Mortgage Qualification Worksheet Template for Excel

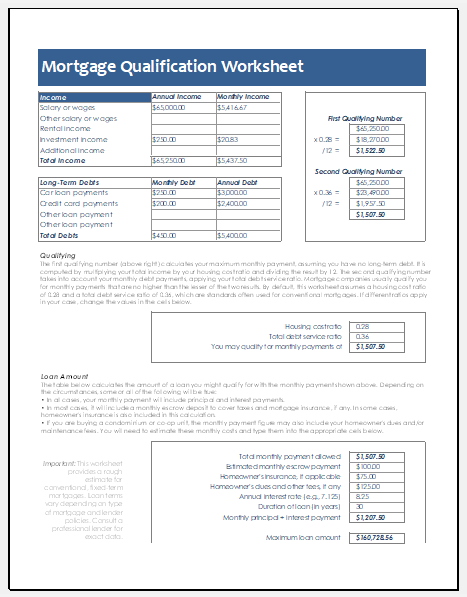

The Mortgage Qualifying Worksheet provides the method used to qualify for a mortgage. If you are deciding to purchase a home you should plan how to use your budget to do so. It is extremely easy to do when we take help from the Mortgage Qualification Worksheet. Although the formulas will vary from place to place the formula involved in calculating the amount you can qualify for taking your house loans and how it will break down into easy monthly payments.

The following parameters are essential for a mortgage-qualifying assessment

- Your Salary

- Extra income or profits

- Debts on a long basis

A mortgage qualification sheet is used to calculate the mortgage amount one can afford to pay. All you have to do is enter the total income, information about the debt, and some other details and the template will calculate the ratios and the amount of monthly payment you qualify. The worksheet also provides the details and instructions which makes the use of worksheets easier.

Based on the above parameter it is calculated that if you are qualified to gain the mortgage or not. This calculation is very easily explained on the Mortgage Qualification Worksheet, available as free online templates online deliver every formula and calculation regarding mortgage qualification

- The total house payment to your income and division of the figure by twelve, for monthly installment

- The debt-to-income ratio is another figure which is of grave importance.

A mortgage qualification worksheet is a tool that defines all the methods the user follows which enables him to qualify for the mortgage. The worksheet enables the user to plan a budget. There are different formulas in the worksheet that are used to calculate the total amount one can qualify for.

These formulas are very helpful in determining the payment to be made each month since this qualification worksheet breaks the house loan into multiple small monthly payments. The formulas to be used in the mortgage qualification worksheet may vary. However, some common and essential parameters are:

- Salary of the person applying for the loan

- The extra income generated from secondary sources of income

- Amount of loan he has applied for

Based on these parameters, it can be known whether or not the person qualifies for the mortgage. The mortgage qualification worksheet template is also available as a free tool that performs the calculations quickly and easily.

The final result will give a dollar amount that you may qualify for. This worksheet computes the maximum monthly mortgage payment you can qualify for. You can customize this monetary calculator with your income and can easily access your standings.

File: Excel (.xls) 2007/10

Size 20 Kb

The template

This template has been designed in such a way that it can easily provide the most accurate results. The maximum amount of mortgage a person can qualify is calculated by the template. It should be kept in mind that the results obtained from the template are based on the parameters provided above.

The prices of the properties seem to be rising over the year. Mortgage at first seems to very terrible although it has many benefits. Many lending institutes lend you money to buy your own home. Mortgage plans of different types are offered by financial institutes. These plans let you know the amount and the number of installments in which you can pay off the debt.

The template exhibits stated figures for predictable mortgages. The template is easily tailored to provide you with more accurate results. Download this template for an accurate assessment.

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

- Departmental Expense Report Template

- Event Planning Gantt Chart

- Employee Attendance Dashboard

← Previous Article

Employee Expense Report TemplateNext Article →

Sports Sign Up Sheet & Tournament Bracket Template