Corporate Tax Calculator

A tax calculator is a tool that can be used to calculate the tax liability of a corporation. The amount of tax a person is liable to pay depends on the net profit made by the company. The company that makes a profit is liable to pay the corporate tax.

Based on the tax period, the tax is calculated with the help of corporate tax and paid annually. When it comes to paying the tax, it is very important to calculate each penny you earn as a profit and the total amount you need to pay on the taxable profit. MS Excel is used for making the corporate tax calculator.

Governments not only work on their own but also need a public contribution to help run the system. This contribution is made in the form of taxes. Taxation is made by the government on common people, workers, goods, services, and businesses to generate revenue.

We know that businesses make a whole lot of profit through their products or services; they are the ones that can contribute to the country more by paying huge taxes according to their profit.

Large corporations are required to pay more tax because they earn more profit. These organizations also make use of a corporate tax calculator to know what they are liable to pay. It should be kept in mind that only trading companies are required to pay the corporate tax.

Though the government applies the tax, companies sometimes have to calculate their own too. For this purpose, large corporations make use of corporate tax calculators. Since there are companies that are investment holding companies and others that are trading companies, make it clear for which corporations the corporate tax calculator is. The corporate tax calculator is for trading companies and not for investment-holding companies. For investment holding companies, there are other formats to calculate the tax.

This calculation tool of corporate tax calculator is called the Excel workbook. Corporations calculate their tax using this workbook and submit their files for legal proof of tax being paid.

Payment or non-payment of tax counts as a legal practice; hence, it can legally be sued. Even if a company makes wrong calculations unintentionally, it may face consequences, the least of which is a decline in public reputation that will cost the company much as a result. The corporate tax calculator is, therefore, a very important tool.

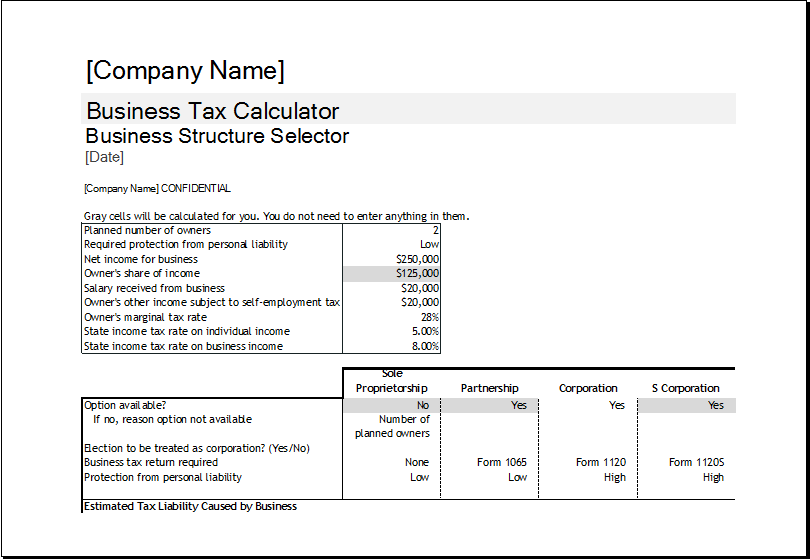

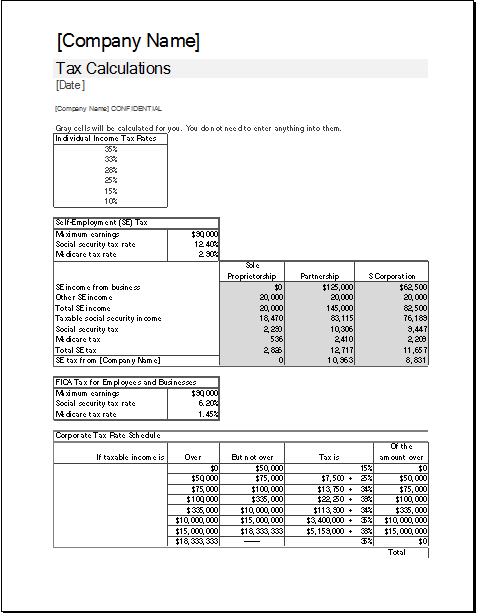

Below is a corporate tax calculator template. Open it to see how it may help you calculate your company’s tax. Calculate & contribute to the country.

Preview

Download your file below.

File Size: 25 KB

Corporate tax calculator template:

This calculator template is prepared in MS Excel format. MS Excel can be easily converted into a calculator by defining some formulas related to what you want to calculate. The template contains all the details that are needed by the user to calculate the corporate tax. The use of this template ensures that the calculations are accurate and error-free.

It is capable of calculating the corporate tax in no time, which eventually saves the user’s time. The template enables the user to know how much his corporation is required to pay. Not paying the tax can create many problems for corporations. The calculator saves the corporation from many legal procedures that it may face due to nonpayment of tax.

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

← Previous Article

Community Event PlannerNext Article →

Logical Model Flowchart