Salary Slip Formats

A salary slip, also known as an itemized pay statement in legal terms, is a document given to the employee from the company that states all the details of income of an employee. It also shows the deductions that have been made from the salary of an employee for different purposes such as tax, provident fund, etc.

In the U.S., according to the Payment of Wages Act 1991, it is a legal obligation of a company to issue pay slips to its employees showing earnings and deductions. Although the employees usually need salary slips when they want to apply for a loan or credit card, it is the responsibility of the company to issue the slips nevertheless.

The Finance department of the company prepares and issues these slips every month to employees after the salary is paid-out.

There are many formats for salary slips. Different companies use different formats. Even the programs used for making salary slips vary. Some organizations may use Microsoft Word templates and other may use Excel. Companies can even make their own formats.

Irrespective of the format used, there are certain things that are an essential part of a salary slip and all companies include them.

- Details of employee and company – this includes personal and professional details such as name, employee number, etc.

- Basic salary – this is a 100% taxable income and is the basic wage that will be given in terms of cash.

- Rent allowance – the amount is mentioned on the slip for the house rent given to the employee.

- Conveyance allowance – this is often given to the employee to manage transport to and fro work.

- Medical allowance – this includes insurances provided by the company.

- Bonuses or special allowances – all the bonuses for a month are mentioned.

- Any other income – if an employee earned any other money through the company in the month, it is also mentioned on the salary slip.

- Deductions – provident fund, taxes, etc.

These salary slips can prove to be very useful for employees. The uses can include but are not limited to:

- When employees want to seek loans or credit cards. These salary slips prove as an evidence of income of the employee.

- Employees can compare different jobs on the basis of these slips. If an employee wants to switch, he/she can compare the packages being offered by different jobs.

- By making use of deductions, the tax liability can be optimized.

- Understand what percentage of your earnings is going toward forced savings so you can manage your monthly budget.

Therefore, salary slips are a useful document for employee and often many employees keep a record of them in case the need arises. It is legally binding on the organization an employee is working in to issue these salary slips every month.

Different salary slip formats can be seen and the templates can be downloaded.

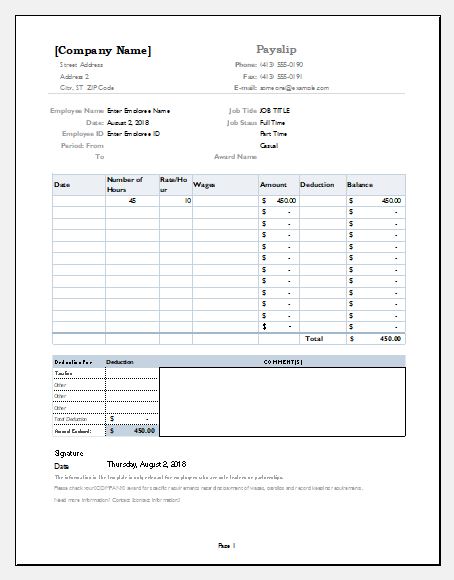

Preview

MS Excel [.xls] | Download

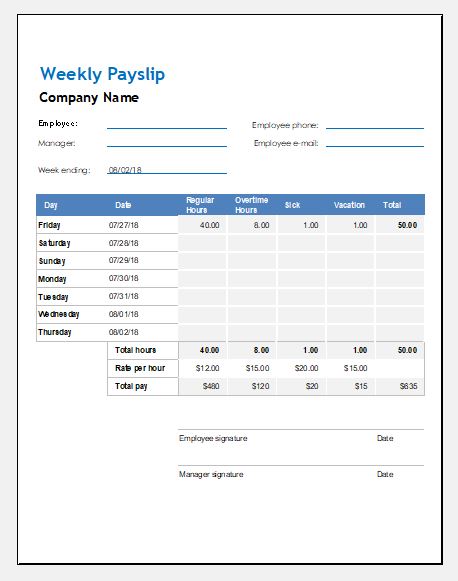

Weekly Payslip Format

MS Excel [.xls] | Download

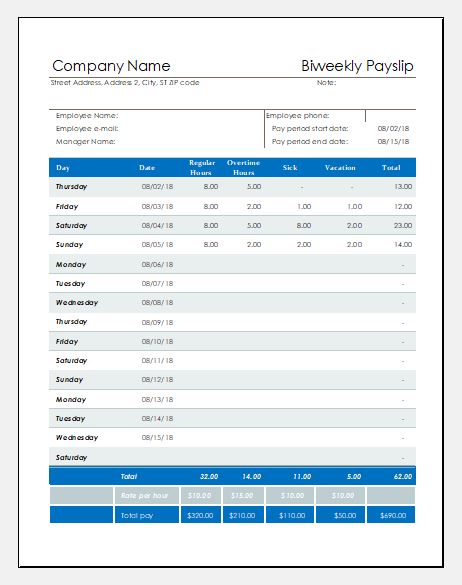

Biweekly Payslip Format

MS Excel [.xls] | Download

← Previous Article

Employee Absence Tracker CalendarNext Article →

Daily Sales Log

Leave a Reply