Employee Payment Advice Template

Employee payment advice documents are used extensively these days to confirm invoice payments. Suppliers and employers feel peace of mind when they use a payment advice document, although the historical use of the same is less common. These documents are also helpful because they enable the employer to perform fast-tracking.

What is employee payment advice?

An employee is compensated for the work he performs for the company. The compensation is usually done weekly or monthly. In some cases, the employees are also paid regularly daily. When a company issues a payment to the employee, it keeps a record that also serves as proof of payment. This payment advice document is sent to the account receivables so that the company and the employee can confirm that the payment has been made.

The payment advice document is prepared to act like a receipt and is used to keep financial records. This gives peace of mind and satisfaction to the employee and the employer about the payment made.

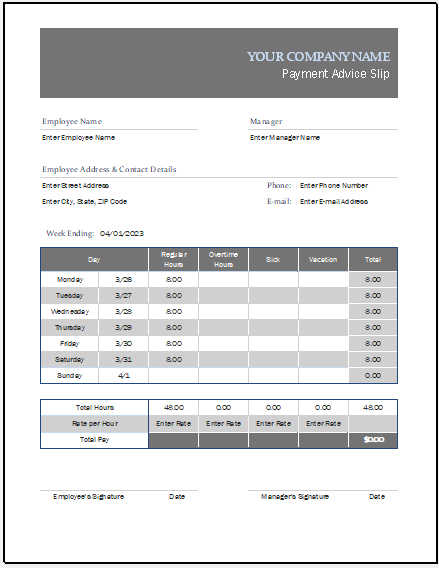

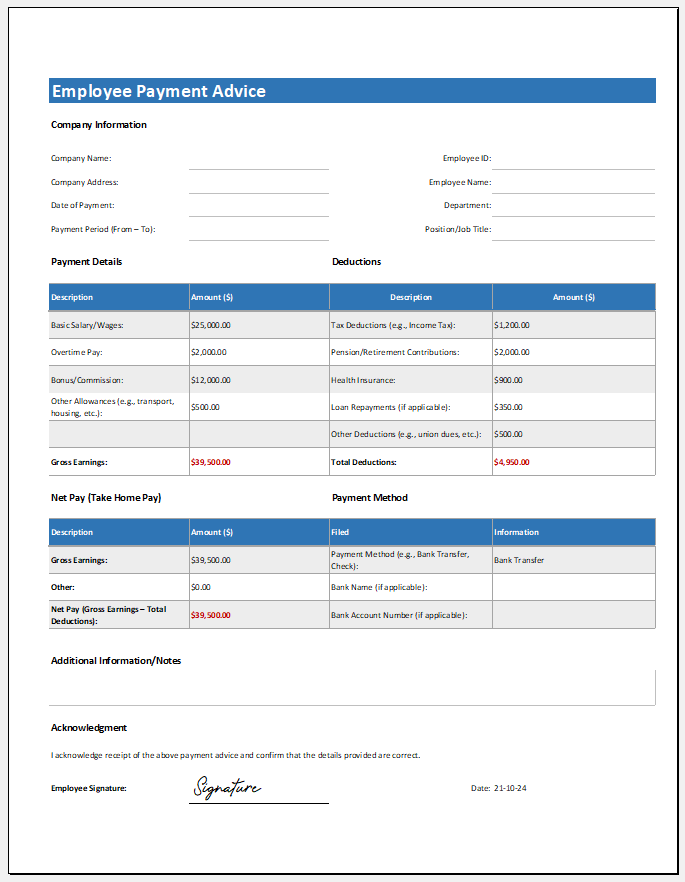

Excel Template File

How a payment advice document is used?

Companies that like to use such documents often consider sending them after issuing an invoice to the employee. However, they can also be used before sending the invoice. Ideally, they should be sent after the payment to the employee has been confirmed. This payment can be in any form, from salary to reimbursement of company expenses.

What is a payment advice template?

Whenever there is a need to confirm the payment made to the employee, employers often send an email or a letter to the employee in which the confirmation is made. Businesses that frequently send payment advice notes to employees like to use software that automatically generates the advice for the employee.

What is the purpose of the payment advice template?

The primary purpose of this advice template is to enable the employer or manager to issue payment advice effortlessly. When the employer confirms the payment through this template, he gets peace of mind, as it is confirmed that the employee cannot claim the salary payment again. This way, the company protects itself against unpleasant situations.

Nowadays, payments are made digitally, and receipts are issued automatically. Therefore, payment devices are not needed. However, some companies still like to use these templates because they ensure effective record-keeping and also help them manage their finances.

What are the benefits of using the payment advice template?

The template created for the payment advice comes with plenty of benefits. Some of these benefits are:

It keeps a business compliant:

Companies are required to show compliance with the state’s rules and regulations. Some states make it mandatory for businesses to issue advice to their employees, as it is the employee’s fundamental right to know about the payment confirmation. So, when a company uses the template, it quickly complies with the state’s rules.

It makes the payroll process simple:

The last step in sending the payment to the employee is to confirm it. Because the template is used, the confirmation process becomes easy for many people; it is an additional headache they often have to contend with.

It gives proof of payment:

To protect yourself financially, your primary responsibility is to ensure that your payment has reached the employee. You confirm by mentioning the employee’s full name, ID, and account number where the payment has been transferred. This way, there is no chance of any dispute related to the non-payment of the money.

The template enables a company to use the advice as proof of payment effortlessly as there is a minimum effort from the people since some companies simply schedule the payment advice sent to the employees. Then, they become stress-free as the template creates the payment advice and prepares it for employees.

The Excel (.xlsx) Template

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

- Daily Attendance Tracker for an Individual Employee

- Overtime Hours Tracker Template

- Vacation and Leave Tracker Template

← Previous Article

Daily Food Expense in Office WorksheetNext Article →

One Day Party Budget Worksheet