Loan Comparison Calculator

Loan comparison is essential when you want to get a clear idea about all the costs you must incur. The expenses required to be compared include the monthly principal, interest rate, monthly fee to be paid, and a lot more. Before you make the loan comparison, you should consider all the above factors to know which type of loan is most suitable for you to be chosen.

What is a loan comparison calculator?

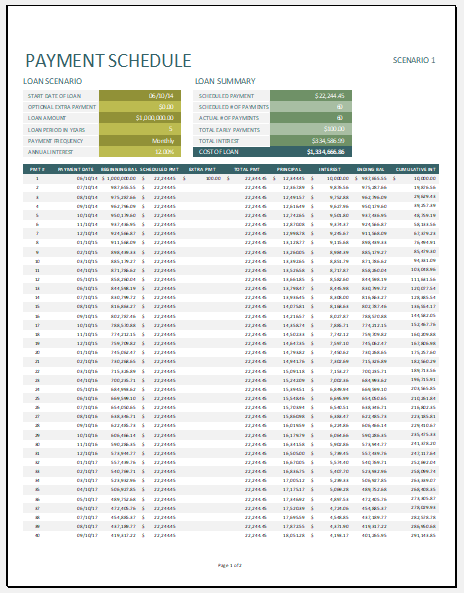

It is an essential tool that computes the estimated amount of monthly payments you will have to make. This calculator calculates the monthly payments of three loans at a time. In this way, you can easily compare multiple loans at a time. When three or more loans are taken into consideration and a comparison is made, the user can easily compare the interest to be paid on each loan, total payments, and a lot more. This will enable the user to know which type of loan will be more suitable for you to choose.

Format: MS Excel [.xlsx] 2007/2010

File Size: 159

To compare different types of loans, the loan comparison calculator assumes that the interest rate on each type of loan stays constant. The calculator tells in how many monthly payments, the loan can be completely paid off. This information is different for different types of payment plans.

Importance of loan comparison calculator:

Different financial institutes provide the facility of borrowing money from them. The borrower is required to pay off the borrowed money in a series of monthly payments. These monthly payments also include the interest that the borrower is required to pay. Sometimes, the user gets so many options to choose from. To know which option will be more feasible for the user, the loan comparison calculator can be used.

Every person has a different level of affordability and preferences. One type of loan suitable for one person can be completely inappropriate for the other person. Therefore, the loan comparison calculator enables the user to compare multiple available loan options.

How to use the loan comparison calculator?

Comparing different types of available loans and making a decision about which loan type is best for you depends on different parameters. All those parameters are required to be taken into consideration so that a wise and appropriate decision can be made.

The factors based on which a general loan comparison calculator makes the comparison are:

- Amount of loan balance

- The rate of interest on the loan money

- Duration of the loan

- Minimum payments to be made over the loan period

Many websites provide the online tool loan comparison calculator that is intended to provide the maximum ease to the user with which the user can easily compare various available loan options. Many people want to compare loans but don’t know about the variables to be chosen to make the comparison. The use of a comparison calculator does not require the user to know about any such details.

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

← Previous Article

Payroll Calculator TemplateNext Article →

Mixed Cash Flow Streams Calculator