Home Office Tax Comparison Benefits Sheet

Many people use their homes as offices, including those who run small businesses or work part-time from home. However, many are unaware that they can reduce their tax burden by claiming home office tax benefits. This allows individuals who regularly and exclusively use a portion of their home for business purposes to deduct eligible expenses and lower their overall tax or business costs.

Before 2013, only the traditional method was available for claiming the home office tax benefit. After 2013, the IRS introduced another option called the simplified home office deduction. Both methods have the same eligibility criteria but differ in their requirements. Choosing between the two can be challenging, so it is important to select the method that provides the greatest tax benefit.

A home office tax comparison should be carried out by individuals who run small businesses from their homes. The purpose of this comparison is to determine the most beneficial tax deduction method and understand the amount of tax payable.

When starting a new business, one of the most important decisions is choosing the form in which the business will operate. However, when a business is run from home, this consideration is often less relevant. Even so, there are certain situations in which a home-based business may still be liable for taxes.

In most cases, using a part of the home as an office allows certain tax deductions, which can reduce taxable income. However, if the business earns a considerable profit, the business owner is still required to pay taxes according to applicable tax laws.

Tax comparison is not easy, especially in today’s world, where many restrictions and conditions must be met. Tax laws vary from country to country, and these differences affect individuals and businesses in different ways.

Types of taxes:

- Sales tax

- Individual (personal) tax

- Corporate tax

To choose the most suitable option for you and your business, it is important to prepare a comparison table that outlines the pros and cons of each method, along with calculations showing the potential tax benefits of each choice. These calculations should be made in accordance with the requirements of the IRS. It is recommended that you involve a qualified accountant to review the calculations, especially if you are uncertain about what expenses should be included or excluded.

Always take time to thoroughly compare your options, as the choice you make will apply for the entire year and, once filed, cannot be changed.

Importance of Home Tax Comparison

Tax comparison is essential and should always comply with the laws of the state in which you reside. Tax rates and regulations vary by state and country, so they must be reviewed carefully. Making regular tax comparisons is especially important when you plan to move your home office or operate your business in a different state.

To perform an effective comparison, you should be familiar with the relevant tax laws and regulations. You can also use reliable online sources to check the applicable tax rates for each state you wish to compare. Listing the tax details side by side provides a clearer understanding of the differences. Using a home office tax comparison benefits sheet can save time and help you compare detailed information accurately and efficiently.

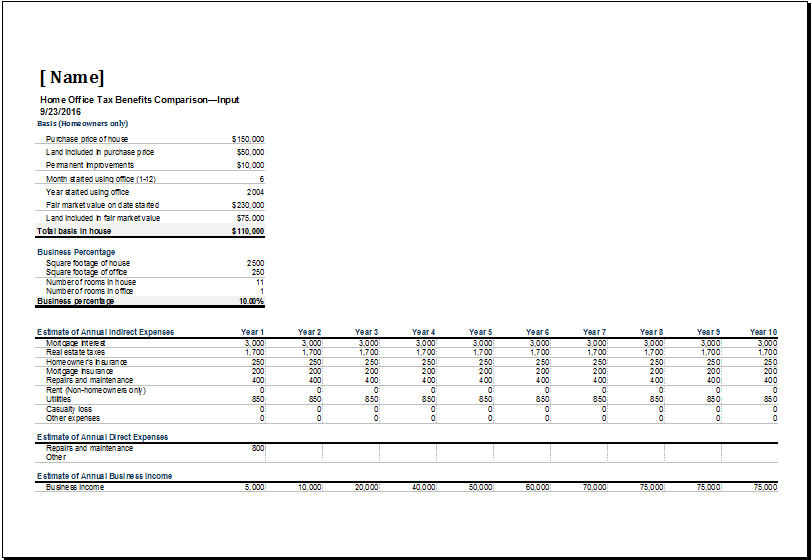

Here we have a sample comparison sheet in Excel for help.

The sheet includes

- Total deductible amount under each method.

- Side-by-side comparison of tax benefits.

- Methods result in higher tax savings.

- Estimated tax reduction based on the user’s tax rate.

- Winter Clothing & Gear Budget Sheet

- Winter Utility Expense Template

- Fuel & Equipment Sheets

- Monthly Attendance Sheet for Employees

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

← Previous Article

Special Order Pricing TemplateNext Article →

Business Planning Checklist Template

Leave a Reply