What is the total cost of ownership?

Many consumers or businessmen estimate the total cost of a product no matter they are direct costs or indirect costs. The results obtained from the estimate are known as the total cost of ownership. In this process, the total value of the asset is determined. It not only includes the purchase value but also the implementation cost.

If you own a certain type of assets you can calculate all the cost that the assets received. This is termed as Total Cost of Ownership (TCO) which is also known as life-cycle cost analysis. Ownership cost does include the initial purchase cost but along with this it also encompasses the substantial associated cost of installing, using, upgrading or handling the asset.

TCO analysis is used to sustain attainment and scheduling resolutions assets that involve momentous functional costs during the whole ownership life. Total cost of ownership (TCO) analysis is the key point to take the managerial decision to attain computing structures, buildings, vehicles, surgical equipment factory machines, and an expensive aircraft.

TCO analysis needs the following consideration

- Accounting and scheduling

- Management of asset life

- Ranking investment attainment offers

- Retailer choice

File: Excel (.xlsx) 2007/10

Size 20 Kb | Download

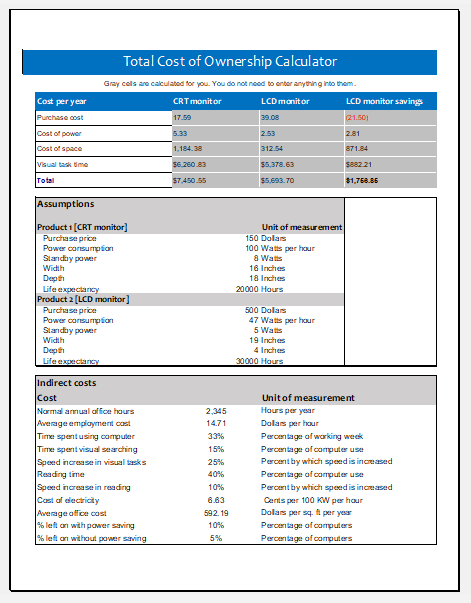

To calculate the total cost analysis accurately downloads free template with fully customizable options. The template accurately calculates the figures. Fill in your figures and gets your instant result.

What is the total cost of ownership calculator?

It is a tool that is used for an accurate and precise calculation of the total cost of ownership.

What is the purpose of using the ownership calculator?

The main objective behind using this calculator is to know the difference between the long-term cost of the product and its price.

Who uses the ownership calculator?

People who purchase a property are usually interested in determining the total cost of ownership. When a person wants to know whether the assets purchased by him are overpriced or not, this calculator is used. The managers of companies, industrialists and other related people use this calculator.

The total cost analysis is sally confused with the purchased price, but this lifetime analysis is completely different from the purchase price. This is not a single price; in fact, it is a total of the different cost applied timely on the purchased asset. It could be understood by the example of expensive computer software system organizations, competitors of such software houses debates that the ownership of a computing system hardware or software is quite high for the past few years as compared to the original purchase price of those computing devices.

Benefits:

- As we all know that the value of the assets depreciates over time. Through the use of this calculator, we can easily determine the depreciation that the asset has faced.

- The obvious cost of the assets can also be evaluated with the help of the total cost of ownership calculator

- These calculators are very effective to use in order to reduce the need of the investor to invest the money in large expenditures of capital.

- TCO calculators basically empower the person to invest in any business according to his capacity. Moreover, the use of the calculator also ensures that the investment is made only when it is highly needed

- In order to save the cost, the support of the total cost of ownership calculator can be taken. The executive presentation can be prepared with the results relate to cost.

- One of the best features of these calculators is that the user can easily modify the assumptions by considering the best needs of a business.