Daily Deposit Report Template

What is a daily deposit report?

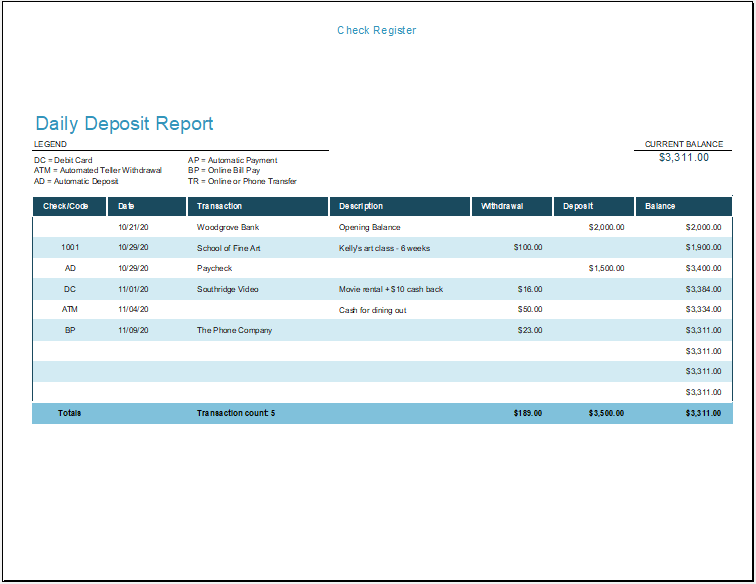

Institutes, where money or other assets are deposited daily, would like to get information about the daily deposits and their summary in the form of a document which is known as a daily deposit report.

Why is a daily deposit report created?

For every financial institute, it is essential to keep track of money being deposited there. This is very important especially when is it required to keep tabs on what an institute is receiving in the form of money from people. A bank generally creates the daily deposit report since there are lots of people depositing money into their accounts in those banks.

Why is the daily deposit report important?

The inflow and outflow of cash is an important parameter to determine the financial health of any institute. How much money an institute has received in the form of deposits tells about the number of accounts in that institute and lots of other details. Based on money received, the liability of these institutes for paying the tax is also evaluated. There are also many other purposes of why the daily cash deposit report is generated.

What information is provided by the daily deposit report?

Let us break down this report into various parts to determine what information this report collects:

Name of the institute:

The deposit report is different for every institute. Therefore, there should be a distinction between every report. To maintain this distinction, the name of the institute for which the report is being created should be mentioned.

Date of report generation:

Since the deposit report is created daily, it is important to mention the date on which the report is created. This data helps in recordkeeping.

Deposit details:

The cash in the bank is usually deposited in two forms: cash and check. The report must tell how much cash has been deposited in the form of cash and how many checks have been received by the bank for cash deposition. After having provided details about both types of deposits, the report should also mention the total of all deposits.

Credit card details:

Some people pay or deposit money through their credit cards. In this situation, the bank is required to keep track of which customer has deposited the money and from which source.

Comments section:

A daily deposit receipt includes a separate section for giving comments on daily deposit records. This information is useful when there is something special associated with the deposit and you want to mention it in the comments section.

Signatures:

Once the deposit receipt is complete, it should be signed by the person who created it. The person who signs this receipt becomes responsible to answer for all the information that he has provided. After the operator has signed the record sheet, it is sent to the reviewer who reviews it and then signs it.

What is a daily deposit report template?

This template is software that provides a structured daily deposit report. Using this template helps the user in creating the daily report. When a report is required to be created daily, it becomes really hard to create a deposit report. So, when a template is used creating a daily report is a piece of cake

Things to remember while creating the template?

No doubt, the daily deposit report template is a useful tool, it is important to know how you can make effective use of this template. Here are a few tips to help you in this regard:

Fill it properly:

Numerous fields in the pre-designed daily deposit receipt are required to be filled by the person using this template. Filling all these fields is important because they collect a certain type of information that one needs to provide information about the money deposited in a single day. When the user appropriately provides these details, he makes the best use of the template.

Attach deposit slips:

It is important to remember that every daily deposit report refers to some deposit receipts or slips that were issued to depositors at the time of depositing money. These receipts are essential for any institute since they are tangible proof that the money has been deposited on a particular date mentioned on the receipt.

Sometimes, adding information to the report is not enough. You are also required to keep the proof with it. So, it is recommended that you attach the receipts with this report or add the receipt number to the report.

Add accurate details:

When you provide details in terms of numbers, you should ensure that you have maintained accuracy in the given data.

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

- Event Planning Gantt Chart

- Employee Attendance Dashboard

- Monthly Study Reminder & Planner

- Move-in Checklist Template

- Camping Checklist Template

- Employee Orientation Checklist Template

← Previous Article

Daily Sales Register TemplateNext Article →

Leave Roster Template