Daily Monthly & Annual Cash Flow Statement

We all have been to a point where we hate spending more money than saving and regretting later. If someone wants to overcome this problem, the best way is to maintain a cash flow statement. Be it daily, monthly or annual. This can help anyone in managing the budget and tracking the flow of money easily.

Cash flow statement or a statement of cash flow is the most convenient method of tracking cash flow as the name signifies. This statement helps in showcasing the flow of funds to and from an organization, business or even an individual.

Usually, an indirect method of accounting is used to calculate net cash flows and a proper statement of cash flows is made by using this method.

As we know that the term cash is a very broad word so it includes both, income and expenditure while may also include investments and cash equivalents in it.

By making the best use of this statement template an individual can get a lot of help from it. This not only allows him to track the present cash uses but also compare the expenditures and all for a better saving plan for next time.

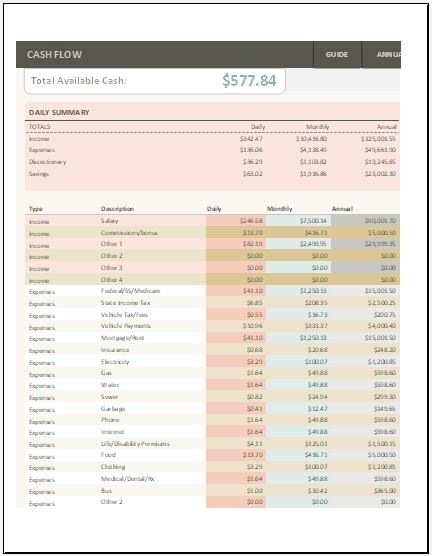

A typical daily, monthly or annual cash flow statement has every piece of detail in it that an individual would want to consider. The section of daily cash flow will have details of income, expenditure, discretionary and savings that will be updated daily.

The monthly part of this statement will have the same details. However, on a monthly basis, as the name describes. The last section of this cash flow statement is the annual one and this will have the summaries of the details that are mentioned in the daily and monthly section.

The heads of summaries include income, expenses, discretionary and savings. The three sections of the cash flow will give a detailed account and guidance on how to save money in the future. The easiest way to use this amazing and the most useful tool is to download the template and start using it today for best results.

Preview

Cash Flow Statement

Format: Microsoft Excel 2007-2013

File Size: 60 KB

← Previous Article

Home Construction Expense Calculator WorksheetNext Article →

Petty Cash Reconciliation Sheet

Leave a Reply