Business Cash Budget Template

A cash budget in a business is an expected receipt of cash or disbursement of money in a particular time period. While making a cash budget, the inflow and outflow of the funds are considered so that total revenue generated by the business, loan receipts, and paid expenses can be calculated easily.

Cash is one of the most important things for anyone—for individuals and businesses. It is more crucial for the latter because cash is the sole thing that can make or break them. They need to manage their cash in a way that allows them to spend it, save it, and sustain their business and organization.

This is why every entity in the business world, from the bottom to the top, has a business cash budget, which helps them make relevant and better choices for their business and maintain their cash more effectively.

Download Excel File

What are the advantages of a cash budget?

The main advantages are:

- A business is required to make long-term planning instead of short-term planning. Budgeting helps the business. The long-term planning enables the business to improve its performance even if it is not achieving its goals

- A businessman needs to know where the company spends most of its money. This information helps him determine which aspect of the company makes most of the money and where it consumes it.

- Budgeting in a business also helps the business owner evaluate the company’s performance. The created budget and the report can be compared to check how the employees perform.

- The cash budget informs a business of the amount of money needed to perform several operations and easily evaluates the company’s funding needs.

- The company should know all the factors that slow down its performance. The cash budget helps a business concentrate on what must be done to handle all those factors effectively.

A cash budget is a projection of the company’s cash inflow and outflow. It helps the company or organization make decisions about revenue and major financial aspects.

To make better decisions and projections about the businesses’ financial future, they need to use a business cash budget template to help them maintain their cash more effectively. This worksheet template can be used repeatedly and helps save a lot of time.

It has two chief aspects, the cash inflow and the cash outflow, which depict how much cash has entered the business and how much money has been spent on the company. To avoid discrepancies, this budget template should be created with help from the finance department and accountants.

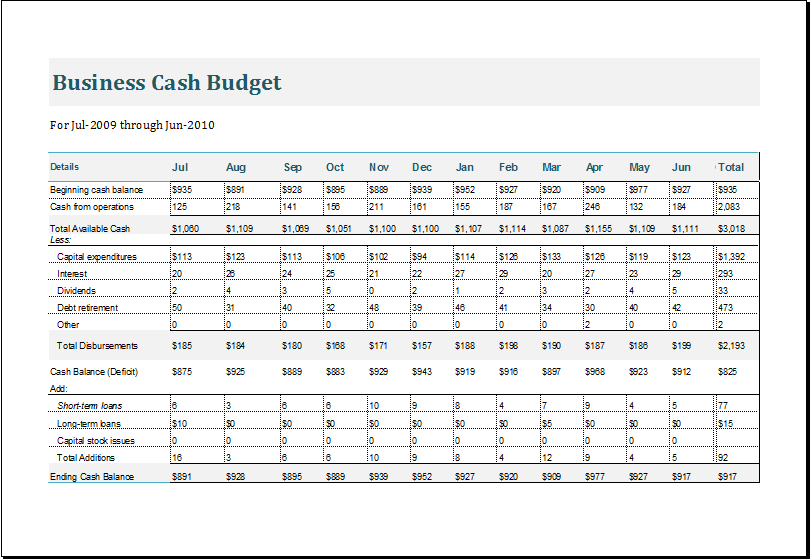

Business cash budget template:

The business cash budget template has been designed to track cash inflows and outflows. It is not based on basic and traditional accounting principles, which makes it a unique document for tracking business cash.

Business cash tracking is important as it tells the business how much cash is required to perform several operations and how much surplus it has. The user can make different types of changes in the template to make it work best for him.

Download your file below.

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

- Event Planning Gantt Chart

- Employee Attendance Dashboard

← Previous Article

Home Construction Budget WorksheetNext Article →

Business Expense Budget Template

Leave a Reply