Home Equity Loan Calculator

A generally used home equity loan calculator is used by the homeowner to get a rough estimate of the amount that has been paid off. Home equity refers to as ownership of the person making payments after regular intervals. With every payment you make, the equity of the home increases.

When you get enough equity in the home, you become a partial owner of the house and then you can use this equity to take a loan for fulfilling your other financial needs. The purpose of using the home equity loan calculator is to know how much loan you are eligible to get based on the equity you have obtained

To make an effect of this calculator, you should be able to know for what purpose you want to use this calculator. Generally, this calculator is used when you want to decide whether or not you should borrow the money against equity. Using this calculator also helps the user decide on the type of loan which will be more suitable.

This calculator is also used when you want to know about the total amount that you are eligible to get as a loan. Many people are also interested in knowing how much time it will take to pay off the loan. Getting this type of information, the home equity loan calculator can be used.

How to use the home equity loan calculator?

The home equity loan calculator is available as an online tool for those people who want to calculate different details independently without taking the help of any financial institution. This calculator contains several empty fields that the user is required to fill in. Once the user provides with all the details, the calculator calculates the desired information in no time.

The basic details that a home equity loan calculator asks the user to provide are:

- The total amount of loan a person wants to get

- The estimated value of the home

- Mortgage value

- Current credit score

- State in which you want to use this calculator

Tips for using a home equity loan calculator?

- It should be kept in mind that the results obtained from different calculators may vary because there are different rules in different states. Therefore, most of the calculators ask the user to provide details about the state in which you want to borrow the money.

- To make sure that you use the home equity loan calculator effectively, make sure that you input all the details into it accurately. Inputting the details incorrectly can lead to incorrect results that can bring on more complications.

- Not every calculator can be regarded as a reliable tool for calculating home equity loans. Make sure that you get this calculator from a reliable source on which you can rely and believe.

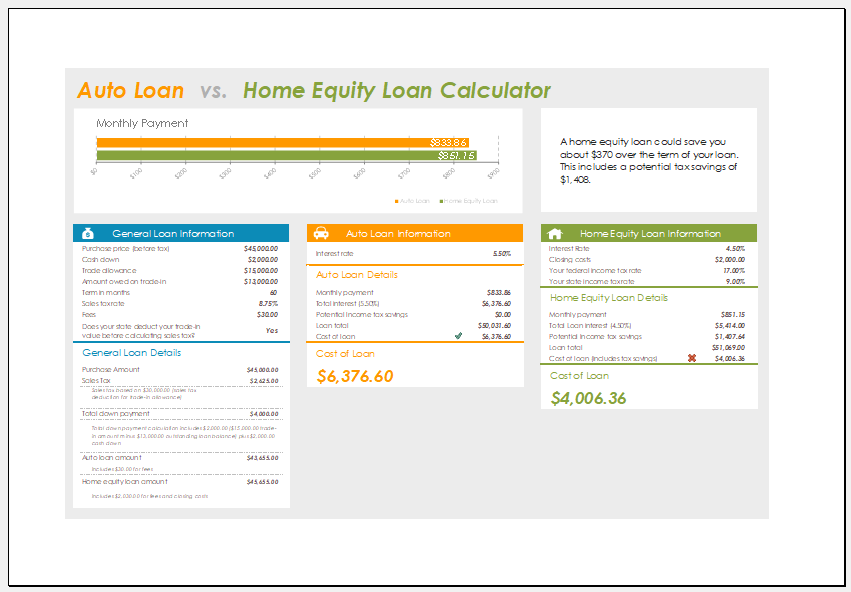

Preview

Format: MS Excel [.xlsx] 2007/2010

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

- Event Planning Gantt Chart

- Employee Attendance Dashboard

- Monthly Study Reminder & Planner

- Move-in Checklist Template

- Camping Checklist Template

- Employee Orientation Checklist Template

- Salon Startup Checklist Template

- Project Completion Checklist

- Construction Site Checklist Template

← Previous Article

Expected Commercial Value CalculatorNext Article →

Kitchen Remodel Cost Calculator