Cash Flow Forecast Template

Cash flow forecast is a document that is used to know how much money a business is likely to get and the amount of money it is likely to lose. The cash flow forecast can be conducted at any point in a business. Businesses use the cash flow forecast document when they want to know their financial position before applying for a loan.

What is the cash flow forecast?

The process to know the expected amount of money a business will earn and pay out in a specific period of time is known as cash flow forecast. In this process, all the revenue sources of the company are taken into consideration.

The money received from revenue is then compared with the expenses of the company. The debtor will always ask you to provide the cash forecast of 6 or 12 months to see how sustained your business plans are.

Cash flow forecast is an important tool for any business. If you are thinking to expand your business, you are required to know if you have enough money for this. The cash flow forecast will help you know this. Similarly, whenever, the flow out of the cash increases than the flow in, the cash flow forecast alerts the business owner.

Cash flow means how much cash the business has to survive successfully in the market. Small business has to be very vigilant about their cash flow analysis because if they run out of cash flow the lender or another supplier may not further support them and it has to end up soon. Therefore, a daily cash flow analysis and a forecast are done by small entrepreneurs to keep their business alive. However for stable businesses, this daily check-up is not mandatory, either they can go for a monthly or quarterly cash flow analysis and forecast.

This forecast is used as a warning alert as it effectively detects the shortfalls in cash holding and it let the businessmen prepared to meet the shortfall. The cash flow forecast will give you a situation to get the cash in hand to give it to suppliers and employees as these two area needs on-time payments.

The cash flow report will identify those clients who are not paying their bills on time and therefore it is a good means to talk the account receivable.

The cash flow forecast will let you craft consolidated financial planning and with its help, the business can set a functional budget. Your lenders want to assess your cash flow to give you loan presently or in future. Many business owners and finance personnel are taking help from the online cash flow templates to assess and develop their cash flow forecast; otherwise, your accountant has the responsibility to make a perfect cash flow forecast report.

About Template

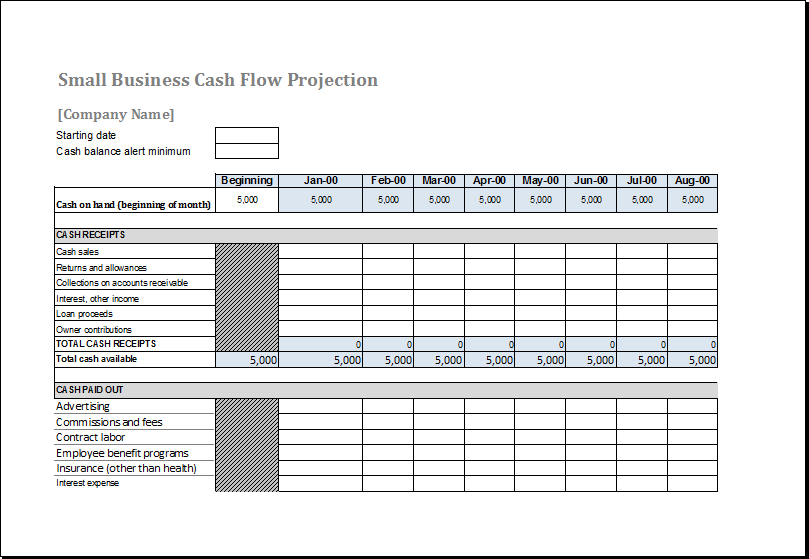

The cash flow forecast template can be used for easily forecasting. It is a very strong tool that dramatically improves the quality of the business. The template fits in all the situations because it is customizable. For a template, it is important to be useful and productive. The template must be aligned in such a way that it can be tailored to the business needs.

The template is designed by the professionals. These professionals spend plenty of time designing this template. The template mainly provides two types of data:

- Actual data.

- Forecast data

Both types of data are represented in the form of graphs. The graph of actual data is plotted on the left side while that of forecast data is plotted on the right side on the same page. This makes it easier for the user to make compare both types of data.

Preview

Download your file below.

Cash Flow Forecast Template

File Size: 49 KB

Download

← Previous Article

Business Travel Audit ReportNext Article →

Employee Task & Weekly Working Hour Record Sheet

Leave a Reply