Loan Repayment Tracker

Paying back a loan on time is essential, as this can impact one’s loan liability and credit history. When they look at your debt repayment history, other lenders and banks can determine whether you paid your loan on time. Knowing when you have to pay and how much needs to be paid at different intervals may be confusing. However, this process can become easier when loan repayment is tracked.

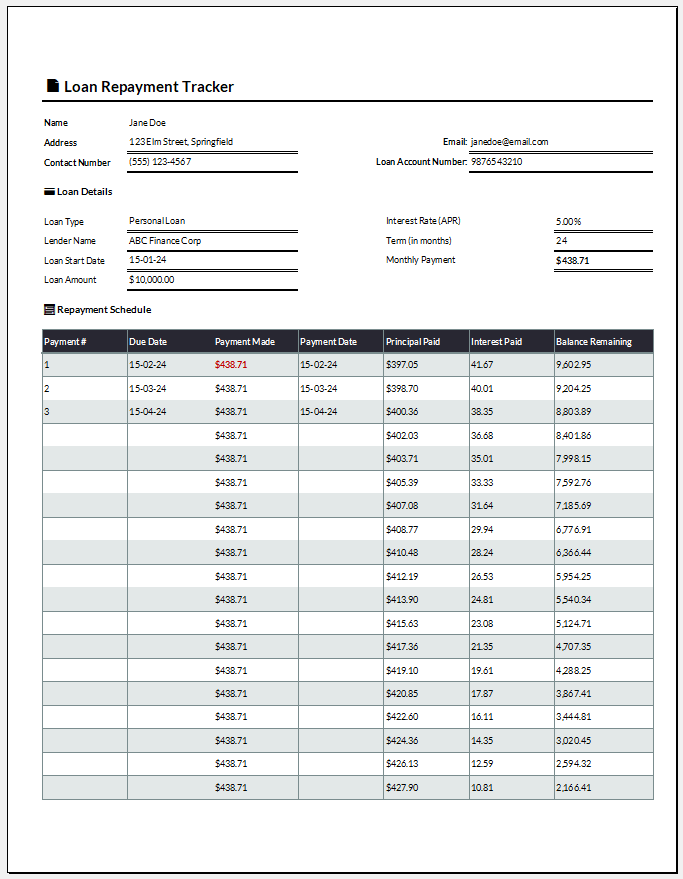

A loan repayment tracker can be used here. This tool aids one in keeping track of their loan payments. It will include details such as due dates, interest, and balances.

The tracker is essential as it can help one manage the loan they must pay. Borrowers will be able to know their loan repayment details, how much they have paid, and how much is left. The borrower will also be able to track the cash being paid to cover the loan. The tracker, therefore, helps one remain organized when paying their loan.

The tracker will include details about when and how much money is being paid to cover the loan. It will also mention the remaining debt and present information on the interest rate. The tracker will help you monitor your loan repayments efficiently.

A loan repayment tracker is a tool used to monitor loan payments over time, helping individuals or businesses stay organized, track outstanding balances, and ensure timely repayments.

File: MS Excel (.xlsx)

The following are some advantages of a loan repayment tracker:

- Borrowers will be able to know details about payments, such as those that are pending, completed, and overdue.

- Borrowers can monitor and track loan repayment to make the process more straightforward.

- One can pay their loan on time when it is being monitored with a loan repayment tracker.

- The loan repayment process can be transparent when recorded on the tracker.

- Human error is likely to occur, invalidating the loan repayment tracker details.

- It can be time-consuming to log the details in real time.

How do you make a Loan Repayment Tracker for Excel?

The following points can be kept in mind when making a loan repayment tracker:

Structure of tracker:

The tracker should have a formal, simple-to-use format. The heading can be “Loan Repayment Tracker.” Please include the name of the person it concerns. You can even mention the tracker’s period. You can include the other essential details related to loan repayment in a table format.

Loan details:

A section can note details about the loan, such as the loan amount, the interest rate, the number of monthly payments, the amount that needs to be paid monthly, and the total repayment.

Create table:

The table can include a column for the date a payment was made, a column for the payment number, which will note this, a column for the total paid, which will mention how much was spent on that date, and a column for outstanding.

The tracker should not be confusing or difficult to use, as this will discourage people from consulting it. Please keep it simple by including only the relevant information.

When a loan repayment tracker is made correctly, it can help one keep track of their loan’s payment schedule and give one an idea about due dates. Interest calculations can even occur, so one knows how much must be paid. In this way, you can handle your cash flow and pursue effective financial plans. You can even allocate resources efficiently.

- Monthly Attendance Sheet for Employees

- Student Entry & Exit Log

- Gantt Chart for Smaller Projects

- Behavior Log of Child for Schools

- Loan Repayment Tracker

- Product Sales Tracker Template

- Debit Memo Template for Excel

- Winter Attire Inventory

- Financial Projections Worksheet

- Employee Absence Tracker

- Weekly Sales Report Template

- Budget Vs Actual Statement

- Remote Work Attendance Tracker

- Mileage Expense Report Template

- Fitness Calendar Template

← Previous Article

Product Sales Tracker TemplateNext Article →

Behavior Log of Child for Schools