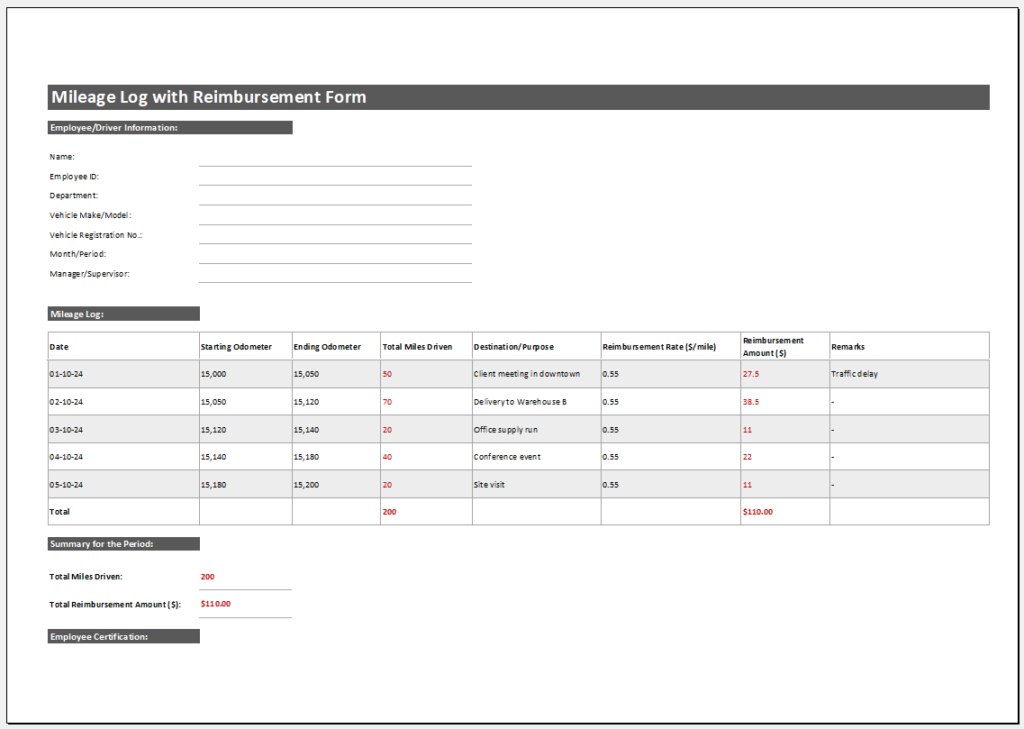

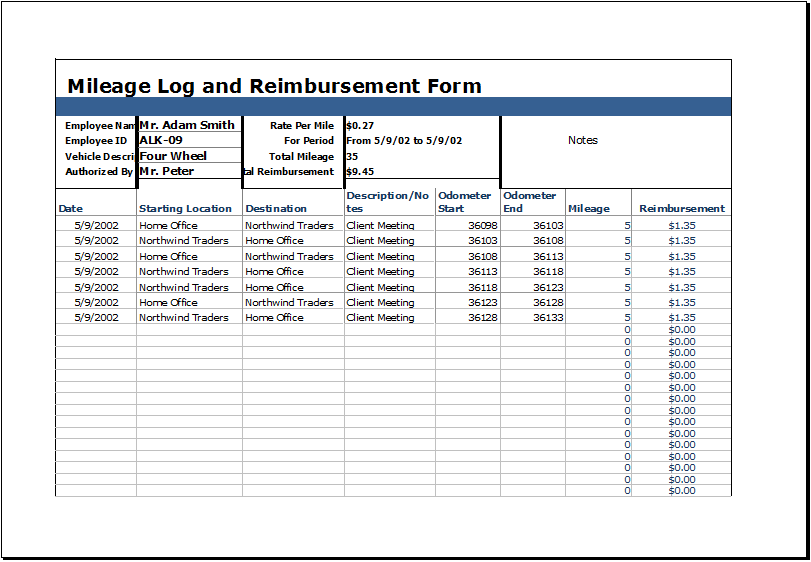

Mileage Log with Reimbursement Form

Businesses and offices that require frequent travel for their operations ask their employees to record the total number and purpose of mileage traveled.

A mileage log records the number of miles a vehicle travels over a certain period. Mileage is the total number of kilometers a car travels on a certain fuel volume.

Reimbursement forms are used to claim each penny paid by an employee on an official trip. The form details the employee, costs, and a description of each expense incurred. The form is filled out and submitted to the finance department, which pays the worker the total amount spent.

Structure of a mileage log:

A mileage log book is easily available at an office supply store. In this technological era, mileage log templates can be downloaded and used and are user-friendly, too. A typical mileage log includes:

- Beginning date.

- Date of travel.

- Odometer reading (beginning and ending).

- Miles traveled.

- Purpose and description of travel.

- Destination traveled.

- Total miles traveled by the vehicle.

The mileage log shall be updated and maintained regularly for accurate calculations. If employees do not keep a proper record, the business won’t be able to track its expenses properly. So, staff must make on-time and accurate entries.

A mileage log is used to:

- Track the number of miles traveled by a vehicle.

- The log is used to collect reimbursements from an employer.

- A mileage log notes other deductible miles, such as medical appointments or social meet-ups.

- The log can also help calculate fuel consumed in a certain period.

- The mileage log also tells the purpose of travel so that nothing can be missed by the finance department when calculating the reimbursement.

How to maintain a mileage log:

The best way to keep a vehicle mileage log is to keep a book in the car and note each and every mile traveled, along with all the essential reimbursement documents like fuel vouchers, toll tax receipts, parking charges, and others.

If your business makes a lot of official trips, we would prefer to use a mileage log template, which is less tedious.

Vehicle mileage record book & reimbursement

When an employee uses the vehicle for inventory, supply purchase, or distribution, he might deduct a percentage of automobile expenses. Recording the mileage is essential. It is always beneficial to record the starting and ending mileage, the destination, and the purpose of the travel. It could be written on a piece of paper or in your diary.

There are two methods to reimburse the use of your car: mileage reimbursement or vehicle expenses. You can opt for one method. The rules for your vehicle expense deduction are quite clear. Still, mileage reimbursement covers the area of the use of gas and the vehicle’s condition based on the number of business miles driven; the organization will reimburse you. The mileage reimbursement rate involves IRS figures that are readjusted promptly.

If you are an employee and need a mileage reimbursement, you can download the free reimbursement form template to record your mileage with a fully customizable option methodically. Download this form, fill in your mileage account, and print it conveniently for official submission.

A consolidated mileage log records the total mileage by adding the substantial mileage you cover in every journey. If you work in an office, the number of miles between your house, to the office, and back again are your commuting miles are counted. It is recommended to write the mileage in separate categories, for example, your business mileage, mileage for excursion, etc.

Download your file below.

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

← Previous Article

Biweekly Time Sheet with Sick Leave & VacationNext Article →

Inventory Management Template

Leave a Reply