Employee Payslip Templates

What is a Payslip?

Payslips are documented record of the amount of payment made to the employee by their respective organization. These payslips are generated by calculating the period of time worked by an employee. Furthermore, other information such as insurance and tax deductions are also mentioned in the document.

However, this information varies from organization to organization. This is because every organization provides different kinds of miscellaneous benefits. For example, some jobs provide finance for house rent, food and laundry, and conveyance. These payments add up to the work-related salary to create total earnings.

Why payslips are made?

This documentation helps the employee understand the amount of pay they receive and where deductions have been made. Salaried employees receive a fixed same amount of payment, with the same deductions made every month. However, payslips are very important for the employees that are paid by hourly or weekly rates, or according to the amount of work the employees received.

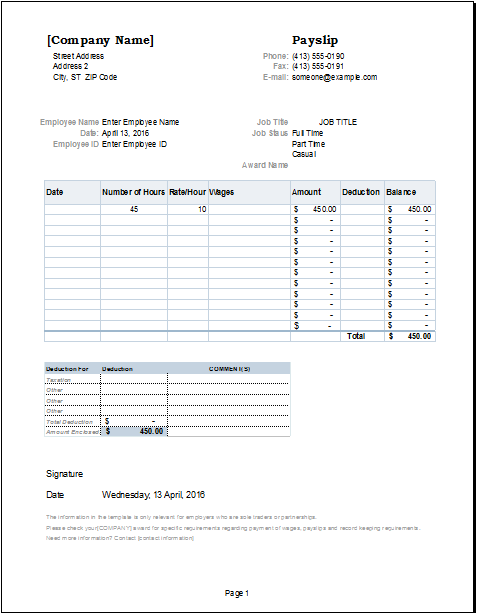

Format: MS Excel [.xlsx]

Download

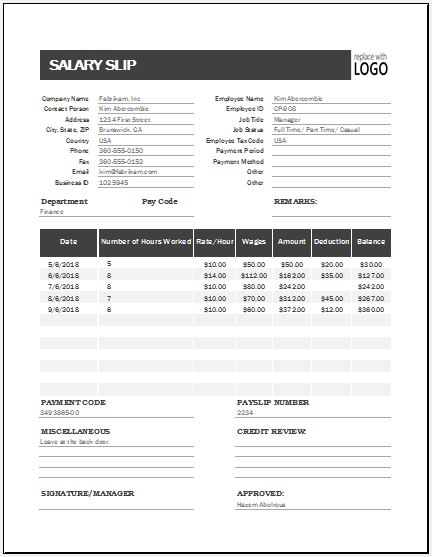

Format: MS Excel [.xlsx]

Download

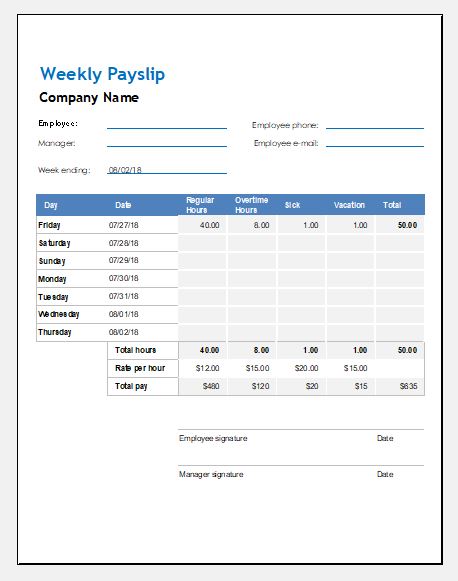

Format: MS Excel [.xlsx]

Download

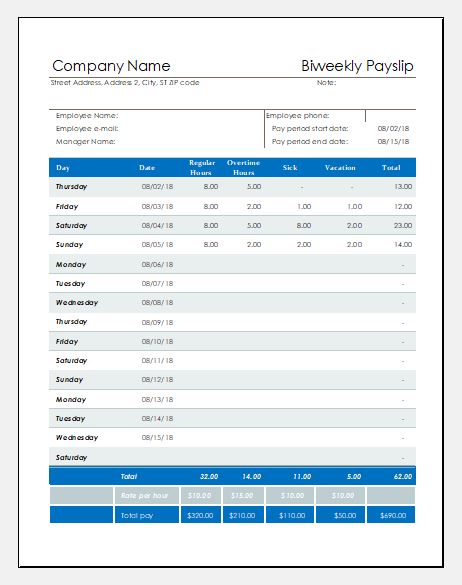

Format: MS Excel [.xlsx]

Download

Who uses it?

A common job of a payslip is that it also acts as documented proof of a person’s employment at their respective organization. This is especially the case in situations such as an employee looking to secure credit. The bank requests proof of employment and also make sure the employee’s amount of pay meets their bank’s requirements. Another situation a person may be required to provide their payslip is when renting real estate.

Furthermore, payslips can also be used by the employer’s to check the employee presence and work performance. This is especially the case when the worker is employed on an hours based contract. If the employee has an extra absentee, the employer or if the employee’s work performance is poor, the employer can deduct their salary.

How payslips are made?

In large-scale organizations, the accounts department provides employees with their payslips. These payslips can be generated online through payslips service or through the automated payslips software. However, an accountant may be necessary for this method.

Organizations operating on a small scale opt for the easy and less costing method by creating payslips through templates. Templates are easy to download online and edit according to the requirements of the organization. Information can be added or removed from these templates to create a format of the company’s desires.

What are the different Payslip formats?

The common information present on the payslip format consists of the employee’s age, designation, organization name, the name of the employer as well as the date and month of the payment. The rest of the information such as the total earning depends on the type of contract an employee has been employed on.

Salaried employees and the employees contracted on wages have different types of payslips. A salaried employee receives the same amount of pay every month with the same amount of insurance, tax and miscellaneous deduction made every month. However, employees working on an hourly basis have their working hours or the work they received mentioned on their payslips. This information is mentioned in detail to erase any confusion of the amount received by the employee.

← Previous Article

Goal, Task or Idea Planner TemplateNext Article →

Meeting Agenda Templates