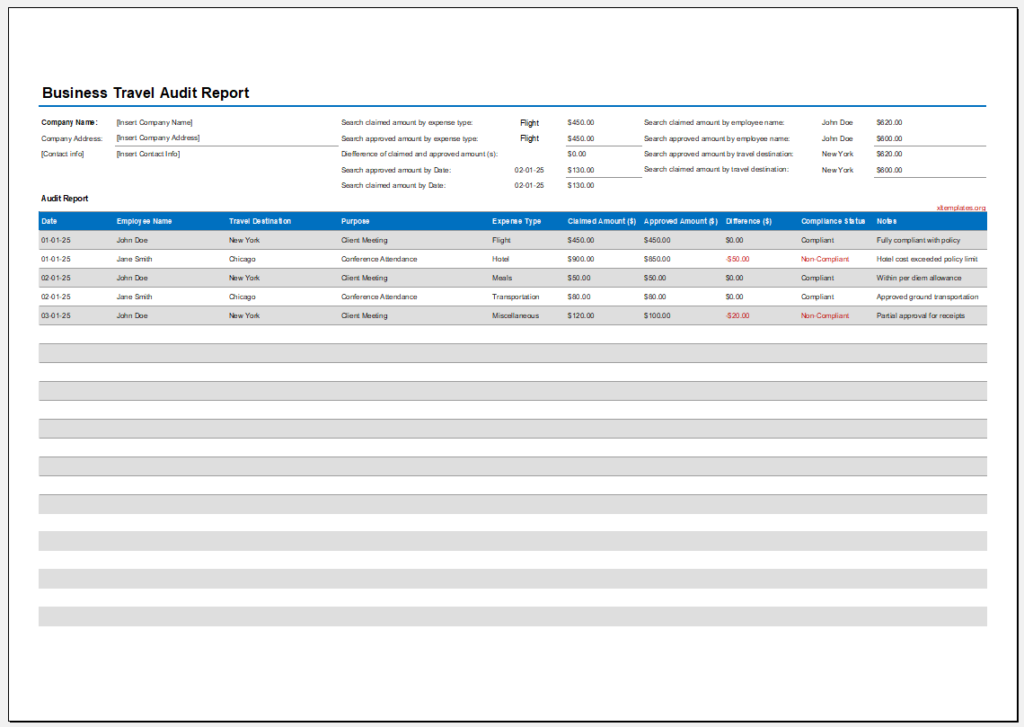

Business Travel Audit Report

A travel audit report is prepared when someone wants to know where a business is spending most of its money. Audits of different sections of a business are conducted to determine the exact amount of expenses incurred. Travel expenses are usually the most common type of expense a business faces.

The travel audit is conducted to determine the exact amount the business spends on travel. The employer may ask his manager to conduct an audit and prepare a report based on which several important decisions can be made. This report is very significant in a business and is widely used.

To keep your business travel safe from auditors, you must look into the following areas to let your audit run smoothly. The travel expense report should entail clear transactions with justified purposes. Your business manager should read every bill or expense issue before signing the document promptly.

The audit team will ask about all transactions spent on weekends and holidays, especially on Thanksgiving, Black Friday, or Christmas. The reason is that people usually fly on Sunday to attend a Monday meeting and spend some expenses for their personal weekend use.

What are the benefits of a travel audit report?

The key benefits a business can avail of using a travel audit report keep it wanting to use it for every type of reimbursement, most commonly travel expense reimbursement.

- The report clearly shows the amount the business is spending on travel. Based on this information, a business can make several decisions.

- Travel expenses are reimbursed when the travel audit report is prepared. The employee is required to submit this report to be eligible for reimbursement.

- Some tax departments also see the travel audit report to know if the business is paying the tax right.

What are the elements of a travel audit report?

- Name of the company

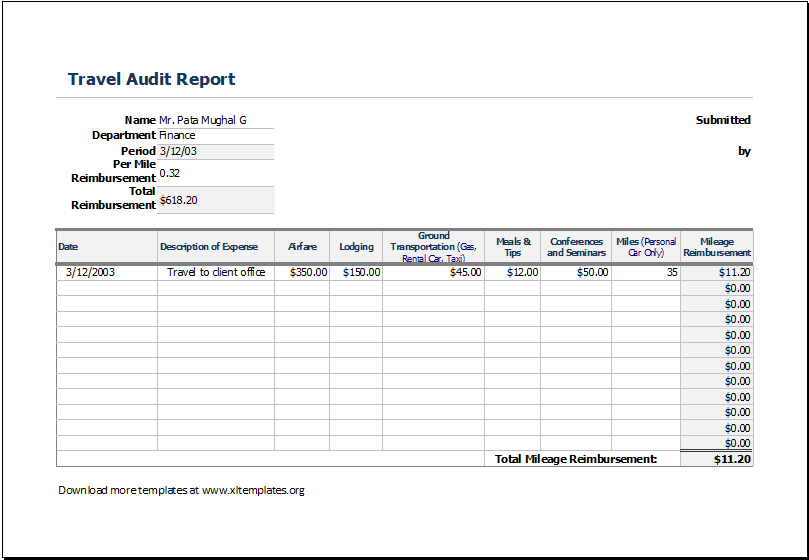

- Name of department

- Date of creating the report

- Reimbursement amount

- Description of all the expenses, including transportation expenses, hotel expenses

The employee must provide receipts for all expenses. The receipts act as return proof of the expenses that the business must reimburse.

Give a grave look at your highest spending. Check why so much is being spent here and how steadily the expenses flow. Are those spikes uniform, or has a significant amount been given for a particular purpose?

Analyze the data taken from months to determine whether such expenses are meaningful or not. The merchant name and its link to the purchased item should coordinate, and the same is the case with the merchant code, which should align the relative expenses.

Flight receipts confirm that the flight is not in someone else’s name. It may happen often that the employee on a business travel accompanies his spouse under the business travel expenses.

Other people who should have a check for such travels are contractors, clients, and people traveling for the sake of a job interview.

Employees usually misuse the cash reimbursement feature without providing the receipt. Therefore, each receipt should be saved to show the authentic reimbursement, and the company should set an amount for the reimbursement to be delivered.

A detailed travel mileage log is necessary to provide good travel expense reports for audits. If you take care of all the above-mentioned features, your business travel audit will be a no–trouble feature.

You can get a printable and downloadable business travel audit report template. The template is very easy to use and customize. The user can add details to it and perform all the calculations on the data provided with complete ease and comfort. The template undoubtedly saves time and energy.

File Size: 31 KB

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

← Previous Article

Sales Invoice TemplateNext Article →

Cash Flow Forecast Template

Leave a Reply