Cashier Closing Checklist Template

A cashier is an individual whose job is very critical for an organization. He is required to be shrewd and active to perform his job responsibilities effectively. Handling cash, sometimes, is a very complex process due to which, there are numerous tools used by a professional cashier. These tools make the job of the person easy to handle.

What is a cashier closing checklist?

It is one of the useful tools that is used to enlist all the responsibilities and tasks to do. At the end of the day, there is a cash register which is completed to record the inflow and outflow of the cash in the day. Before the closing of the register, there are so many operations to perform at the end of an accountant. For this purpose, a cashier closing checklist is used.

Why does a professional bookkeeper like to use a cash closing checklist?

There is nothing more precious than peace of mind for an accountant. The closing checklist plays a big role in enabling him to carry out all the necessary procedures with accuracy. This checklist is very helpful in preparing the cashier for the next business day. A bookkeeper knows that he will have to be responsible for all the discrepancies that may arise in the cash register.

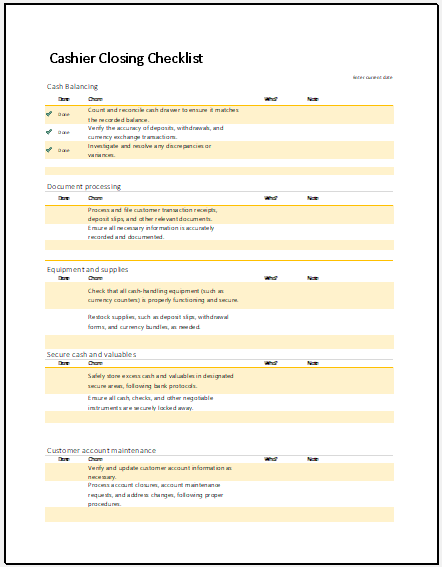

Tasks included in the checklist:

Since the purpose of any checklist is to make the user remember the tasks he has to perform in a day, this checklist makes a list of things to be done before the closing including the counting of the cash, taking record of all the transactions, securing the cash and much more. These are some general tasks that are performed by an accountant that you will see on almost every checklist. However, some other activities are performed only by specific companies and these tasks also vary from company to company. You can also add tasks related to your work in the checklist to make it more coherent with your job.

What are the advantages of the cashier closing checklist?

Every cashier reaps some or many benefits from this list of tasks. Here are a few of them to be taken into account:

It maintains financial accountability:

Dealing with the cash daily is not easy. A little change in the total amount can hold you accountable as an accountant. If you use a checklist, you will go through a proper process and this way, if the stakeholders hold you accountable and ask you anything about the cash you have been managing, you will be able to defend yourself because of staying disciplined and using a checklist.

The bookkeeper does not miss anything:

There are so many operations associated with the management of the cash before the closing that it is normal for people to miss out on anything important. However, when a checklist is used daily, the cashier becomes accustomed to using it and then all the tasks are performed in an automated way without getting any of them skipped.

It ensures the safety of the cash:

The use of a checklist enforces an appropriate cash management procedure in the company. For instance, the accountant always keeps in mind using the checklist to count the cash, putting it in a safe place such as drawers, and having a proper mechanism to keep it safe. This way, unauthorized access to the money is prevented to a great extent.

It makes the transition smoother:

In some companies, multiple people are working in one position on different shifts. The checklist enables a smooth transition and one cashier can easily resume cash management activities after the other due to the records of the data and the sequence in which all the operations are performed. Every person in such a system knows where to start the cash processing work before the closing and then closing the entire system in an efficacious way.

Even if one accountant leaves the job, the company can easily hand over this list of operations to the new person and ask him to start following it instead of getting into the complexities of how everything works.

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

- Event Planning Gantt Chart

- Employee Attendance Dashboard

- Monthly Study Reminder & Planner

- Move-in Checklist Template

- Camping Checklist Template

- Employee Orientation Checklist Template

← Previous Article

School Farewell Party Budget WorksheetNext Article →

Restaurant Daily Opening Checklist