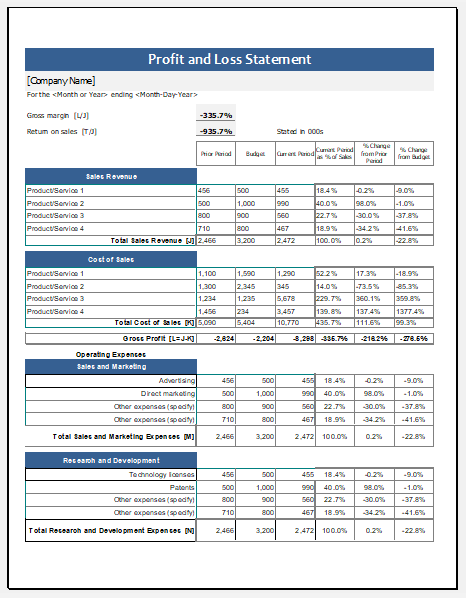

Profit and Loss Statement Template

A profit and loss statement also referred to as an income statement is a document that is used to show the loss and revenue generated by the company. The financial health of the company can be seen with the help of a profit and loss statement.

A profit and loss statement is one of the most commonly used financial statements that have great significance in business. The revenue is made by the company in a specific period from selling the products and then it is converted into the net income. It is the most important financial statement a business needs.

It is one of the three statements every business issue on a quarterly and annual basis. The other two are a balance sheet and a cash flow statement. This profit and loss statement is also known as the income statement and includes revenue and cost.

The cost is accessed through operational cost, taxes, interest plaids, and goods sold then the total cost is subtracted from the revenue to get the net income or profit. The actual earnings can be assessed by comparing the investment statement at different accounting periods as the operational cost, research investment, and other parameters are varied in different periods.

Those records provide information about a company’s strategies how it could produce a profit or why it is not generating earnings. What should be done to increase revenue and reduce costs? The profit and loss statement is also called “income statement”, “statement of financial results”, ”statement of operations” or “income and expense statement“.

File: Excel (.xls) 2007/10

Size 96 KB

What is the purpose of the profit and loss statement?

The basic objective of the income statement is to let the owner of the company know whether a company is making a profit or loss. With the information obtained from this statement, the manager of the company can make several important decisions.

It should be kept in mind that the profit and loss statement is made for a specific period. The expenses incurred by a business are also tracked through this statement.

The revenue that a company has generated in a particular period is the center of attention. The income statement along with other financial statements is very crucial for a businessman since they enable him to make some important decisions.

It is a summary of the business performance in the finance region. The monthly quarterly and annual analyses are done to seek out the financial performance of a business and the statements reflect how your business is surviving in the market.

The profit and loss statements also integrate simple calculations to gain net and gross profits through a fixed formula and grids are designed to list the different incomes and their total. Businessmen adopt software to design such statements and free online templates can also ease this documentation and calculation procedures.

When to create a profit and loss statement?

After every particular period, every business needs to prepare a profit and loss statement. The tax return of a business is prepared by reviewing this statement. The amount of income tax a business has to pay should be following the income of the business. So, whenever a company is asked to pay the income tax, it should prepare the income statement, and then based on the result obtained from this statement, income tax can be calculated.

A business is also required to prepare the income statement at the very start of the business. Whenever your business needs to start a new project, it can consult the income statement to see the funds it will need.

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

- Event Planning Gantt Chart

- Employee Attendance Dashboard

- Monthly Study Reminder & Planner

- Move-in Checklist Template

- Camping Checklist Template

- Employee Orientation Checklist Template

← Previous Article

Credit Card Log TemplateNext Article →

Wine Collection Inventory Template