Mileage Expense Report Template

Certain business operations require employees to travel to various locations on behalf of the company. When employees use their vehicles for such official duties, it is the company’s responsibility to reimburse them for the expenses incurred, including fuel costs related to business travel.

To ensure accurate compensation, employees must report the total number of miles traveled during these activities. Submitting a professional mileage expense report allows the company to verify and process reimbursements efficiently.

What is a Mileage Expense Report?

A mileage expense report is a useful tool for employees whose travel expenses are reimbursed by their company. It records the distance traveled for work-related purposes over a specific period and serves as a formal request for a mileage reimbursement or car allowances.

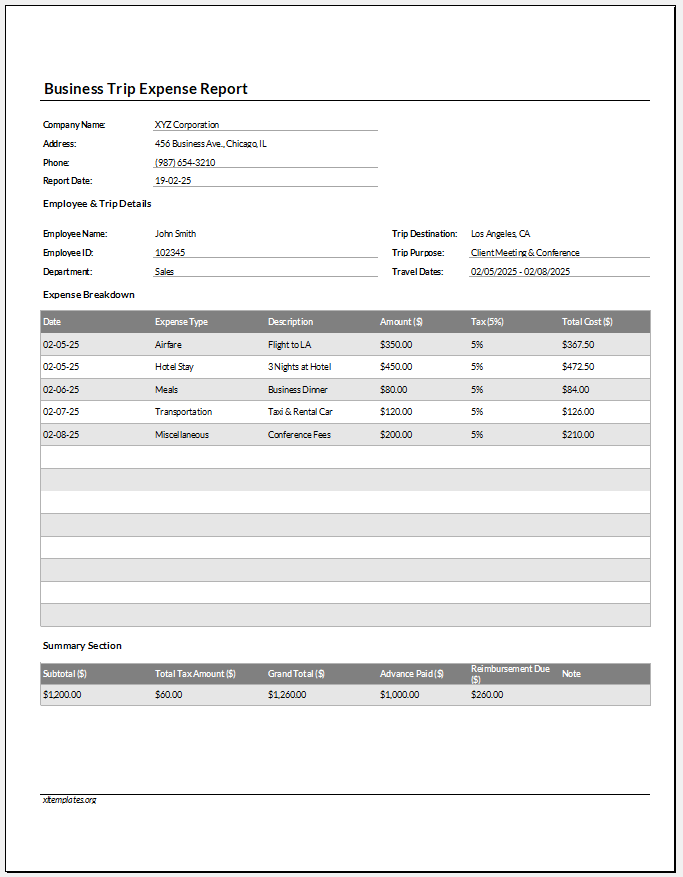

The report typically includes sections such as:

- Employee Name and ID

- Vehicle Description

- Pay Period

- Mileage Rate

- Date of Travel

- Starting Location and Destination

- Total Miles Traveled

- Purpose of the Trip

- Total Rembursement Amount

This reimbursement format ensures accurate and efficient processing of travel-related reimbursement.

See also: Business Mileage Expense Report given below.

Purpose and Benefits of a Mileage Expense Report

A mileage expense report helps the company accurately track the number of miles an employee has traveled for business purposes. Based on this information, the company can determine the appropriate reimbursement amount for the employee.

Additionally, the report provides insight into travel-related expenses, allowing the company to identify areas where costs may be reduced.

For employees, the report serves as a professional way to document their business travel, ensuring they receive fair and accurate reimbursement for the miles they have covered on behalf of the company.

To create a report that clearly and accurately communicates mileage details, consider incorporating the following key points:

Choose the right application

To create a well-organized and professional report, it is important to choose the right application. The tool you select should enable clear and effective communication of your data. Microsoft Excel is a great option, as it allows you to create structured tables and perform calculations with ease, making your report both accurate and visually appealing.

How to start the report

The report should clearly identify the employee submitting it and the purpose of the report. A suitable title, such as “Mileage Expense Report,” helps set the context. After the heading, include the employee’s full name and job title. You should also provide information about the vehicle used and specify the relevant pay period.

Filling the report

When completing a mileage reimbursement form, make sure to enter the mileage rate applicable in your area (per mile). It is important to specify the travel date so the trip can be verified. You should also clearly describe each trip to explain its business purpose.

Be sure to include both the starting point and the destination for every trip. Additionally, record the total miles traveled for each journey.

Once the total miles are entered, the amount column will automatically calculate the mileage expense for each trip by multiplying the mileage rate by the miles traveled. The total mileage reimbursement will be automatically summarized at the bottom of the form under the “Total Reimbursement” section.

Finally, add designated spaces for employee and manager signatures to validate and approve the report.

It is important…

A travel expense report is essential because it offers a formal and professional method for employees to inform their company about travel plans and request reimbursement for any expenses incurred. This report also serves as a valuable record for the company, enabling it to monitor where and how funds are being spent.

If cost-cutting measures are needed, the company can review these reports to evaluate the impact of business travel expenses. Thus, the report plays a key role in both communication and financial oversight.

Business Mileage Expense Report

Excel File -112 KB

- Winter Clothing & Gear Budget Sheet

- Winter Utility Expense Template

- Fuel & Equipment Sheets

- Monthly Attendance Sheet for Employees

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

← Previous Article

Fitness Calendar TemplateNext Article →

Remote Work Attendance Tracker