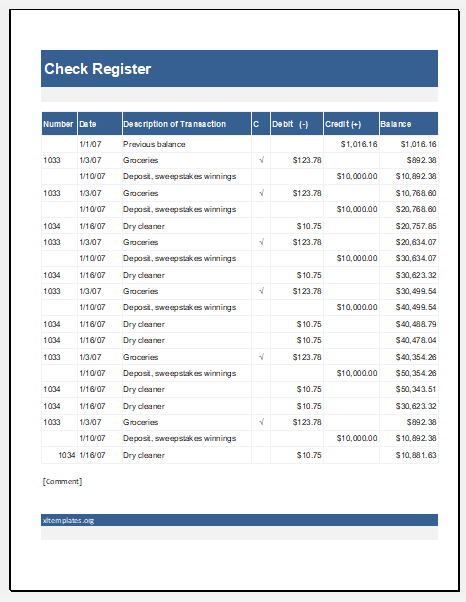

Checkbook Register Template for Excel

Checkbook Registers

Checkbooks, debit cards, ATMs, and credit cards are used very often. Nowadays carrying cash is not as common as it used to be and plastic money has taken over the world. For the smallest of things or bigger transactions, we use either cards or checks and for that maintaining a record of all the transactions conducted is important.

Yes, your bank does keep a record of all the balances but it is necessary that you on an individual level keep them as well. For this, a Checkbook Register is used which is a journal used to keep track of all the transactions that you have conducted such as purchases, or in other words the journal which records the issuance of money by your side.

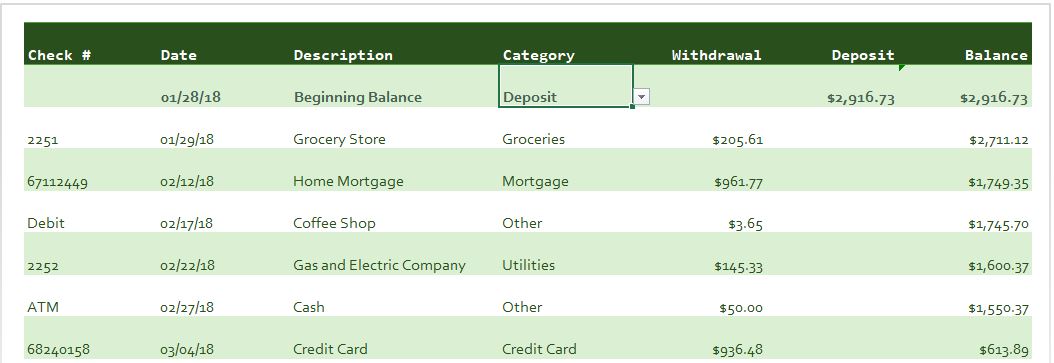

You can use an electronic checkbook register or a book one as well. The usage is according to your feasibility and in both of the methods, you can use the same layout. A well-organized checkbook register should have these columns: The date, check number (or in the case of an ATM or credit card the transaction number on the receipt), the person or entity you have paid, the amount, the credit or debit amount, and the balance remaining.

Always remember to save your ATM or credit card receipts until you don’t record the amount. These receipts contain the transaction number and the balance remaining which would save you the hassle of calculating the amount. Maintaining a checkbook register would help you keep a check and balance on all your transactions.

File: Excel (..xlsx) 2007/10

Size 15 KB

Checkbook Register with Chart

How is it to keep a record of your money for where it is coming from and where it is being spent? Yes, now you can do it with the help of an Excel template provided by Microsoft Corp.

To do this you must have installed MS Excel software of any version on your computer. Most of the people around have it and I expect you do have one available with you, of course.

A checkbook register is a record of all the withdrawals and deposits you made. Although your bank keeps the record for the same still it is okay to keep the record for yourself to monitor your financial transactions.

Let me explain to you how it works.

- Let’s begin with a deposit.

- Select the date you want to deposit some money in your account or in case you have already deposited the money.

- Enter the amount that you have deposited. Don’t forget to choose ‘Deposit’ from the category drop-down.

- Your balance will show you the current deposit that you have made.

- On the next line select the date, give it some description or detail of your withdrawal/deposit, select the category from the drop-down, and enter the amount.

- The balance will show you the deducted or in case of any deposit the added money.

- Again on the next line do the same

and this is how you can keep a record of all of your transactions at home.

The template also has a graphical representation for each of the categories that you have in the dropdown. It gives a quick analysis of your financial happenings.

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

- Event Planning Gantt Chart

- Employee Attendance Dashboard

- Monthly Study Reminder & Planner

- Move-in Checklist Template

- Camping Checklist Template

- Employee Orientation Checklist Template

← Previous Article

Employee Attendance Tracker for ExcelNext Article →

Payroll Calculator Template for Excel