Many people use their house as their offices. These are the people who run a small business or are working part-time from their homes. Many don’t know that they can reduce off the money spent on taxes if they claim the Home Office Tax Benefits. This allows people who use a part of their house regularly and exclusively for business purposes to reduce their expenses spent on taxes or on their business.

Before 2013 there was just the traditional method of claiming the home office tax benefit, but after 2013, the IRIS has come up with another option called as the simplified home office deduction. Both have the same criteria for qualifications but have some different requirements. Choosing between the two could be a hassle and you would want to choose the method which gives you the most benefits.

Home office tax comparison is required to be made by the person who runs a comparatively small business from his home. The purpose of the tax comparison is to know how much amount he should pay as a tax.

When it comes to starting a new business, the most important decision that a business owner is required to make is in which form a business should operate. Considering the forms of running a business becomes totally out of the question when you run the business from home. However, there are some situations in which a business is liable to pay

In most of the cases, the person using the home office is not liable to pay the tax since he is using a place in the house as an office. However, if the business is making a considerable amount of profit, then the tax should be paid by the business owner.

As a matter of fact, tax comparison is not something easy to be done especially in today’s’ world where there are a lot of restrictions and conditions to fulfill. There are different tax-related laws in different countries. These tax laws affect everyone differently.

There are basically three types of taxes:

- Sales tax

- Individual tax

- Corporate tax

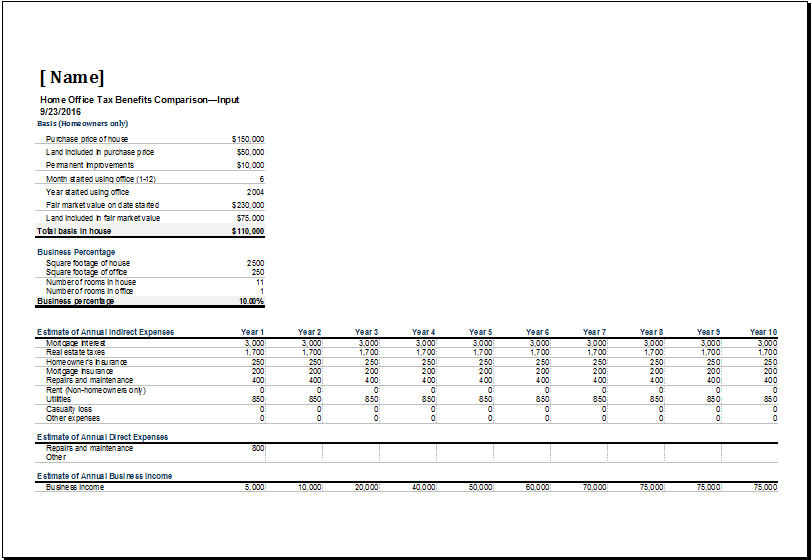

For choosing the best option for you and your business, you need to make a comparison table which includes the pros and cons of both the methods, along with the calculation of what will you be benefited with when choosing either method. The calculation would be according to the requirements of the IRIS. Make sure that you involve an accountant as well to help you out with the calculation if you doubt yours or are unsure as to what should be added or what shouldn’t be included.

Always remember to take some time out to compare thoroughly about the option you choose since it would be for a whole year and once filed, you won’t be able to make any changes.

Download your file below.

Home Office Tax Benefits Comparison Sheet

File Size: 82 KB

Download

What is the best way to make tax comparison?

Tax comparison is very important and should conform to the laws of the state in which you are residing. The sales taxes vary from country to country and should be checked carefully. The tax comparison is required to be made often when you decide to move your home office business to another state.

In order to make a good comparison successfully, you should be well aware of the laws and regulations of the state. You can also the internet to determine the tax rate of each state you want to make a comparison between. Write the tax details of each state side by side in order to see a clear picture. You can also use the tax comparison template for saving your time and comparing the intricate details effortlessly.