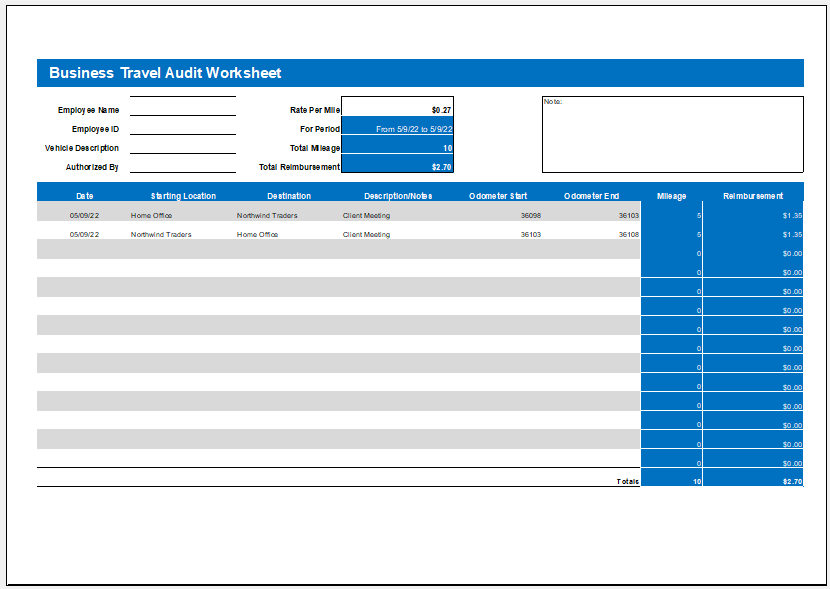

Business Travel Audit Worksheet

A business audit is carried out to determine what amount of money a business is spending and where. By travel audit, the amount of money spent in the area of traveling is taken into account.

It is a worksheet (document) that is used to determine the amount spent on travel expenses of a business. A business has to spend money in various areas on a day-to-day basis. However, one of the most common types of expenses a company incurs is travel.

Who performs the business travel audit?

There are specific authorities in an organization that carries out the audit of a business. The employer issues the order to the employee to perform the audit.

Benefits?

Here are a few benefits:

It enables a business to take several decisions:

Based on information obtained by carrying out the travel audit, a business can make many important decisions. For instance, auditing often tells that a business is spending way too much on traveling. This way, the business cuts down its expenses.

It helps in the reimbursement of expenses:

If a person has paid for some business-related travel expenses from his own pocket, he will later apply for reimbursement of expenses. The reimbursement will be performed after the employer has checked the entire audit report that is generated with the help of this audit worksheet.

It helps find out discrepancies:

When you are using an audit worksheet, it will not be possible for you to do any kind of fraud because the employer can easily find out discrepancies in the audit report. The worksheet gathers information regarding travel expenses and does not let any information go missing. Due to this, it is very easy to pinpoint discrepancies and take the responsible people to task.

What information does the travel audit worksheet collect?

Any tool or worksheet can be useful for you only if you choose to use it sensibly. This is possible when the worksheet is efficient and collects the necessary information. The information obtained from this worksheet includes:

Date of traveling:

In this part of the worksheet, the user mentions the date on which different employees traveled for work-related purposes.

Description:

In the second column, the user mentions the purpose of the travel and some other details.

Transportation costs:

In this part, it is mentioned how much an employee has spent when he was traveling using whichever mode of transportation. Plane, bus, or taxi fares are mentioned in this area of the worksheet.

Additional costs:

When a user travels, there are various other costs he incurs such as payment of toll tax, fuel expenses, and much more. These details are also very important for carrying out an audit honestly. If a person has attended a seminar or a conference, the total expenses he confronted there are also mentioned in the section on additional costs.

Worksheet File 45 KB

Excel Templates

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

- Project Gantt Chart

← Previous Article

Business Tool Register TemplateNext Article →

Commission Invoice Format for Excel