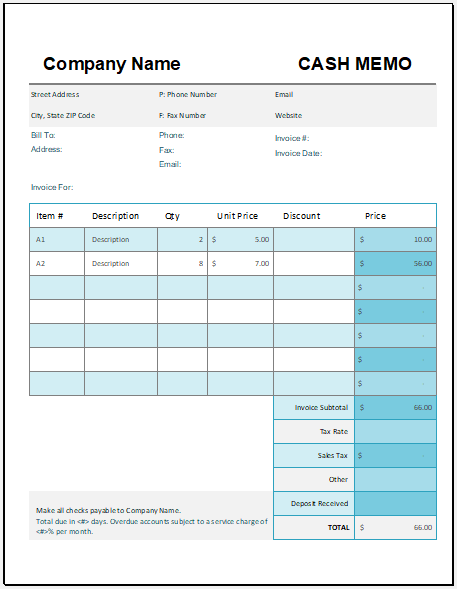

Cash Memo Formats and Template

A manufacturer or seller needs to consider many factors when selling goods. They need to comply with the law. All transactions should be recorded and some form of evidence present for them. Any issue can arise therefore it is important to be conscious.

What is a Cash Memo?

A cash memo is a document made when goods get sold for cash. It is presented by the trader when they sell something. It is gotten by the person who buys something from the seller. The document is often employed in different business transactions. It is like a receipt and is given when payment has occurred.

Importance of a Cash Memo

The cash memos can be kept as a record of any transactions of products and services. It is legal proof confirming a business has gotten cash from their client. In case any problem occurs whereby the business has claimed they did not get paid; the cash memo can be shown. The owner of the company can also have a look at these to check how the business is going.

Tips to create a Cash Memo:

When wanting to make a cash memo you should include all necessary details and make it look professional. The below tips can be remembered when creating the cash memo:

Application: The cash memo is a professional document and so should be typed without any errors. You can use Microsoft Word or Microsoft Excel to make it in.

Heading: A heading is required so that people know what the document is concerned with. This one will have a heading like “Cash Memo”.

Details of supplier: It is necessary to include the name along with the address of the trader or supplier. This will confirm who the supplier is that has carried out the sales. You may include a company logo if there is one.

Details of the purchaser: The name and address of the person buying the goods or services will be given. It will be proof for the buyer so they can record what has been brought.

Serial number: The serial number of the cash memo has to be stated. It acts as a trail when wanting to track any sales that the business has made. It carefully records every transaction completely without leaving out any.

Date: The date that the transaction occurred needs to be included. It can track transactions daily and monthly.

Order number: Include the customer’s order number. It will help track how many transactions happened with one customer.

Goods details: The description of products or services brought should be stated. It will help figure out the nature of the products that have been sold. The quantity needs to be included as well. It helps figure out the inventory position. The rates of the products will be given to calculate the exact sale value.

Amount: The amount tells how many sales occurred.

Discount: If there is any type of discount included, show it separately. It aids in tracking discounts given.

Tax registration number: This will be of the buyer and supplier when goods are being sold. It is required for any tax payments.

Total: You need to include the total amount. It should be written in both words and figures.

Signatures: It is important to include signatures so that the cash memo becomes authentic. It should be signed by the authorized individual. It will become more valid with this.

Any terms and conditions: There are sometimes terms and conditions attached with a transaction. If this is the case you will need to include an area for it.

Advantages of the Cash Memo

- Easy to prepare.

- Suitable for small businesses that experience cash transactions.

- Being a legal document, it is similar to an invoice.

- The process is mostly manual therefore you will not require a computerized system for it.

- The document is an authenticated one because it includes the signature of the appropriate individual.

Final words

A cash memo is required by a business if it wants to remain on the safe side. It helps figure out any transactions made. The cash memo is also kept as a record by both parties. When making the memo do it carefully so that all important details are added.

← Previous Article

Renovation Project SpreadsheetNext Article →

Credit Control List Template