculate the percentage of interest rate he can afford. This makes it easier for the user to choose the terms more appropriate for him

- They help manage the credit:

The credit score of the user increases when the mortgage payments are made on time. Timely payments are possible when the payment details are always kept in mind. Mortgage calculator plays the main role in enabling the person to increase the credit score so that he can refinance.

In this calculator, one needs to enter the value of the home and how much amount has been borrowed (loan), what is the interest rate and how long is the mortgage time period and when does it start from. just hit enter and then VOILA, one has the exact amount that is to pay on a monthly basis, how many payments are to make, when will the loan be paid and etc. this helps in making better decisions and helps in making the right choice regarding the mortgage.

Preview

Download your file below.

File Size: 125 KB

Download

← Previous Article

Projected Balance SheetNext Article →

Opening Day Balance Sheet

Leave a Reply