Capital Gains and Losses Calculator

Paying the tax is an obligation. When it comes to calculating the tax you are required to pay, you should take a look at all your income and sources of income. The income generated by selling the capital assets, as well as stocks and property, should also be included in the income on which tax is to be paid.

It is not advisable to pay the taxes on all the sales prices. The best thing to do is to calculate capital gains and losses. It is recommended to make a report about your capital gains and losses so that you can form a file for returns.

Capital gains and losses:

Capital gains are generally obtained from selling the assets owned by a person. The capital gains from the assets that you own for less than a year are known as short-term capital gains. Whereas, the capital gains from selling the assets you own for more than a year are known as long-term capital gains. Long-term capital gains have a lower tax rate.

To know whether you have gotten capital gain or suffered from capital loss, you are required to keep track of everything you sold. For this, you should also consider how much you have paid to acquire the capital.

How do I calculate capital gains and losses?

The tax is required to be paid on every capital gain. How much tax you need to pay depends on capital gains and losses. So, calculating the capital gains and losses before paying the taxes is inevitable in this situation.

Many online tools and calculators help determine the value of capital gains and losses. It is very simple to calculate the capital losses and gains by using any available online tool. The tool to be used should be efficient enough to give accurate results.

The simple way to calculate the capital gains and losses is to subtract the basis from the amount you get after completely paying the expenses of the sales. Similarly, if you want to calculate the percentage of capital gains or losses, you are required to divide the gain or loss by basis and then multiply it by 100. The result obtained from the calculation is the profit or loss in the performance percentage.

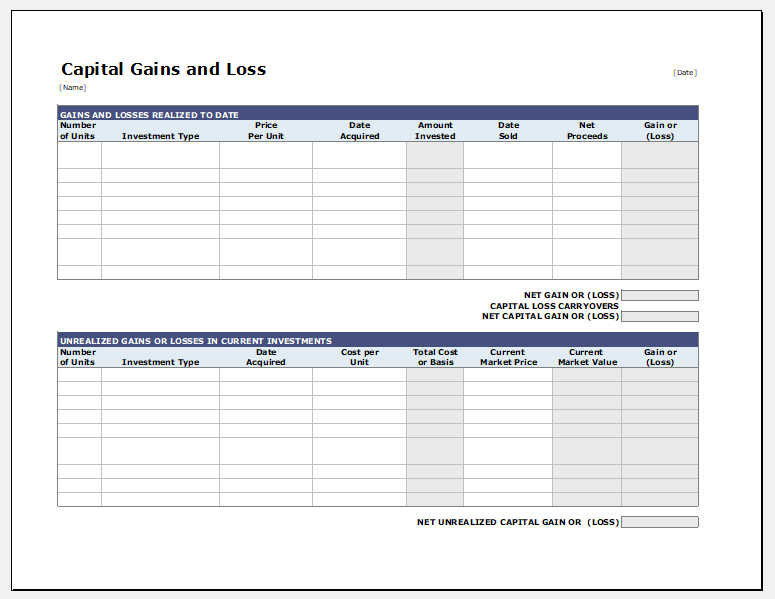

Capital gains and losses calculator template

A calculator template worksheet prepared in MS Excel is a useful tool that helps in calculating gains and losses. Moreover, this template also helps the user organize the data so that it can be used for tax purposes.

This calculator template uses its own formulas. The user does not need to think about the in-depth details of the calculations since the calculator performs everything on its own.

Many companies hire account specialists who are paid to perform the calculations to get the exact value of capital gains or losses. This template saves them from having to hire an individual specifically for this purpose.

Preview

Format: MS Excel [.xls & .xlsx]

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

- Event Planning Gantt Chart

- Employee Attendance Dashboard

← Previous Article

Buy Vs Lease Car CalculatorNext Article →

Bathroom Remodel Cost Calculator